Your Strategic Guide to the Most Balanced Market in Years

Table of Contents

- Part I: The National Economic Foundation

- The Economist Consensus

- Mortgage Rate Projections

- The Affordability Reset

- Inventory Recovery

- Part II: Why North Texas Is Different

- DFW’s #1 Ranking

- Ellis County Deep Dive

- Price Stability Analysis

- Part III: Strategic Intelligence by Market Segment

- Buyer Persona Strategies

- Neighborhood-Level Intelligence

- The 2026 Calendar

- Part IV: Your Action Framework

- Risk Analysis

- Decision Framework

- What Others Get Wrong

- Part V: The Bottom Line & Next Steps

Listen, I’m going to be straight with you. After three years of watching buyers get crushed by affordability challenges and sellers trapped by the rate lock-in effect, something fundamental is shifting in the North Texas housing market. And if you’re not paying attention, you’re going to miss it.

The top economists at NAR, Realtor.com, Zillow, and Redfin aren’t just cautiously optimistic about 2026, they’re using words like “opportunity,” “reset,” and “normalization.” Redfin is literally calling this “The Great Housing Reset.” Not a crash. Not a boom. But the first genuine rebalancing of market forces we’ve seen since before the pandemic turned everything upside down.

Here’s what nobody’s telling you: this isn’t about waiting for perfect conditions. Those pandemic-era 3% rates? They’re not coming back unless the economy collapses, and if you’re banking on economic collapse to afford a house, you need a better strategy. This is about recognizing when the fundamentals align in your favor for the first time in years, and having the strategic intelligence to act while others are still paralyzed by analysis.

Let me break down exactly what’s happening, why North Texas is positioned differently than the rest of the country, and what this means for your specific situation. Because while national trends matter, real estate is hyperlocal, and if you’re making decisions based on what’s happening in Phoenix or Miami instead of understanding Ellis County dynamics, you’re already five steps behind.

Part I: The National Economic Foundation

The Economist Consensus: Why Smart Money Is Paying Attention to 2026

When you get the chief economists from NAR, Realtor.com, Zillow, and Redfin all saying essentially the same thing, you need to pay attention. These aren’t bloggers with hot takes, these are PhDs with billions of dollars in research budgets analyzing every data point in the housing market.

Danielle Hale, Chief Economist at Realtor.com: The Modest Improvement Framework

“After a challenging period for buyers, sellers and renters, 2026 should offer a welcome, if modest, step toward a healthier housing market.” -NAR 2026

Hale isn’t promising you the moon. She’s projecting mortgage rates averaging around 6.3% throughout 2026, with home prices rising a modest 2.2%. Now, if you’re disappointed by those numbers, let me reframe this for you: that 2.2% price growth is the slowest appreciation we’ve seen in years, which means your purchasing power is finally catching up to home values instead of falling further behind.

Think about what happened between 2020 and 2024. Home prices surged 45% nationally while wages grew maybe 20%. That’s why you felt priced out, because you literally were. In 2026, that dynamic reverses. For the first time since the Great Recession, your wages are growing faster than home prices. That’s not just an improvement. That’s a fundamental shift in the affordability equation.

Mark Fleming, Chief Economist at First American: The Tailwind Analogy

“For the first time in several years, the underlying forces are finally aligned toward gradual improvement. Mortgage rates may drift down only slowly, but income growth exceeding house price appreciation will provide a boost to house-buying power, even in a higher-rate world.”

Fleming uses the perfect metaphor: we’re a ship that’s finally caught a steady tailwind. Affordability won’t snap back overnight, but for the first time in years, the wind is at your back instead of in your face.

Here’s what he’s really saying: stop waiting for rates to hit 3%. That’s like waiting for gas to cost $1.50 a gallon again, technically possible in some catastrophic scenario, but strategically stupid to build your life plans around. Instead, recognize that when wages outpace home prices, you can benefit from a “higher-rate world” because your actual purchasing power is increasing month after month.

Mischa Fisher, Chief Economist at Zillow: The Breathing Room Concept

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

Zillow is projecting just 1.2% price growth nationally with sales volume up 4.3%. Why does that matter to you? Because more transaction volume with modest price growth means a functional market where real people can actually buy and sell homes based on their life circumstances instead of being frozen by market dysfunction.

“Breathing room” might sound boring, but it’s exactly what’s been missing. When was the last time you could tour a house, think about it overnight, and make a decision without getting into a bidding war with twelve other buyers? That’s what a normalized market looks like.

