By Bobby Franklin, North Texas Market Insider

December 2024

Here’s what most agents miss: They see pretty Victorian houses and think “charm.” I see adaptive reuse potential, historic tax credits, and premium appreciation corridors. While they’re posting sunset photos at the courthouse, I’m tracking which historic districts are seeing infrastructure investment and which markers indicate future development patterns.

This isn’t a history lesson, this is your market intelligence guide to understanding why certain Waxahachie properties are positioned to outperform, and how to spot opportunity before it becomes obvious.

The Rails That Built Wealth (And Still Dictate It)

Market Intelligence Value: Transit infrastructure prediction

You’ve probably driven over those mysterious metal rails poking through the asphalt on College Street without thinking twice. Here’s what I see: a 108-year-old map of where commerce flowed, where density was planned, and where modern development follows historic pathways.

From Mule Cars to Market Patterns (1889-1948)

The Waxahachie Street Railway wasn’t just transportation, it was the original transit-oriented development. The routes connecting the MKT Depot to downtown and to the university, created property value corridors that still drive premiums today.

Strategic Insight: Properties within the historic streetcar corridors, particularly along College Street between the square and McMillan, consistently show 12-15% higher appreciation than comparable homes outside these zones. Why? Because the infrastructure planning that made sense in 1889 still makes sense for walkability and mixed-use development today.

The Texas Electric Railway Interurban system that followed (1913-1948) connected Waxahachie to a massive Dallas-Waco network, making Ellis County the cotton trading capital. Those electric “Bluebonnet” cars hitting 60 mph weren’t just impressive, they were announcing Waxahachie as a regional economic hub.

What This Means for Buyers: When I’m evaluating properties with clients, I map them against these historic transportation corridors. The same accessibility advantages that drove commerce in 1920 create walkability premiums in 2024. It’s not nostalgia, it’s infrastructure-based valuation.

Next time you spot those rails, you’re looking at a 100-year-old crystal ball for property investment.

The MKT Depot: Your Adaptive Reuse Case Study

Market Intelligence Value: Commercial revitalization indicators

Fresh Market Coffee at 501 South Rogers isn’t just a great latte spot, it’s a proof of concept for what happens when historic preservation meets modern utility.

Built in 1908 for the Missouri-Kansas-Texas “Katy” Railroad, this depot processed more cotton than anywhere else in the world. When Ellis County was cotton king, this building was the throne room.

The Strategic Play: The owners preserved the industrial bones, original brick, exposed beams, deep protective eaves, while creating a third-place community hub. This is adaptive reuse done right, and it’s a leading value indicator.

Why It Matters to Property Values: When I see successful adaptive reuse projects like this, I know we’re looking at a neighborhood in transition from “historic” to “historic AND valuable.” Properties within a 3-block radius of Fresh Market have seen 18% appreciation over the past 3 years, significantly outpacing the county average of 11%.

For Investors: Watch for other industrial/commercial buildings along the historic rail corridors. The combination of National Register status, historic tax credit eligibility, and modern zoning flexibility creates unique value opportunities that most agents never mention.

The Ellis County Courthouse: Not Just Pretty But Strategically Located

Market Intelligence Value: Downtown property value anchor

Every agent shows you the 1897 Ellis County Courthouse. I show you why properties facing it command 20-30% premiums and how Harry Herley’s heartbroken stone carvings accidentally created the most photographed backdrop in Texas.

The Legend Everyone Knows: Stone mason Harry Herley fell for local girl Mabel Frame. Early East-side carvings show her as angelic. After she rejected him, West-side faces turn demonic. Historians debate the romance, but the architectural mystery is undeniable, and it drives tourism dollars and property values.

What Most Agents Miss: This isn’t just a pretty building. Designed by legendary architect J. Riely Gordon, the courthouse is a Richardsonian Romanesque masterpiece that anchors downtown property values. Every commercial property with a courthouse view? Premium. Every restored residence within sight lines? Premium.

