Let’s Talk About the Elephant in the Room

You’re putting off buying a house because mortgage rates are “too high.”

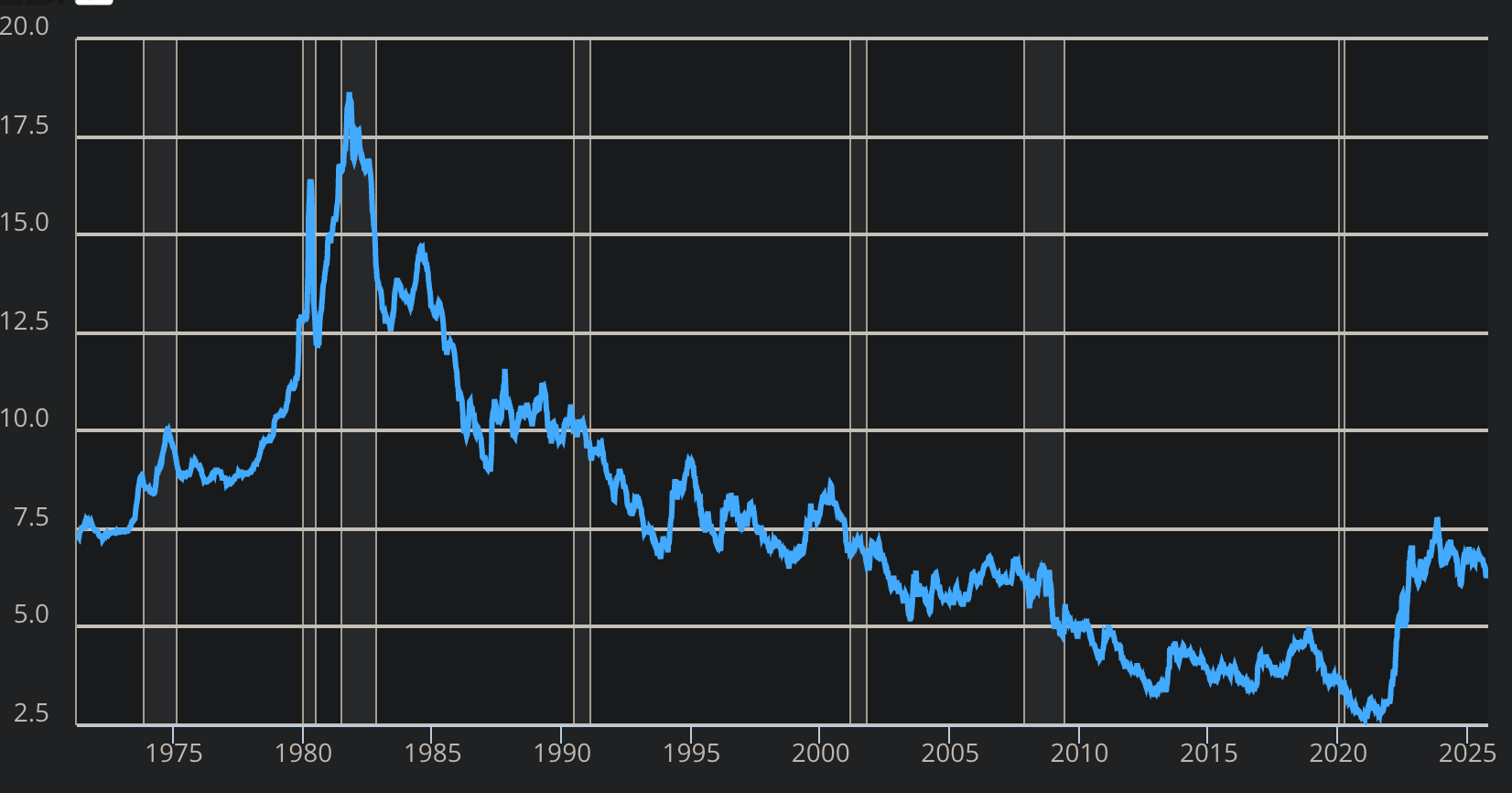

I get it. When you compare today’s 6.5-7% rates to the 3% rates your coworker locked in during COVID, it feels like you’re getting a raw deal.

But here’s what nobody’s telling you: Those COVID rates were the anomaly, not today’s rates.

And if you’re waiting for 3% mortgages to come back before you buy, you might be waiting until your kids are in college.