Lawrence Yun, Chief Economist at NAR: The Volume Surge Prediction

“Lower mortgage rates and a rising supply of homes will save the day for the housing market next year. In 2026, we expect higher inventory, modest improvements in affordability and more accommodating monetary policy from the Federal Reserve will help more Americans buy their next home.”

NAR is projecting a 14% increase in home sales. Let me translate: pent-up demand is about to meet improving conditions, and when that happens, the buyers who are strategically positioned will have options while the ones still “waiting for the perfect time” will find themselves competing again.

Yun notes something critical: middle-income buyers could afford 50% of listings before the pandemic but only 21% by 2025. If 2026’s improvements move that needle back to even 30-35%, that’s millions of households nationwide, and thousands in North Texas alone, who suddenly have realistic paths to homeownership.

KEY INSIGHT: When four major economic forecasters with different methodologies all reach the same conclusion, that’s not coincidence, that’s confirmation. The fundamentals are shifting in favor of balanced market conditions for the first time since 2019.

For more information on current mortgage rates visit our DFW Market Updates page.

Mortgage Rates in 2026: The Realistic Expectation Framework

Let’s talk about the elephant in the room: mortgage rates. After hitting nearly 8% in late 2023 and bouncing around 6.5-7.5% through most of 2024-2025, rates are expected to stabilize and decline modestly in 2026.

The Consensus Range: 6.0-6.3% (And Why That’s Actually Good News)

Here’s what every major forecaster is projecting for 2026:

- Realtor.com: 6.3% average

- Redfin: 6.3% average

- Zillow: Around 6.3%

- NAR: Trending toward 6.0%

- Mortgage Bankers Association: 6.4%

- Freddie Mac: Below 6% by year-end

The expected trading range is roughly 5.5-6.5%, with potential dips below 6% in the second half, if the Federal Reserve continues its accommodative approach.

Now, before you tell me that’s still higher than you wanted, let me give you some perspective that apparently nobody else is willing to share: the 30-year average mortgage rate from 1990-2020 was approximately 6.3%. You know what that means? The rates economists are projecting for 2026 are literally historically normal.

Those 2-3% pandemic rates? Emergency monetary policy that only existed because the economy was in crisis. If you’re waiting for another economic crisis to buy a house at crisis-level rates, I need you to think about what that strategy actually means for your job security, your savings, and your life.

What Rate Relief Actually Means for Your Wallet

Even modest rate declines create substantial purchasing power improvements. Let me show you the math on a $400,000 mortgage:

- At 7.0%: Monthly payment of approximately $2,661 (principal + interest)

- At 6.5%: Monthly payment of approximately $2,528 (saves $133/month, $1,596/year)

- At 6.0%: Monthly payment of approximately $2,398 (saves $263/month, $3,156/year compared to 7%)

Over a 30-year mortgage, the difference between 7% and 6% amounts to over $94,000 in total interest savings. That’s the equivalent of adding 15-20% to your purchasing power without increasing your monthly payment.

But here’s what really matters: while you’re waiting for rates to drop another half percent, you’re missing months of equity building and home value appreciation. Even at modest 2% annual appreciation, a $400,000 home gains $8,000 in value that first year. So you save $1,500 in interest by waiting for a better rate, but you miss $8,000 in equity and another 12 months of rent payments. Do that math.

Why Rates Are Declining (And Why They Won’t Plummet)

The Federal Reserve has signaled a more cautious approach after the aggressive rate hikes of 2022-2023. Core inflation has cooled from 9% to around 2.9%, approaching the Fed’s 2% target. Economic growth is stabilizing without overheating. The Fed’s recent rate cuts and “wait and see” approach favor stability or modest declines.

But Minneapolis Fed President Neel Kashkari made it clear: “interest rates don’t need to be cut much more.” Translation: don’t expect dramatic rate drops unless something breaks in the economy. And if something breaks badly enough to trigger 3% rates again, you probably have bigger problems than mortgage shopping.

INSIDER TAKE: I hear people say “I’m waiting for rates to drop to 5%.” Okay, let’s say that happens in late 2026 or early 2027. Meanwhile, you’ve paid rent for another 12-18 months (let’s say $2,000/month = $24,000-$36,000 gone), missed a year of appreciation on a $400,000 home (at 2% = $8,000), and you have zero equity. That’s $32,000-$44,000 in opportunity cost to save maybe $100/month on your mortgage payment. That’s not strategy. That’s paralysis.

