North Texas Market Insider – Strategic Intelligence Briefing

Let me cut through the noise for you right now: on January 30, 2026, President Trump nominated Kevin Warsh to replace Jerome Powell as Federal Reserve Chair when Powell’s term expires on May 15, 2026. And while every real estate agent in DFW is asking “will this lower mortgage rates?”, they’re asking the wrong question entirely.

The right question is this: How do you position yourself as the agent who understands what’s actually happening while your competitors are still regurgitating headlines they barely understand?

Because here’s the truth that separates market leaders from the pack: Fed policy doesn’t directly set mortgage rates. Understanding the real mechanisms, the balance sheet strategy, the yield curve dynamics, the AI productivity thesis that Warsh is building his entire framework around, that’s what creates strategic dependency with your clients.

When a California relocator asks about whether they should wait for lower rates to buy in Waxahachie or Midlothian, your agent should be able to explain not just if rates might drop but why they might or might not based on balance sheet reduction versus federal funds rate cuts, that’s how you can differentiate good agents from “just another agent”.

That’s exactly what we’re breaking down today. Not surface-level “rates might go down” speculation that every agent is copying from the same three sources. Real intelligence. The kind that positions you five steps ahead of your market.

Who Is Kevin Warsh? (And Why His Wall Street Background Actually Matters to Your Ellis County Buyers)

Kevin Warsh isn’t some academic economist who’s never operated in the real world. At 55, he’s got a resume that spans the 2008 financial crisis, Wall Street M&A at Morgan Stanley, and direct White House economic policy experience under George W. Bush.

Here’s what actually matters about his background:

The 2006-2011 Fed Experience: Crisis Management Under Fire

Warsh became a Fed Governor at 35, the youngest person ever appointed to that position, right before everything went sideways in 2008. While most of America was watching their home values crater and their 401(k)s evaporate, Warsh was in the room designing emergency lending programs and working with the Treasury Department on TARP.

This isn’t theoretical economics. This is a guy who’s seen what happens when credit markets seize up and housing markets collapse. He knows exactly what mortgage market dysfunction looks like from the inside.

The Stanford/Hoover Institution Perspective: Where Policy Meets Reality

Since leaving the Fed in 2011, Warsh has been at Stanford’s Graduate School of Business and the Hoover Institution, which means he’s been watching the post-crisis recovery, the pandemic stimulus explosion, and the 2021-2023 inflation surge from an academic perch while also working with billionaire investor Stanley Druckenmiller in the private sector.

That combination, crisis experience + academic analysis + private capital markets perspective, creates a very specific worldview about how the Fed should operate. And understanding that worldview is critical to predicting what happens next.

The Evolution of Warsh’s Monetary Policy Philosophy: From Inflation Hawk to Rate-Cut Advocate

Here’s where most agents completely miss the strategic intelligence opportunity: Warsh’s views have evolved significantly, and that evolution tells you everything about where policy is headed.

The Original Hawk: 2009-2011 QE Skepticism

During his Fed tenure, Warsh was consistently the guy raising concerns about inflation when everyone else was worried about deflation. In April 2009, with the Consumer Price Index actually negative and unemployment climbing, Warsh was warning about future inflation risks.

He was particularly skeptical of quantitative easing (QE), the Fed’s massive bond-buying program. While he initially voted to launch QE with Chairman Ben Bernanke, he grew increasingly uncomfortable with the expanding Fed balance sheet. He called it “bloated” and ultimately resigned in 2011 because he opposed continued QE.

This wasn’t academic disagreement. Warsh genuinely believed that flooding the system with Fed-created money would create market distortions and inflation down the road.

The Surprising Pivot: 2024-2026 Rate Cut Advocacy

Fast forward to 2024-2025, and Warsh is making a completely different argument: the Fed needs to cut rates more aggressively because they’re holding down economic growth and causing a “housing recession” that’s crushing first-time homebuyers.

This isn’t a flip-flop. It’s strategic evolution based on changing circumstances. And understanding why he changed his position is the key to understanding what he’ll do as Fed Chair.

The AI Productivity Game-Changer: Why Warsh Thinks Lower Rates Won’t Cause Inflation

Here’s the strategic insight that most agents are completely missing: Warsh’s entire framework for cutting rates rests on his belief that artificial intelligence is a massive disinflationary force that fundamentally changes the Fed’s calculation.

His argument goes like this:

If AI increases productivity growth from 2% annually to 3.5% or even 4%, then the economy can grow faster without generating inflation. That means the Fed can cut interest rates more aggressively without reigniting price pressures, because productivity gains are offsetting demand increases.