Let me give you the realistic timeline for rate relief, what’s actually driving these decisions, and why understanding this timeline might completely change your home buying strategy.

The Rate Relief Timeline (Reality-Based)

Q4 2024 – Q3 2025: The Holding Pattern

Expected Mortgage Rates: 6.5-7.2%

This is where we are now. The Fed is playing a waiting game, watching inflation data like a hawk before making any moves. [1]

What’s happening:

- Fed Funds Rate holding at 4.5%

- Inflation stubborn around 3-3.5% (target is 2%)

- Fed still reducing bond holdings ($95B/month)

- Housing market in “wait and see” mode

What this means for you:

This is actually a strategic buying window. Inventory is up, seller competition is down, and you have negotiating power. Many sellers will offer concessions (paying points to buy down your rate) because they’re motivated. [2]

Ellis County specific insight: I’m seeing 2-3% seller concessions becoming standard. On a $350,000 purchase, that’s $7,000-$10,500 toward buying down your rate or closing costs. Use this leverage.

Q3 2025: The First Rate Cuts Begin

Expected Mortgage Rates: 6.0-6.5%

Assuming inflation continues its downward trend (big assumption), the Fed will likely start cutting rates by 0.25% per meeting. [3]

What’s happening:

- Fed begins cutting Fed Funds Rate to 4.0-4.25%

- Mortgage rates respond but not dramatically

- Market psychology improves

- Buyer demand starts accelerating

What this means for you:

This is when the “waiting” crowd rushes back into the market. Suddenly everyone who’s been sitting on the sidelines says “rates are dropping!” and competition intensifies.

The strategic mistake: Most people wait until rates actually drop, then fight 10 other offers for the same property. Smart buyers act BEFORE this rush.

Ellis County specific insight: With major developments like the Ferris project breaking ground, this is when appreciation will accelerate. The intersection of lower rates + development news = rapid price increases.

Q4 2025 – Q2 2026: The Gradual Descent

Expected Mortgage Rates: 5.5-6.0%

If, and this is a big if, inflation stays controlled and the economy doesn’t slip into recession, we’ll see continued gradual rate cuts. [4]

What’s happening:

- Fed Funds Rate potentially down to 3.5-4.0%

- Multiple rate cuts of 0.25% each

- Housing demand fully recovered

- Prices appreciating steadily

What this means for you:

This is the “sweet spot” everyone is waiting for. Rates are meaningfully lower than today, and the market feels more “normal.”

The problem: Prices will have risen 10-20% from today’s levels in most markets. That $350,000 house is now $385,000-$420,000.

Ellis County specific insight: Our market is already undervalued compared to surrounding DFW areas. As development accelerates and Dallas continues sprawling south, Ellis County becomes increasingly attractive. The price appreciation here could exceed the DFW average.

Late 2026 and Beyond: The New Normal

Expected Mortgage Rates: 5.0-5.5%

This is probably where rates settle long-term, barring any major economic crisis.

What’s happening:

- Fed Funds Rate stabilized around 3.0-3.5%

- Market fully adjusted to post-COVID economy

- Housing supply still constrained

- Prices significantly higher than today

What this means for you:

If you’re still waiting at this point, you’ve potentially missed 20-30% in appreciation. The monthly payment on that higher-priced home at a slightly lower rate is probably HIGHER than buying today.

Reality check: 5-5.5% mortgages are historically normal. Your parents probably paid 7-9%. Your grandparents paid 12-15%. [5] The idea that 3% is “normal” is just recency bias from an unprecedented global pandemic response.

The Variables That Could Change This Timeline

Scenario 1: Inflation Resurges

Timeline Impact: Delays everything by 12+ months

If inflation ticks back up to 4-5%, the Fed will have to pause or even reverse course on rate cuts.

Warning signs to watch:

- Oil prices spiking above $100/barrel

- Wage growth accelerating above 4%

- Services inflation remaining sticky

- Housing costs continuing to rise

What this means: Mortgage rates could stay at 6.5-7% or even climb back to 7.5% through 2025-2026.

Your strategy: If you’re waiting and this happens, you’ve potentially wasted 2-3 years of equity building for nothing.

Scenario 2: Recession Hits

Timeline Impact: Accelerates rate drops dramatically

If the economy slides into recession, the Fed would cut rates aggressively and potentially restart bond buying. [6]

Warning signs to watch:

- Unemployment rising above 5%

- Corporate earnings declining

- Consumer spending slowing significantly

- Stock market correction of 20%+

What this means: Mortgage rates could drop to 4.5-5% quickly.