For more information on mortgage rates visit our Mortgage Rates section of our Market Intel Blog.

The Affordability Reset: The Most Important Story of 2026

Here’s what nobody’s talking about clearly enough: the most significant development for 2026 isn’t mortgage rates or inventory, it’s the relationship between wages and home prices fundamentally shifting in your favor for the first time in over a decade.

The Great Housing Reset: Not a Crash, But a Rebalancing

Redfin calls it “The Great Housing Reset”, not a dramatic crash, but a gradual normalization where income growth finally exceeds home price appreciation.

Between 2019 and 2024, home prices surged roughly 45% while wages grew maybe 20%. That’s why it felt impossible, because the math literally didn’t work. You weren’t bad at budgeting. The market was objectively broken for wage earners.

In 2026, this reverses:

- Home price growth: 1.0-2.2% projected

- Wage growth: 3.9% annually

- Real wage growth (after 2.9% inflation): Approximately 1.0%

This is the first sustained period since 2008-2012 when your wages are actually catching up to home prices. Every month that continues, you can afford more house with the same income. That’s not speculation. That’s arithmetic.

What This Means in Real Numbers

Consider a North Texas household earning the median income of approximately $82,000:

- 2024: Could afford about 35% of available homes in the market

- 2026 projection: Could afford approximately 42-45% of available homes

That 7-10 percentage point improvement represents you from being able to afford three out of ten homes, to being within reach of four or five out of ten. In practical terms, that’s the difference between “nothing fits our budget” and “we actually have choices.”

Let me be clear: the affordability crisis isn’t solved. Lawrence Yun notes that middle-income buyers could afford 50% of listings pre-pandemic but only 21% in 2025. We’re not back to pre-pandemic conditions, and we probably never will be. But 2026 moves the needle in your direction for the first time in years.

Why This Reset Benefits Everyone (Yes, Even Sellers)

Here’s the counterintuitive reality: improved affordability doesn’t hurt sellers. A larger pool of qualified buyers means:

- More consistent demand instead of boom-bust volatility

- Faster sales timelines as buyer pools expand

- Greater price stability reducing the risk of value declines

- More predictable transaction processes

Healthy markets benefit everyone. When buyers have realistic options and sellers have qualified purchaser pools, transactions happen based on life circumstances instead of market timing gambling. That’s what “breathing room” actually means.

KEY INSIGHT: The affordability reset isn’t about returning to 2019, it’s about stopping the bleeding. For the first time in 5+ years, affordability is improving month over month instead of deteriorating. That’s the shift that matters.

Inventory Recovery: More Homes, More Choices, More Strategy

After years of severe housing shortages that created bidding wars and waived contingencies, inventory is finally recovering. Not to historical norms yet, but moving in the right direction.

The Numbers: Gradual Recovery, Not Flood

Realtor.com projects active listings will increase 8.9% year-over-year in 2026. By year-end, inventory is expected to reach approximately 88% of pre-pandemic levels, still 12% below normal, but substantially improved from the desperate shortage of 2021-2022.

Why does gradual matter? Because a sudden flood of inventory destabilizes prices while steady increases allow proper market adjustment. This isn’t 2008 where foreclosures overwhelmed the system. This is healthy normalization.

The Lock-In Effect Is Breaking (Slowly)

One major inventory constraint has been the “lock-in effect”,

homeowners with 2-3% mortgages refusing to sell and trade up to 6%+ rates. This dynamic removed millions of potential listings as move-up buyers decided to stay put.

But NAR economists note the lock-in effect is “steadily disappearing.” Why? Because life circumstances eventually trump financial spreadsheets. Growing families need more space. Job relocations happen. Divorces force sales. Retirees downsize. Deaths trigger estate settlements.

Every month, more homeowners reach decision points where moving makes sense despite rate differentials. That’s not speculation, that’s demography and life cycles.

For more information on the “lock-in effect” read our Stranger Things themed article: Episode 2 Vecna’s Curse

Baby Boomer Supply: Gradual Addition, Not Tsunami

Baby boomers own approximately 32 million properties nationwide, with about 4.4 million homes annually entering the market through various channels. Before you get excited about a supply tsunami, understand this: annual home sales typically run 5.5-6 million transactions. Boomer supply represents steady inventory addition, not market-flooding volume.

More importantly, boomers aren’t all selling at once. This is a 15-20 year process as the generation ages through different life stages. The supply comes gradually, gets absorbed by sustained demand, and creates opportunities for strategic buyers, not panic for sellers.

