Because while everyone’s obsessing over home inspections, the real intel is hiding in plain sight

Here’s something that’ll blow your mind: I’ve watched buyers drop six figures on North Texas properties without knowing the house had THREE insurance claims in the past five years.

Not because sellers were hiding it. Not because agents were negligent. Because nobody asked the right questions.

This is exactly the kind of chaos other agents run from, but I run straight toward it. Because chaos? That’s where the opportunity lives. That’s where YOU get the edge that protects your investment while everyone else is playing checkers.

Let me introduce you to your new best friend in Texas real estate: the CLUE report.

What’s a CLUE Report? (And Why Should You Give a Damn?)

Comprehensive Loss Underwriting Exchange. Sounds boring, right?

WRONG.

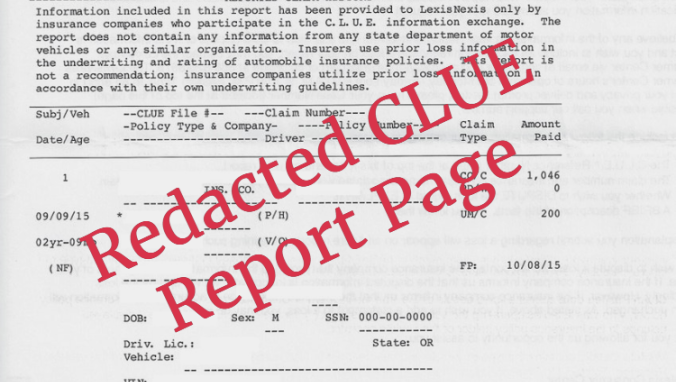

This is your seven-year window into every insurance claim that property has ever filed. Every hailstorm repair, every foundation crack, every water leak that insurance paid for, it’s all documented in this report generated by LexisNexis.(CLUE Report)

Think of it like this: you wouldn’t marry someone without knowing their history. Nope. So why would you marry a $400,000 house without knowing what problems it’s been hiding?

In Texas, where we’ve got expansive clay soils trying to eat foundations for breakfast, hailstorms that think they’re at batting practice, and flooding that shows up uninvited, this report isn’t just nice to have. It’s ammunition.

The Part Nobody Tells You: How to Actually GET One

Here’s where it gets interesting. You can’t just order a CLUE report on any property you want. Only the current owner can request it.

But that doesn’t mean you’re powerless. Far from it.

Strategy #1: The Free Route

Property owners get one free CLUE report per year. They can request it at consumer.risk.lexisnexis.com or by calling 866-312-8076. Reports arrive within 15 days.(How To Order CLUE Report)

Strategy #2: The Chess Move

Make your offer contingent on receiving a satisfactory CLUE report. Now the seller has to get one if they want to close.

See what we did there? Turned their gatekeeping into your leverage.

Strategy #3: The Insurance Agent Backdoor

When getting insurance quotes, many agents can pull property loss history during their quote process. Ask them to share what they find.

This is strategic thinking 101: while everyone else is asking permission, you’re finding three different ways to get the same information.

When You ABSOLUTELY Need This Report (Non-Negotiable)

The “Hell Yes” Scenarios:

1. Older Homes (Pre-1990)

Listen, I love a good vintage property. Character, charm, all that. But decades of Texas weather? That’s a lot of opportunities for things to go sideways. Foundation settling, roof damage from hail the size of baseballs, water intrusion that’s been playing hide-and-seek for years.

2. Properties in Flood Zones

Texas flooding isn’t a joke—it’s a recurring nightmare. Any property near waterways, in low-lying areas, or with drainage issues needs this report like it needs oxygen.

3. Recent “Renovations”

Fresh paint and granite countertops are great. Know what’s NOT great? When they’re covering up $50,000 in previous water damage. A CLUE report reveals whether those “improvements” were actually insurance claim repairs.

4. The “Too Good to Be True” Price

Property priced 15% below comps? Either you found a motivated seller or there’s a reason everyone else walked away. CLUE report tells you which.

5. Investment Properties

You’re running numbers on rental income and ROI? Cool. Now factor in that the property has had three foundation claims in five years. Changes the math, doesn’t it?

When to Skip It (Yes, Sometimes You Can)

New Construction (Never Occupied)

Brand new home? Save your energy. There’s no history to review. Put that effort into a killer new construction inspection instead.

Properties Under $100K

At this price point in Texas, you’re already expecting issues. CLUE report probably won’t tell you anything that changes your decision.

Cash Buyers Planning Gut Renovations

Tearing everything down to studs? Previous damage becomes less relevant when you’re replacing it all anyway.

Seller Already Disclosed Major Issues

If they’ve already told you about the foundation work and priced it accordingly, CLUE report adds minimal value.

Reading the Red Flags: What Makes Me Reach for My Phone

When I see a CLUE report, here’s what makes my radar ping:

DEFCON 1 Alerts:

Multiple Water Damage Claims

One water claim? Could be bad luck. Three water claims? That’s a pattern. And in Texas, where foundation issues often stem from water management problems, this is your “proceed with extreme caution” signal.