BUT HERE’S THE CATCH: In a recession, you might lose your job, your down payment might shrink if it’s in stocks, and lenders tighten credit standards dramatically. Getting approved becomes much harder even with lower rates.

Your strategy: If you have stable income and good credit NOW, buying before a potential recession is actually the safer move.

Scenario 3: Housing Supply Increases Dramatically

Timeline Impact: Could lower rates independent of Fed action

If builders massively increase supply (unlikely but possible), the housing shortage eases and price pressure reduces. [7]

What would cause this:

- Major zoning reform in Texas cities

- Homebuilders going all-in on new construction

- Economic conditions favoring rapid building

What this means: Even if Fed rates stay high, mortgage rates could drift lower due to reduced housing market pressure.

Ellis County reality: We’re seeing development announcements, but actual building takes 18-36 months from permit to completion. Supply relief is years away, not months.

Scenario 4: Political Intervention

Timeline Impact: Unpredictable, likely minimal

Politicians love to promise housing affordability solutions. Expect to hear about:

- First-time buyer tax credits

- Down payment assistance programs

- FHA loan expansion

- Pressure on the Fed to lower rates faster

Reality check: Most political “solutions” are either too small to matter or take years to implement. The Fed is independent specifically to resist political pressure on rate decisions.

What this means: Don’t base your buying decision on political promises. Base it on market reality.

What Most Buyers Get Wrong About This Timeline

Mistake #1: Focusing Only on Interest Rates

Most buyers obsess over the rate while ignoring the purchase price.

The math everyone misses:

Option A: Buy today at $350,000 @ 6.5%

- Monthly payment: $2,212 (P&I)

- Refinance in 2026 at 5.5%: $1,988/month

- Equity gained in 2 years: $35,000+

Option B: Wait 2 years, buy at $385,000 @ 5.5%

- Monthly payment: $2,185 (P&I)

- Equity gained: $0 (you just started)

- Rent paid during wait: $36,000+ (gone forever)

Net cost of waiting: -$71,000

You “saved” $27/month but missed $35,000 in appreciation plus threw away $36,000 in rent. This is horrible math.

Mistake #2: Believing Rates Will Drop Dramatically

The fantasy: “I’ll wait until rates hit 4% again.”

The reality: That probably requires a major recession or crisis. [8]

Are you really hoping for economic catastrophe so you can save 2% on your mortgage? Because that same crisis might cost you your job or wipe out your down payment.

Mistake #3: Underestimating Appreciation in Growth Markets

National averages mean nothing if you’re buying in a high-growth area.

Ellis County specifically:

- Dallas sprawl continuing south

- Major infrastructure improvements

- 5,200-acre Ferris development

- New businesses following population

- School districts improving

Conservative estimate: 8-12% annual appreciation over next 3-5 years

Aggressive estimate: 15-20% annual appreciation if development accelerates

Waiting for a 1% rate drop while prices climb 10-15% annually is financial suicide.

Mistake #4: Forgetting You Can Refinance

Your first mortgage rate isn’t your forever rate.

The strategic play:

- Buy now at 6.5%

- Build equity for 18-24 months

- Refinance when rates drop to 5.5%

- Enjoy lower payment PLUS substantial equity

Versus waiting:

- Pay rent for 18-24 months

- Buy at higher price when rates drop

- Start equity building from zero

- No refinance benefit because you just bought

The first scenario wins by $50,000-$100,000 over a 5-year period.

The Ellis County Advantage: Why Our Timeline Differs

Here’s something most buyers don’t realize: Not all markets follow the national timeline.

Ellis County is positioned differently than most markets:

We’re Still Relatively Affordable

While rates are high everywhere, our prices remain reasonable compared to Dallas, Plano, Frisco, McKinney.

Current situation:

- Average home price: $350,000-$400,000

- Comparable Dallas County home: $500,000-$600,000

- Comparable Collin County home: $550,000-$650,000

When rates drop: That affordability gap shrinks as Dallas/Collin County buyers discover they can get more house in Ellis County for less money. Demand surges. Prices rise faster than the rate drop saves you.

We’re in the Development Sweet Spot

Major projects are announced but not yet built. This is THE time to buy before development drives prices up.

Strategy: Buy now, before these projects are finished and everyone realizes how much Ellis County is growing.