ACTION ITEM: Set up saved searches in your target neighborhoods NOW. Watch how inventory trends over the next 3-6 months. The neighborhoods where inventory expands fastest will offer the best buyer opportunities. The neighborhoods where inventory stays tight will see continued price strength for sellers.

Part II: Why North Texas Is Different

North Texas: Why We’re the #1 Market to Watch in 2026

Now let’s talk about why everything I’ve discussed so far matters more in North Texas than almost anywhere else in the country.

PwC Rankings: DFW Takes the Crown (Again)

PwC’s “Emerging Trends in Real Estate” report ranked Dallas-Fort Worth as the #1 market to watch in 2026 for overall investment and development prospects. This marks the second consecutive year we’ve topped the rankings.

Why? Job growth, population trends, business climate, and real estate fundamentals all converging. While other markets face challenges, North Texas combines strong economic growth with relative affordability and consistent corporate relocations.

Let me be blunt: when the smartest institutional money in real estate ranks your market #1 for two years running, you pay attention.

Fort Worth Market Snapshot: The Transition to Balance

Fort Worth’s late-2025 numbers tell a strategic story:

- Median home price: $359,000 (flat year-over-year)

- Months of inventory: 3.9 months (up from 3.6 months)

- Days on market: 56 days average

- Sales volume: Stable

That increase from 3.6 to 3.9 months of inventory is more significant than it looks. Real estate economists consider 4-6 months “balanced market” territory where neither buyers nor sellers hold overwhelming advantages.

Fort Worth’s trajectory toward 4.5+ months by mid-2026 signals conditions favorable for both sides: buyers get more choices and less competition; sellers get strong demand with price stability. That’s the definition of a healthy market.

Why North Texas Outperforms: The Structural Advantages

Several factors position North Texas for continued strength that other markets can’t replicate:

Corporate Relocations: Over 100 corporate headquarters have moved to DFW since 2018. Charles Schwab. CBRE. Oracle (partially). Multiple Fortune 500 firms. These aren’t branch offices, these are headquarters bringing thousands of high-income employees who need housing.

Economic Diversification: Unlike Austin (too tech-dependent) or Houston (too energy-dependent), DFW’s economy spans finance, healthcare, technology, logistics, manufacturing, and energy. When one sector struggles, others compensate.

Relative Affordability: The median home in Fort Worth ($359,000) or DFW overall ($375,000-$418,000) remains dramatically cheaper than coastal metros and even neighboring Austin. When California professionals can sell their $800,000 starter home and buy a 3,000-square-foot house in Waxahachie for $450,000 while pocketing $350,000, they keep coming.

Population Growth: The metroplex continues adding thousands of new residents monthly through domestic migration and international immigration. That’s not speculation, that’s Census data and corporate relocation announcements.

Business Climate: Texas’s lack of state income tax, reasonable cost of living, and pro-business environment maintain competitive advantages. When companies evaluate where to expand, we’re consistently in the top three options.

Infrastructure Investment: Ongoing highway expansions, public transit development, and commercial real estate growth support long-term property values.

DFW vs. Other Texas Markets: We’re Still Leading

While Austin, Houston, and San Antonio have shifted into buyer’s markets with rising inventory and softer pricing, DFW has maintained the strongest demand in Texas with the lowest months of supply at 3.4 months.

That relative supply constraint supports price stability while still improving buyer conditions compared to the insanity of 2021-2023. We’re getting the best of both worlds: better buyer conditions without the price weakness other markets are experiencing.

INSIDER’s Take: I track every major Texas market, and here’s what most agents won’t tell you: DFW is the Goldilocks market right now. Austin got too hot too fast and is correcting harder. Houston has oil & gas volatility. San Antonio lacks the corporate HQ relocations. DFW has the perfect mix of growth without speculation, jobs without single-industry dependence, and affordability without being “cheap.” That’s why institutional investors keep betting on us.

For more information on Corporate Relocations to the metroplex, visit our Corporate Relocations section of our Market Intel Blog.

Ellis County Deep Dive: The Strategic Opportunity Others Are Missing

Here’s where we get into intelligence most North Texas agents don’t have. Ellis County isn’t just “affordable DFW”, it’s the most strategically positioned growth market in the entire metroplex for the next decade.