Think about what that means for the North Texas real estate market: if Warsh is right about AI productivity, we could see a scenario where:

- Economic growth accelerates (more job creation, wage growth, population influx to DFW)

- Interest rates decline (better mortgage affordability)

- Inflation stays moderate (housing costs don’t explode like 2021-2022)

That’s the goldilocks scenario for our market. Not guaranteed, but it’s the framework Warsh is operating from.

The Balance Sheet Strategy: Why Understanding Sets You Up As an Expert

Let me get technical for a moment, because this is where real market intelligence lives.

Most people think the Fed “lowers rates” by just announcing a rate cut. That’s surface-level understanding. The reality is far more complex, and that complexity creates opportunity for buyers who actually get it.

How the Fed Actually Influences Mortgage Rates (The Mechanism Nobody Explains to Clients)

The Federal Reserve doesn’t set mortgage rates. Period. What they control is:

- The federal funds rate (overnight lending rate between banks)

- The size and composition of their balance sheet (how many bonds they own)

Mortgage rates are determined by the 10-year Treasury yield, which reflects investors’ expectations about:

- Future inflation

- Economic growth

- Federal deficits and government borrowing

- Fed balance sheet policy

- Global demand for U.S. bonds

Here’s Warsh’s distinctive approach: he wants to shrink the balance sheet while lowering the federal funds rate.

Why This Could Keep Mortgage Rates Higher Than Buyers Hope

Traditional QE logic said: Fed buys bonds → bond prices rise → yields fall → mortgage rates drop.

Warsh’s strategy reverses this: Fed stops buying bonds (or even sells them) → less demand for long-term bonds → yields might stay elevated → mortgage rates don’t fall as much as the federal funds rate cut would suggest.

This is called “yield curve steepening”, short-term rates fall while long-term rates stay relatively higher. It’s happened before, and it could happen again under Warsh.

What this means for buyers in Ferris, Red Oak, or Ennis: Don’t wait for 3% mortgage rates that aren’t coming. The “new normal” is probably 5.5%-6.25%, and understanding why that’s the case positions you as the expert who won’t miss the market window.

Current Mortgage Rate Reality Check: Where We Actually Are in February 2026

Let’s talk real numbers, because hope isn’t a strategy.

As of early February 2026, here’s what actual borrowers are seeing:

| Loan Type | Typical Rate Range |

|---|---|

| 30-year fixed | 5.9% – 6.1% |

| 15-year fixed | 5.4% – 5.6% |

| 30-year FHA | ~6.0% |

| 30-year VA | Mid-5% range |

| 5/1 ARM | 5.8% – 6.1% |

These rates are roughly 50-75 basis points lower than the 2023-2024 peak, but still well above the emergency pandemic lows of 2020-2021.

Expert Forecasts: The Range of Possibilities

Most credible forecasters, the ones who aren’t trying to generate clickbait headlines, are projecting mortgage rates for 2026 in these ranges:

Conservative forecast: 6.0% – 6.5%

Moderate forecast: 5.75% – 6.25%

Optimistic forecast: 5.5% – 6.0%

Notice what’s missing? Nobody credible is predicting sub-5% rates in 2026 absent a significant economic downturn.

Why Sub-5% Rates Are Unlikely (And What Would Have to Happen)

For mortgage rates to drop below 5% in 2026, we’d need to see:

- Inflation firmly back at 2% and trending lower (not just one good month)

- Clear economic weakness (rising unemployment, declining consumer spending)

- Flight to safety in bond markets (global crisis driving demand for U.S. Treasuries)

- Fed aggressively cutting AND resuming bond purchases (contradicts Warsh’s stated philosophy)

That’s possible. But it would likely coincide with job losses, recession fears, and exactly the kind of economic environment where your clients might struggle to qualify for mortgages even at lower rates.

Strategic positioning for your clients: The best time to buy is when you can afford the payment and the property meets your needs, not when rates hit some arbitrary “perfect” number that may never arrive.

The Warsh Confirmation Timeline: When Does This Actually Matter?

Understanding the political process helps you counsel clients on timing.

Key Dates

- Jerome Powell’s term as Fed Chair ends: May 15, 2026

- Nomination announced: January 30, 2026

- Senate Banking Committee hearings: Likely March-April 2026

- Full Senate confirmation vote: Likely April-May 2026

- Warsh assumes Fed Chair role: May 15, 2026 (if confirmed)

Political Dynamics Worth Watching

Markets don’t wait for confirmation. They start pricing in expectations immediately when a nominee is announced.