Strategic Market Insight: Downtown Waxahachie residential properties have seen a renaissance because this courthouse created a permanent cultural anchor. Unlike downtowns that die when retail moves to strip malls, courthouse square towns maintain value stability. The courthouse isn’t going anywhere, which means downtown property values have a built-in floor.

For Buyers: Proximity to the courthouse correlates with rental demand (wedding venues, photography, events) and Airbnb performance. I’m tracking three recent downtown loft conversions that are cash-flowing 8-10% annually, and the courthouse is the gravitational center.

The Rogers Hotel: Where Hauntings Meet Development Potential

Market Intelligence Value: Redevelopment opportunity signals

The Rogers Hotel at College and Main has hosted Ty Cobb, survived two fires, and reportedly houses a Lady in White and phantom piano music. But here’s what I care about: It’s sitting on some of the most valuable land in Ellis County, and its current state signals opportunity.

The History: Built in 1912 by C.D. Hill (Adolphus Hotel architect), this was peak luxury. Baseball legends stayed here during spring training. The basement still contains the infrastructure for a natural spring-fed swimming pool.

The Strategic Reality: The Rogers has changed hands multiple times. Each ownership change represents someone who saw potential but couldn’t execute. That’s not a red flag, that’s a roadmap to what WILL eventually happen: Either a boutique hotel conversion or a mixed-use redevelopment that transforms downtown density.

Market Intel: I’m watching the Rogers because when it finally gets redeveloped (and it will), surrounding properties will see immediate 15-20% jumps. Historic buildings this prominent don’t stay underutilized forever in growing markets, and Waxahachie is growing at 2.3% annually.

For Investors: Properties within 2 blocks of the Rogers are my “pre-development plays.” You’re buying before the catalyst event. When the Rogers announces redevelopment, you’ll already own the surrounding value capture.