Foundation or Structural Claims

Any claims related to foundation movement, settling, or structural damage require immediate additional investigation. Our expansive clay soils don’t mess around.

The Same Problem, Different Day

Multiple claims for the same issue, like repeated roof damage, means either repairs weren’t done right, or there’s an underlying problem nobody’s fixed.

Six-Figure Insurance Payouts

Large settlements might indicate major damage that, even when repaired, could lead to future problems.

Potentially GOOD News:

Single Large Claim + Complete Repair

A major storm claim that resulted in a complete roof replacement? You might be getting a newer roof without paying for it. That’s found money.

Professional Remediation Evidence

Proof of proper professional repair work provides peace of mind about fix quality.

Real Stories: How This Report Changed Everything

The Dallas Disaster Avoided

Client was looking at a beautifully renovated home in Plano. Magazine-worthy. CLUE report? Three water damage claims over five years, $40,000+ in payouts. Further investigation uncovered ongoing foundation issues causing repeated water intrusion. We walked. They found a different property. Potential disaster avoided.

The Fort Worth Negotiation Win

Target property had hail damage two years prior. Used this intel to negotiate a $15,000 price reduction, savings went toward additional inspections and preventive maintenance. That’s not luck. That’s strategy.

The Houston Insurance Reality Check

CLUE report showed multiple theft claims. Explained why insurance quotes were sky-high and helped factor ongoing higher costs into the purchase decision. No surprises at closing.

Using This Intel Like a Weapon (The Good Kind)

Negotiation Ammunition:

Price Reductions

Use documented claims history to justify lower offers, especially for properties with recurring issues.

Repair Credits

Request seller credits for additional inspections or preventive measures based on revealed claims.

Insurance Shopping

Share CLUE information with multiple insurance companies to find competitive rates for properties with claims history.

Due Diligence Superpowers:

Targeted Inspections

Use CLUE information to direct your inspector’s attention to previously damaged areas. No more generic walk-throughs.

Specialist Consultations

Bring in foundation specialists, water damage experts, or roofing professionals based on specific claims history.

Maintenance Planning

Understand what issues the property faced to budget for potential future problems.

The Legal Reality in Texas

Here’s what you need to know: While Texas law requires sellers to provide a Seller’s Disclosure Notice for residential properties, CLUE reports are NOT legally required disclosures. However, sellers must disclose known material defects.

Texas Property Code Section 5.008 mandates seller disclosures for single-family residential properties, but this doesn’t include insurance claims history.

Translation: Smart buyers proactively request CLUE reports as additional due diligence. Don’t wait for information to come to you. Go get it.

The Money Question: Is It Worth It?

The Investment:

- Free for property owners once annually

- $19.95 if needed more than once

- Potential savings: Thousands in avoided repairs, lower insurance premiums, negotiated price reductions

The Time:

- Request processing: 15 days maximum

- Report review: 30-60 minutes

- Follow-up investigations: Varies

For most Texas buyers—especially on properties over $200K or in weather-prone areas—this is the easiest money you’ll ever save.

Your Quick-Hit FAQ

Q: How long do claims stay on record?

Five to seven years, depending on claim type and reporting insurance company.

Q: Can I order one on a property I want to buy?

No, only the current owner can request it. But you can ask the seller to provide one or make it a contingency of your offer.

Q: Will previous claims affect MY insurance rates?

Yes. Insurance companies consider property claims history when setting premiums, regardless of who filed the previous claims.

Q: What if the report shows errors?

Property owners can dispute incorrect information by contacting LexisNexis at 888-497-0011.

The Bottom Line (Because You’re Busy)

Get the CLUE report when:

- Buying older properties (especially pre-1990)

- Considering homes in flood-prone areas

- Dealing with properties showing recent repair signs

- Making offers on suspiciously low-priced homes

- Planning investment purchases

Skip it when:

- Buying new construction never occupied

- Purchasing very low-value properties with expected issues

- Planning complete gut renovations

- Sellers disclosed and priced in major known issues

Here’s What Separates Winners from Everyone Else:

While other buyers are walking through open houses taking pictures of the kitchen backsplash, you’re going to be the one asking about CLUE reports. While other agents are pushing for quick closes, I’m the one making sure you have every piece of intel that matters.

Because in Texas real estate, information isn’t just power. It’s profit.

This is exactly the kind of strategic thinking that transforms you from someone who BUYS real estate into someone who WINS at real estate.

Want to know what else the competition isn’t telling you about North Texas properties?

📊 Get market moves before they hit the news

🎯 Text 214-228-0003 | Link in bio

Bobby Franklin – REALTOR®

Legacy Realty Group – Leslie Majors Team

Disclaimer: This content is created for North Texas real estate buyers and sellers, aligning with current federal regulations (Fair Housing Act, RESPA, NAR Code of Ethics, Texas Property Code Section 5.008), professional standards, and advertising policies. All content is original and reflects current market research. For personalized guidance on CLUE reports or your next North Texas transaction, let’s talk strategy.