That means:

- Bond yields may have already adjusted based on Warsh expectations

- Mortgage rates might shift before he actually takes the job

- Waiting for “certainty” means missing the market’s actual move

Some potential political friction points:

- Senate Democrats may scrutinize his Wall Street background and past criticism of consumer protection policies

- Ongoing Fed governance investigations could slow the process

- Trump’s pressure for aggressive rate cuts might force Warsh to publicly balance independence versus political expectations

But with Republicans controlling the Senate, most analysts expect confirmation, perhaps after contentious hearings, but ultimately successful.

North Texas Housing Market Reality: What’s Actually Happening in DFW Right Now

Let me bring this home to what matters for your business: our local market.

The Current DFW Market Snapshot (February 2026)

After years of explosive growth, we’ve shifted into what I’m calling “strategic normalization”:

Inventory: Up significantly year-over-year across Ellis County, Johnson County, and southern Dallas County

Prices: Flat to down 2-4% from peak in most submarkets

Days on market: Extended from 15-20 days to 30-45 days in many areas

Seller concessions: Now common (closing costs, rate buydowns, repair credits)

New construction: Heavy inventory in northern suburbs creating resale competition

This isn’t a crash. This is opportunity for strategic buyers and strategic agents.

The Submarket Intelligence That Matters

Here’s where local market knowledge crushes generic “DFW market” analysis:

High new-build inventory areas (Prosper, Celina, parts of Frisco):

- Builders offering aggressive incentives

- Resale homes facing pricing pressure

- Opportunity for buyers willing to negotiate

Established Ellis County communities (Waxahachie, Midlothian, Red Oak):

- More balanced inventory

- Modest price adjustments

- Strong fundamentals (schools, infrastructure, I-35 corridor access)

Emerging development corridors (Ferris, Palmer, parts of Ennis):

- The South Creek Ranch project creating long-term value proposition

- Current buyer opportunity before infrastructure completion drives prices

- Strategic timing for investors and long-term buyers

Lake markets (Whitney, surrounding areas):

- Seasonal dynamics still apply

- Recreation property values holding steady

- Different buyer profile (lifestyle versus commuter)

What This Means for Your Buyer Clients

If you’re coming from California, Utah, Colorado, or Arizona, which is a huge part of my business, here’s the strategy you need to consider:

The opportunity: Lock in today’s prices while inventory is high and sellers are negotiable, with the option to refinance if rates drop 50-75 basis points over the next 12-18 months.

The risk: Waiting for “perfect” rates that may never materialize, then watching inventory tighten and prices firm up when other buyers decide 5.75% is good enough.

The strategic move: Get pre-approved, understand your monthly payment comfort zone, and pounce when you find the right property in the right location at a fair price.