Why Ellis County Is Different

The Geography of Opportunity: Ellis County sits directly south of Dallas County, positioned perfectly in the I-35E corridor that connects Dallas to Austin. As Dallas pushes south and development costs in Tarrant and Collin counties skyrocket, Ellis County becomes the obvious next growth target.

The Numbers That Matter:

- Waxahachie median home price: $365,000 (up from $315,000 pre-pandemic)

- Midlothian median: $385,000

- Red Oak median: $340,000

- Ennis median: $295,000

Compare that to:

- Plano: $485,000+

- Frisco: $525,000+

- McKinney: $445,000+

- Arlington: $320,000

You’re getting new construction, modern schools, and Dallas access at 20-30% below Collin County prices. That gap is strategic opportunity.

The Ferris Development: The Biggest Story No One’s Talking About

In late 2024, a 5,200-acre tract in Ferris (southern Ellis County) was purchased for master-planned development now named South Creek Ranch. Let me put that in perspective: 5,200 acres is nearly 8 square miles of new residential and commercial development.

Read more about South Creek Ranch: The $2.4B Secret That Will Transform North Texas Real Estate

That’s not a neighborhood. That’s a new city within Ellis County.

What this means strategically:

Infrastructure Investment Coming: You don’t develop 5,200 acres without major road improvements, utility expansion, school district growth. That infrastructure benefits existing Ellis County homeowners through improved access and services.

Employment Hub Development: Master-planned communities of this scale always include commercial components. That means jobs coming TO Ellis County instead of residents commuting out.

Appreciation Catalyst: Every phase of this development increases Ellis County’s profile and attracts more homebuyers. Early buyers in surrounding areas benefit from the halo effect.

Timeline: First phases likely 2027-2028, but smart money positions ahead of that. By the time ground breaks, appreciation has already started.

Waxahachie: The Ellis County Anchor

Waxahachie isn’t just the county seat, it’s becoming a legitimate alternative to overpriced Collin County suburbs.

What’s Driving Waxahachie:

School District Excellence: Waxahachie ISD is growing rapidly with new campuses, athletic facilities, and academic programs that rival more expensive districts.

Historic Downtown + Modern Amenities: The preserved historic downtown offers character you can’t replicate, while new retail and dining options provide modern convenience.

Commuter Access: 35 minutes to downtown Dallas via I-35E. 25 minutes to southern Dallas employment centers. Better commute than many Collin County locations.

New Construction Value: You can buy brand-new construction in Waxahachie for $350,000-$450,000 that would cost $500,000+ in Collin County. Same builder, same finishes, $100,000+ less.

Price Trajectory: Waxahachie has shown steady 3-5% annual appreciation (compared to 1-2% in more expensive suburbs). That’s sustainable growth, not speculation.

To learn more about Waxahachie: visit our Waxahachie city page

Midlothian: The Industrial Growth Engine

Midlothian’s strategic position on US-67 and proximity to I-35E makes it the industrial and logistics hub of southern DFW.

Economic Drivers:

Corporate Relocations: Several manufacturing and distribution companies have chosen Midlothian for Texas operations due to land availability and logistics access.

Employment Growth: Midlothian is adding jobs faster than housing, creating upward pressure on home values as employees seek to live near work.

Infrastructure: Recent highway improvements have cut commute times to Dallas and Fort Worth, making Midlothian increasingly attractive to dual-income households.

Market Dynamics: Higher median price ($385,000) reflects stronger job base and newer housing stock. This is Ellis County’s “move-up” market.

To learn more about Midlothian: visit our Midlothian city page

Red Oak: The Value Play

Red Oak offers the most affordable entry point to quality Ellis County living.

Strategic Positioning:

Dallas ISD Access: Parts of Red Oak feed into Dallas ISD schools, giving buyers Dallas school choice at Ellis County prices.

Development Pipeline: New subdivisions targeting first-time buyers and young families are creating modern housing stock at accessible price points.

Appreciation Potential: Currently undervalued relative to Waxahachie and Midlothian, Red Oak has 15-20% appreciation potential as Ellis County gentrifies.

Investor Opportunity: Strong rental demand from Dallas workers seeking affordable housing within commuting distance.

To learn more about Red Oak: visit our Red Oak city page

Ennis: The Frontier Market

Ennis represents the furthest south Ellis County growth, and the highest risk/reward opportunity.

The Case for Ennis:

Pure Value: $295,000 median means buyers can access homeownership that’s impossible in Dallas or Tarrant counties.

I-45 Corridor: The High-Speed Rail proposal between Dallas and Houston could transform Ennis into a legitimate commuter option.