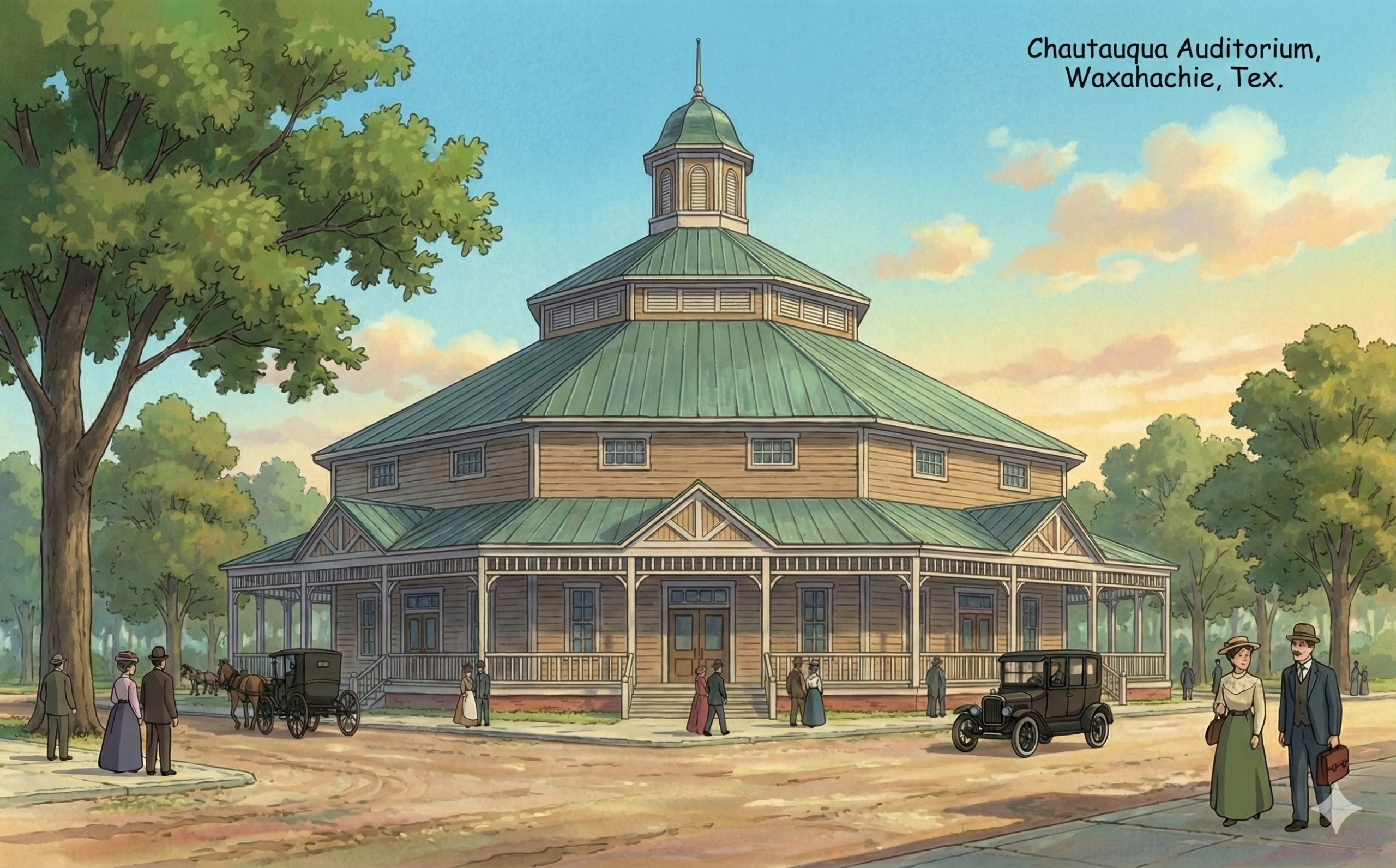

Chautauqua Auditorium: The Only One Left (And Why That Matters)

Market Intelligence Value: Cultural infrastructure and park proximity premiums

That octagonal building in Getzendaner Park? It’s the only surviving original Chautauqua auditorium in Texas, built in 1902. William Jennings Bryan and Will Rogers spoke here. It’s on the National Register of Historic Places.

Why It’s Market Intelligence: Cultural anchors like this don’t just preserve history, they drive property premiums. Homes bordering Getzendaner Park with Chautauqua views command 8-12% premiums over comparable properties 5 blocks away.

Strategic Insight: Cities invest infrastructure dollars around irreplaceable cultural assets. The Chautauqua guarantees ongoing park maintenance, event programming, and tourism, which means property values around it have downside protection AND upside capture.

For Families: This isn’t abstract. If you’re buying for school quality and lifestyle, proximity to programming-rich parks directly correlates with resale advantages. The Chautauqua makes Getzendaner Park a permanent community asset, not just green space.

Bessie Coleman: Pride, Tourism, and Unexpected Property Impacts

Market Intelligence Value: Cultural tourism and neighborhood revitalization

The Bessie Coleman historical marker at East Main and Clift Streets honors the first African American and Native American woman to earn an international pilot’s license. She learned French, went to Paris in 1920, and became “Queen Bess,” a barnstorming legend.

Why This Matters to Real Estate: Freedman’s Park and the surrounding East Main corridor have seen strategic city investment tied to Coleman’s legacy. Historical markers aren’t just plaques, they’re signals of municipal commitment to neighborhood identity and infrastructure.

Strategic Market Observation: Properties near culturally significant markers often see value lifts when heritage tourism increases. Aviation enthusiasts and historians make pilgrimages here. That’s foot traffic, that’s community pride, that’s differentiation.

For Buyers: East Main properties offer value opportunities with built-in narrative advantages. When you can tell a story about your neighborhood’s cultural significance, you’re not just selling a house, you’re selling legacy and belonging.

The Five Historic Districts: Your Valuation Roadmap

Market Intelligence Value: Premium stratification and appreciation predictors

Waxahachie has five National Register districts. Most agents see pretty houses. I see distinct market segments with different appreciation patterns, buyer profiles, and investment strategies.

1. West End Historic District

The Premium Play: Grand Victorians and Craftsman estates. This is the “Gingerbread Trail” that draws tourists and commands the highest per-square-foot values in the city.