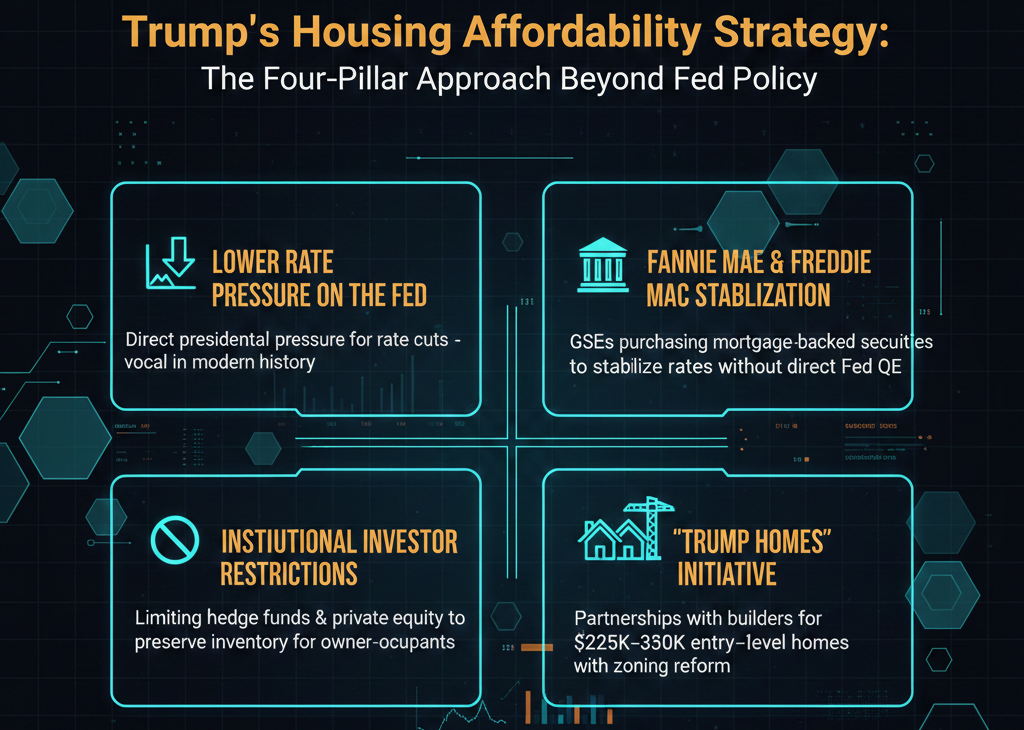

Trump’s Housing Affordability Strategy: The Bigger Picture Beyond Fed Policy

Fed policy is one piece of the puzzle. Trump’s broader housing agenda is the other piece, and it directly impacts our North Texas markets.

The Multi-Pronged Approach

1. Lower Rate Pressure on the Fed

Trump has been extremely vocal about wanting lower interest rates, more vocal than any president in modern history. That political pressure doesn’t force the Fed’s hand (they’re independent), but it creates a political environment where rate cuts align with administration priorities.

2. Fannie Mae and Freddie Mac as Market Stabilizers

Discussions about using the GSEs (government-sponsored enterprises) to purchase more mortgage-backed securities would essentially replicate some QE effects without the Fed directly doing it. This could help keep mortgage rates more stable even as the Fed shrinks its balance sheet.

3. Institutional Investor Restrictions

Policies aimed at limiting large institutional investors (hedge funds, private equity, foreign buyers) from dominating single-family home purchases are intended to keep inventory available for:

- First-time homebuyers

- Small local investors

- Owner-occupants

This matters in DFW because we’ve seen significant institutional buyer activity, particularly in Dallas County, Tarrant County, and parts of Ellis County.

4. “Trump Homes” and Entry-Level Development Initiatives

Reports indicate partnerships with major homebuilders to develop more affordably-priced homes, potentially with:

- Zoning reform incentives

- Streamlined permitting

- Federal financing support

- Focus on $225K-$350K price range

This aligns perfectly with our Ellis County market position and the Ferris development project.

The Affordability Paradox Nobody’s Talking About

Here’s the strategic tension that most agents are missing: Trump has explicitly said he doesn’t want home prices to fall significantly because he wants to protect existing homeowners’ equity.

That creates a contradiction:

- Lower rates help new buyers afford more expensive homes

- But keeping prices elevated limits actual affordability gains

- The balance likely means slower, more modest improvement rather than dramatic changes

Strategic positioning for your clients: Manage expectations. We’re not returning to 2019 prices. We’re returning to more normal appreciation rates (2-4% annually versus 15-20% during the pandemic years).

Should You Buy Now or Wait? The Strategic Framework

This is where rubber meets road. Every buyer conversation eventually gets to this question.

The Case for Buying Now (February-March 2026)

Price advantage: Softening prices in many North Texas submarkets mean buyers have 5-10% more negotiating power than they had 12 months ago. On a $350,000 home, that’s $17,500-$35,000 in potential savings.

Inventory selection: More options means better ability to find the right property, not just any available property. In 2021-2022, buyers were making offers sight-unseen. Today, they can be selective.

Seller concessions: Many sellers are offering:

- 2-1 or 1-0 rate buydowns (effectively lower first 1-2 years’ payments)

- Closing cost credits ($3,000-$8,000 typical)

- Repair credits or pre-closing repairs

- Flexibility on timing and contingencies

Refinance optionality: If Warsh’s Fed cuts rates and mortgage rates drop to 5.25%-5.5% range, buyers can refinance. But they can’t go back in time and repurchase the house at today’s lower price if they wait and prices firm up.

The Case for Waiting (Calculated Patience)

Potential rate decline: If mortgage rates drop another 50-75 basis points to the 5.25%-5.5% range, monthly payments would improve by $75-$125 per month on a $300,000 loan. That’s meaningful.

Further price adjustment: Some neighborhoods, particularly those with heavy new-build competition, might see additional 2-3% price declines over the next 6-9 months.

Economic uncertainty: If you’re in a volatile employment situation or expect income changes, waiting until you feel more stable makes sense regardless of rates.

Market timing for specific properties: If you’re targeting a very specific neighborhood or property type where inventory is increasing, patience might yield better options.