Land Availability: Ennis has room to grow for decades without constraint, unlike hemmed-in suburbs.

The Risk: Longer commute (45+ minutes to Dallas) limits buyer pool. Economic downturns hit frontier markets hardest.

Strategic Play: Ennis is for buyers with long time horizons (7-10+ years) who want maximum value and can tolerate volatility.

To learn more about Ennis: visit our Ennis city page

School District Intelligence: The Hidden Value Driver

Ellis County’s school districts are investing aggressively to accommodate growth and attract families from more expensive areas.

Waxahachie ISD:

- New high school under construction

- Expanded career/technical programs

- Growing athletic program competitiveness

- Rating: 7/10 (improving)

Read more about WISD: Waxahachie ISD Guide

Midlothian ISD:

- Strong academic reputation

- Consistent UIL competition success

- New facilities and technology investment

- Rating: 8/10

Read more about MISD: Midlothian ISD Guide

Red Oak ISD:

- Smaller district with personalized attention

- Improving test scores and college readiness

- Some Dallas ISD overlap (strategic advantage)

- Rating: 6/10 (improving trajectory)

Read more about RISD: Red Oak ISD Guide

WATCH THIS: School district quality is the #1 driver of home values in suburban markets. Ellis County districts are investing heavily while more established districts plateau. That trajectory matters more than current ratings.

Infrastructure Projects Most Agents Don’t Know About

I track permit filings, city council minutes, and TxDOT planning documents. Here’s what’s coming to Ellis County that will impact property values:

Highway Improvements:

- I-35E expansion project (2026-2028)

- US-287 widening through Midlothian

- FM-663 improvements in Red Oak area

Utility Expansion:

- Water line extensions enabling development in southern Ellis County

- Fiber optic expansion bringing high-speed internet to rural areas

Commercial Development:

- Multiple retail and dining projects in Waxahachie

- Industrial park expansions in Midlothian

- Medical facilities coming to underserved areas

WHY THIS MATTERS: Infrastructure improvements are leading indicators of appreciation. Properties near these projects see 5-10% premiums over comparable homes further away.

ACTION ITEM: If you’re buying in Ellis County, prioritize areas within 2 miles of planned infrastructure improvements. That proximity will drive value over the next 3-5 years.

Learn more about upcoming infrastructure and developments: visit the Developments section of our Market Intel Blog

Price Stability: Why We’re Not Crashing (And Why That’s Good)

After years of dramatic swings, 45% surge during the pandemic, then stagnation in 2024-2025, the 2026 forecast centers on stability and modest appreciation.

The National Picture: Modest Growth

- Realtor.com: +2.2% nationally

- Redfin: +1.0% nationally

- Zillow: +1.2% nationally

- NAR: +4.0% nationally

The range reflects different methodologies, but all major forecasters agree: dramatic appreciation is unlikely, as are widespread price declines.

North Texas Projections: 1.8% and Strategic Positioning

For DFW specifically, Realtor.com projects approximately 1.8% appreciation in 2026. Fort Worth data through late 2025 shows prices essentially flat year-over-year at $359,000 median, suggesting the market has already undergone its price adjustment and is positioned for modest growth.

Industry analysts identify the $400,000-$750,000 mid-tier market as offering particularly strong value in North Texas. Why? Attractive inventory, builder incentives for new construction, and reduced competition from entry-level and luxury segments that are behaving differently.

Why Prices Won’t Crash: The Fundamentals

Despite perennial crash predictions, economists consistently reject that scenario. Here’s why:

Supply Still Constrained: Even with inventory recovery, housing supply remains 12% below pre-pandemic levels nationally. You can’t have a price crash without oversupply.

Strong Household Formation: Millennials (now in peak homebuying years ages 28-43) and Gen Z are forming households at elevated rates. That’s sustained demand from the largest generations.

Limited Distressed Sales: Unlike 2008-2012, today’s homeowners hold substantial equity and aren’t facing foreclosure waves. Most have locked-in low rates, so even if they’re struggling, they can sell at market value rather than in foreclosure.

Wage Growth Supporting Values: Rising incomes maintain buyer purchasing power even at higher rates, creating price floors.

If you’re waiting for a crash, you’re going to be waiting a long time. And while you wait, you’re paying rent instead of building equity, missing appreciation, and watching your purchasing power erode. That’s not strategy. That’s paralysis.