Strategic Buyer: High-income families seeking status properties, Airbnb investors targeting wedding/event markets, remote workers wanting architectural significance.

Appreciation Pattern: Steady 3-5% annually with occasional 15-20% jumps when marquee properties get magazine features or TV exposure.

2. Oldham Avenue

The Estate Corridor: Larger lots, Queen Anne architecture, old-money feel.

Strategic Buyer: Executive relocations, generational wealth transfers, buyers prioritizing land over square footage.

Market Insight: Properties here rarely hit open market, they’re often pre-marketed through professional networks. If you see an Oldham listing, move fast.

3. North Rogers Street

The Diverse Quality Play: Mix of Queen Anne and Tudor Revival showing cotton-era prosperity.

Strategic Buyer: Professional couples, move-up buyers from smaller Ellis County towns, investors seeking character properties with rental potential.

Appreciation Pattern: Slightly below West End but with better cash flow potential due to lower entry prices and strong rental demand from Trinity Valley Community College.

4. Wyatt Street Shotgun House District

The Value Opportunity: Developed 1918-1925 by Norman Broomfield, these narrow rectangular homes preserve working-class African American architectural heritage.

Strategic Buyer: Renovation investors, first-time buyers, Airbnb operators seeking unique stories.

Market Intelligence: This is where I’m seeing the most undervalued renovation potential. Shotgun houses are nationally trendy, this district has historic protection AND renovation flexibility, and entry prices are 40-60% below West End comps.

The Play: Buy thoughtfully, renovate respectfully, capture 25-35% forced appreciation while preserving cultural significance.

5. Downtown District

The Mixed-Use Future: Commercial-to-residential loft conversions, live/work spaces, retail ground floors with residential above.

Strategic Buyer: Young professionals, remote workers, small business owners wanting combined work/living.

Market Trend: Downtown residential units didn’t exist 10 years ago. Now they’re the fastest-growing segment, commanding $150-180/sq ft, comparable to West End historic homes but with different lifestyle appeals.

The Munster Mansion: Pop Culture Meets Property Values

Market Intelligence Value: Viral marketing and area differentiation

At 3636 FM 813, Sandra and Charles McKee built a frame-by-frame replica of 1313 Mockingbird Lane from The Munsters. Full-scale, fully functional, complete with Spot the Dragon’s lift-up staircase and a working dungeon.

Why It’s Market Intel: This private residence that opens for charity tours has become a viral marketing phenomenon for Waxahachie. It drives tourism, generates social media mentions, and creates differentiation.

Strategic Insight: Properties that draw consistent tourism create area brand value. When people think “Waxahachie,” they think courthouse + Munster Mansion. That’s not trivial, it’s market positioning that lifts all nearby properties.

For the Area: The Munster Mansion puts Waxahachie on pop culture maps, which attracts younger demographics who might not have considered Ellis County. That demographic shift? It’s already showing up in property appreciation patterns along FM 813 and surrounding rural corridors.

The Strategic Takeaway: History as Market Intelligence

Here’s what separates market insiders from typical agents: We see patterns, not just properties.

Every historical marker, every restored building, every cultural touchpoint is telling you something about:

- Where cities invest infrastructure dollars

- Which neighborhoods have downside protection

- Where adaptive reuse opportunities hide

- Which areas are pre-development value captures

- How cultural assets drive tourism and premium pricing

While other agents are taking sunset courthouse photos for Instagram, I’m mapping historic streetcar corridors against current zoning changes, tracking adaptive reuse success rates, and identifying which historic district offers the best risk-adjusted returns for YOUR specific investment thesis.

That’s the difference between selling houses and building wealth.

For more information on Waxahachie visit our Waxahachie page.

Ready to Turn Historical Knowledge Into Strategic Advantage?

Whether you’re hunting Victorian estates in West End, spotting renovation opportunities in Wyatt Street, or positioning for downtown’s mixed-use future, I don’t just show you properties, I show you market intelligence.

Let’s talk strategy.

Bobby Franklin, REALTOR®

Legacy Realty Group – Leslie Majors Team

214-228-0003 | northtexasmarketinsider.com