The Strategic Framework I Use With Clients

Here’s how I actually counsel buyers through this decision:

Step 1: Get fully pre-approved (not pre-qualified, actually underwritten)

This tells you your real budget at today’s rates, including:

- Maximum purchase price

- Required down payment

- Monthly payment (PITI + HOA if applicable)

- Cash reserves needed

- Debt-to-income constraints

Step 2: Define your monthly payment comfort zone

Not what the bank says you can afford, what you’re comfortable paying while maintaining your lifestyle, saving for emergencies, and handling unexpected expenses.

For most buyers, this is 25-30% of gross monthly income, not the 43-50% that underwriting allows.

Step 3: Identify your true priorities

- Location (commute, schools, family proximity)

- Property features (size, layout, condition)

- Timeline (how urgent is your need to move)

- Risk tolerance (how comfortable are you with uncertainty)

Step 4: Make a decision based on fundamentals, not rate speculation

If you find a property that:

- Meets your needs and priorities

- Is fairly priced for current market conditions

- Fits within your comfortable monthly payment

- Is in a location you want to be for 5+ years

Then buy it. Don’t let the hope of a marginally lower rate six months from now cause you to miss the right property at the right price.

The Intelligence Advantage: Why You Deserve THE Expert on Fed Policy and Local Market Dynamics

Let me bring this full circle to what actually matters for you as a buyer or seller.

Every agent in DFW is going to be talking about the Warsh nomination and mortgage rates. Most of them will be regurgitating the same surface-level analysis they found on some national real estate blog.

That’s not intelligence. That’s noise.

Real intelligence is understanding:

- The balance sheet reduction strategy and why it might keep long-term rates elevated even as the Fed cuts short-term rates

- The AI productivity thesis and how it changes the inflation-growth tradeoff

- The yield curve dynamics that determine whether Fed cuts actually translate to lower mortgage rates

- The political timeline and when markets will start pricing in Warsh’s expected policies

- The local market microtrends that matter more than national headlines

When your agent can explain why a 5.75% mortgage rate in 2026 is actually a good deal given structural factors, and back it up with real analysis instead of hopeful speculation, you’re working with someone who can save you time and money.

That agent is operating in a different category entirely.

The Bottom Line: What Kevin Warsh as Fed Chair Means for North Texas Real Estate

Let me synthesize this into actionable intelligence:

Most Likely Scenario (60-70% Probability)

- Warsh confirmed as Fed Chair in April-May 2026

- Fed cuts federal funds rate 2-3 times in 2026 (50-75 basis points total)

- Mortgage rates drift to 5.5%-6.0% range by year-end

- North Texas home prices remain flat to up modestly (0-3%)

- Inventory stays elevated but begins normalizing in Q3-Q4

- Best buying opportunities are Q1-Q2 before any rate-driven demand surge

Optimistic Scenario (20-25% Probability)

- Fed cuts more aggressively based on AI productivity confidence

- Mortgage rates approach 5.25%-5.5% by late 2026

- Moderate increase in buyer activity but not panic-buying

- Prices firm up in desirable submarkets but remain negotiable

- Refinance wave in 2027 for 2025-2026 buyers

Pessimistic Scenario (10-15% Probability)

- Economic weakness forces more aggressive cuts

- Mortgage rates drop below 5.5% but unemployment rises

- Housing demand softens despite lower rates

- Further price adjustments in some North Texas markets

- Buyer opportunities but qualification challenges

The Final Strategic Truth

Kevin Warsh’s nomination as Fed Chair matters, but it matters less than most people think for individual buying and selling decisions.

What matters more is:

- Location: You can’t refinance a bad location

- Property fundamentals: the condition, layout, and features need to meet your needs

- Financial position: Buying within your comfort zone regardless of rates

- Timing: Your life circumstances and timeline

- Market knowledge: Understanding specific submarket dynamics in Ellis County and surrounding areas

The agents who thrive in 2026 won’t be the ones who predicted mortgage rates perfectly. They’ll be the ones who helped clients make confident decisions based on comprehensive analysis of both macro policy and micro market dynamics.

While everyone else is waiting for the perfect rate, you’re 5 steps ahead securing the perfect property at today’s prices with the flexibility to refinance tomorrow if conditions improve.

That’s not speculation. That’s strategy.

Bobby Franklin, REALTOR®

Legacy Realty Group – Leslie Majors Team

📲 214-228-0003 | northtexasmarketinsider.com

Need personalized analysis of how Fed policy changes affect your specific buying or selling situation in North Texas? Let’s talk strategy. Because in this market, intelligence isn’t just power, it’s profit.

Join The Discussion