We Have the “Drive Time” Advantage

As remote/hybrid work stabilizes, the 30-45 minute drive to Dallas becomes more acceptable.

Current trend: Buyers prioritizing space and value over commute time.

When this accelerates: Ellis County sees the same surge Frisco/McKinney saw 15 years ago. Prices explode.

Your Personal Timeline: When Should YOU Buy?

Forget the national timeline. Here’s how to determine YOUR timeline:

Buy Immediately If:

- You have stable income and good credit (620+)

- You have down payment funds ready

- You plan to stay in the area 5+ years

- You found a property that meets your needs

- Sellers are offering concessions in your target area

Why: Every month you wait is rent money gone forever + missed appreciation + lost negotiating leverage.

Wait 6-12 Months If:

- Your credit is below 620 (use the time to improve it)

- You need to save more for down payment

- You’re changing jobs in the next 6 months

- You’re unsure about long-term area commitment

Why: Use this time productively to strengthen your position, not just to wait for perfect rates.

Don’t Buy Until 2026+ If:

- You might relocate for work within 3 years

- You have less than 5% for down payment

- Your job stability is questionable

- You haven’t researched the market thoroughly

Why: Real estate is a 5+ year wealth building tool, not a get-rich-quick scheme. If you can’t commit to that timeline, keep renting.

The Action Plan

Phase 1: Immediate (This Month)

- Get Pre-Approved – Not pre-qualified. Actual underwriting approval. Know EXACTLY what you can afford at today’s rates.

- Run the Real Numbers – Don’t guess at payments. Calculate real scenarios:

- Today at 6.5%

- Refinance scenario at 5.5% in 2 years

- Price appreciation impact

- Rent vs. buy comparison

- Tour Ellis County Neighborhoods – Identify areas positioned for development/appreciation:

- Proximity to new projects

- School district quality

- Infrastructure improvements

- Community amenities

Phase 2: Strategic (Next 30-60 Days)

- Make Competitive Offers – In today’s market, you have negotiating power. Use it:

- Request 2-3% seller concessions

- Ask seller to buy down your rate

- Negotiate on inspection items

- Get creative with closing timeline

- Lock Your Rate with Float-Down Option – Many lenders offer this: lock today’s rate, but if rates drop before closing, you get the lower rate. Costs $500-$1,000 but worth it.

- Plan Your Refinance – Even before you buy, know your refinance strategy:

- When will you refinance? (18-24 months typical)

- What rate would trigger refinance? (1% improvement minimum)

- How much equity will you have?

Phase 3: Long-Term (Next 2-5 Years)

- Build Equity Aggressively – Make extra principal payments when possible. Every $100/month extra saves you thousands in interest and accelerates your refinance options.

- Monitor Rate Trends – Set rate alerts for 5.5% (definite refinance territory) and 5.0% (slam dunk refinance).

- Leverage Your Equity – As your home appreciates, you’re building wealth. After 2-3 years, that equity can:

- Eliminate PMI if you started with less than 20% down

- Fund investment property down payment

- Be tapped for major improvements that increase value further

The Bottom Line

The realistic timeline for rate relief: 18-24 months for meaningful improvement, 36+ months for “ideal” rates that may never come.

But here’s what nobody tells you: The best time to buy is almost never when conditions feel “perfect.”

When rates hit 3% in 2020-2021, everyone said “this is temporary, prices are too high, I’ll wait for prices to drop.”

Prices didn’t drop. They exploded.

Now rates are higher, and everyone says “this is temporary, rates are too high, I’ll wait for rates to drop.”

Prices aren’t dropping. They’re still climbing.

The pattern: People always find a reason to wait, and they always regret it 3-5 years later.

What Winners Are Doing Right Now

The agents closing the most deals right now aren’t telling clients to wait. They’re showing clients:

- How to buy strategically at 6.5%

- How to structure offers with concessions

- Which neighborhoods offer maximum appreciation potential

- How to refinance later when rates drop

- Why starting equity building TODAY beats waiting for perfect conditions

Want to be one of the winners who looks back in 2027 and says “I’m so glad I bought in 2024” instead of “I should have bought when I had the chance”?

Let’s talk strategy.

📊 Weekly market intel + insider opportunities

🎯 Text 214-228-0003 for the VIP list

Bobby Franklin – REALTOR®

Legacy Realty Group – Leslie Majors Team