Insider’s Take: I’ve heard “the market’s going to crash” every year since 2012. People who waited for crashes in 2013, 2015, 2018, 2021, and 2024 all missed massive equity building while paying rent. The fundamentals we’re seeing don’t support crashes, they support modest, sustainable growth. That might be boring, but boring builds wealth.

Part III: Strategic Intelligence by Market Segment

Strategic Buyer Personas: Your Specific Game Plan

National trends don’t matter if they don’t translate to your specific situation. Here’s how 2026’s conditions impact different buyer types, with actual numbers and strategic recommendations.

First-Time Buyers: The Affordability Window Is Opening

Your Profile:

- Household income: $70,000-$100,000

- Savings: $15,000-$35,000 for down payment

- Current situation: Renting, building credit, ready to stop throwing money away

- Target: $280,000-$380,000 homes in Ellis County or southern Tarrant County

Why 2026 Is YOUR Year:

Down Payment Programs: Multiple Texas programs offer 3-5% down payment assistance for first-time buyers. On a $325,000 home, that’s $9,750-$16,250 in help, potentially cutting your cash requirement in half.

FHA Loans at 3.5% Down: With FHA rates competitive with conventional loans, you can buy a $325,000 home with roughly $11,400 down payment (3.5%) plus closing costs. Total cash needed: $18,000-$22,000.

Seller Concessions: In 2026’s balanced market, sellers are more willing to contribute toward closing costs. Negotiating 2-3% seller contribution saves you $6,500-$9,750 on a $325,000 purchase.

The Math That Works:

- Home price: $325,000

- Down payment (3.5% FHA): $11,375

- Closing costs (after 2% seller concession): $4,000

- Total cash needed: $15,375

- Monthly payment (6.3% rate, including taxes/insurance): $2,550-$2,700

Compare to renting:

- Current rent: $1,800-$2,200 for comparable 3-bed apartment

- Additional monthly cost for ownership: $350-$900

- BUT: Building $600-$800/month in equity + appreciation

Strategic Moves for First-Time Buyers:

- Get pre-approved now even if you’re 3-6 months from buying, understand your exact buying power

- Target Ellis County where $325,000 gets you new construction or recent (sub-10 year) homes

- Avoid bidding wars in 2026’s balanced market, walk away if you’re pressured to waive inspections or escalate beyond value

- Work with local lenders experienced in down payment assistance programs, not all lenders understand Texas programs

- Plan for 5+ year ownership, first homes are stepping stones, not forever homes

WHERE TO FOCUS:

- Waxahachie: New construction in the $320,000-$360,000 range in growing subdivisions

- Red Oak: Slightly older homes (10-15 years) in the $295,000-$335,000 range

- Southern Tarrant County (Mansfield, Grand Prairie): More established neighborhoods with proximity to employment

WHAT TO AVOID:

- Overextending on price, if the payment makes you uncomfortable in pre-approval, trust that feeling

- Compromising on school districts, resale value suffers in weak districts

- Older homes without inspection, deferred maintenance becomes your problem

- HOAs over $100/month – that’s $36,000 over 30 years

California/High-Cost State Relocators: The Lifestyle Upgrade Play

Your Profile:

- California (or northeast/west coast) homeowner

- Selling $700,000-$1,000,000+ home in high-cost state

- Looking to reduce cost of living while improving lifestyle

- Target: $400,000-$600,000 Ellis County or western DFW

The Arbitrage Opportunity:

California (Bay Area or Southern California):

- $850,000 home: 1,800 sq ft, 3-bed/2-bath, built 1975, needs updates

- Property taxes: $10,600/year (1.25%)

- State income tax: 9.3%-13.3% on income over $61,000

Ellis County, Texas (Waxahachie):

- $450,000 home: 2,800 sq ft, 4-bed/3-bath, built 2020, modern finishes

- Property taxes: $11,250/year (2.5% typical Ellis County rate)

- State income tax: $0

Your Financial Transformation:

- Equity capture: $400,000+ from California sale (after mortgage payoff)

- Monthly housing cost reduction: $500-$1,500 depending on California location

- Income tax savings: $5,000-$15,000+ annually (on $100,000-$150,000 household income)

- Total annual savings: $11,000-$33,000

But Here’s What You Really Get:

Space: 1,000-1,500 more square feet for hundreds of thousands less

Newness: Modern construction vs. maintaining 40-50 year old California homes

Land: 0.3+ acre lots common in Ellis County vs. 5,000 sq ft California lots

Lifestyle: Pool, game room, media room all possible at your price point

Strategic Moves for Relocators:

- Don’t overpay because it “feels cheap” – $450,000 in Texas requires the same financial discipline as $850,000 in California

- Understand Texas property taxes – they’re higher than California but offset by no state income tax

- Visit multiple times before buying – experience Texas weather, culture, commute for yourself

- Work with agents who understand California buyer mindset – not all North Texas agents get your perspective

- Consider renting first – 6-12 months renting lets you explore neighborhoods and acclimate to the area before fully committing

WHERE TO FOCUS:

- Waxahachie: Best value with solid schools and character

- Midlothian: Stronger job base if you’re still working

- Western Ellis County: Closer to Fort Worth/Dallas if you need frequent airport access

WHAT TO AVOID:

- Buying based on Zillow alone – Texas markets are hyperlocal

- Underestimating commutes – DFW traffic is real even in suburbs

- Assuming all new construction is equal – builder quality varies dramatically

- Ignoring flood zone maps – Texas weather is different than California

Insider’s Take: I work with California relocators regularly. The ones who succeed buy based on Texas value metrics, not “this would be $1.2M in San Diego.” The ones who struggle treat Texas like discount California instead of a different market with its own rules. Respect the market you’re entering.

Move-Up Buyers: Leveraging Your Equity in a Balanced Market

Your Profile:

- Current homeowner in Ellis County or DFW

- Purchased 2015-2020 (have significant equity)

- Household income: $120,000-$175,000

- Target: Upgrading from $350,000 current home to $500,000-$650,000

Your Equity Position:

Example: Purchased 2018 in Waxahachie for $285,000

- Current value: $365,000 (28% appreciation)

- Remaining mortgage: $225,000 (after 7 years of payments)

- Equity: $140,000

- Potential cash-out: $105,000-$120,000 (after 6% selling costs)

Why 2026 Works for Move-Up:

2021-2023: Tight inventory meant finding your next home was nearly impossible before selling current home. Contingent offers got rejected.

2026: Balanced market means you can:

- List your home with realistic pricing

- Take 30-60 days to sell (not 3 days like 2021)

- Shop for next home while under contract

- Make offers with home sale contingencies that sellers accept

- Time your transactions to minimize temporary housing needs

The Strategic Sequence:

Step 1: Get pre-approved based on debt-to-income with both mortgages (shows you can carry both temporarily if needed)

Step 2: List your current home priced at market value based on recent comps (not “2021 prices”)

Step 3: Start shopping once your home hits market, don’t wait for it to sell

Step 4: Make offers with home sale contingency (sellers accept these more readily in balanced markets)

Step 5: Coordinate close dates 3 days apart if possible (sell current home, close on new home same or next day, temporary leaseback in current home, 3 days to move into new home)

The Math:

- Current home sale proceeds: $105,000-$120,000

- Down payment on $575,000 home (20%): $115,000

- Cash needed beyond equity: $10,000 (closing costs) = manageable

- Monthly payment increase: $1,200-$1,600 (but your household income has grown 15-25% since 2018)

Strategic Moves for Move-Up Buyers:

- Don’t wait for rates to hit 5% – your 3% rate is gone, but your equity is real

- Price your current home to sell in 30-45 days – fast sale gives you negotiating power on next purchase

- Target neighborhoods with 5-10 year growth trajectory – you’re buying for the next decade, not next quarter

- Consider new construction with longer close timelines – lets you sell current home first

- Negotiate seller concessions on new home to offset rate buydown or cover your closing costs

WHERE TO FOCUS:

- Midlothian: Best school options in Ellis County, strong appreciation trajectory

- Western Waxahachie: New construction clusters with modern amenities

- Southern Grand Prairie/Mansfield: Closer to DFW employment if you’re still commuting

WHAT TO AVOID:

- Emotional attachment to your rate – you can’t take it with you

- Overpricing current home – sitting on market for 90+ days kills your negotiating position

- Stretching to absolute max budget – life happens, maintain cushion

- Compromising on must-haves – if you’re moving up, actually upgrade

Real Estate Investors: The Cash Flow vs. Appreciation Decision

Your Profile:

- Looking for rental property investment

- Either local to DFW or out-of-state investor

- Target: Positive cash flow or appreciation play

- Budget: $250,000-$450,000 per property

The Ellis County Investment Thesis:

Cash Flow Markets (Ennis, parts of Red Oak):

- Entry price: $250,000-$295,000

- Rent: $1,850-$2,200/month

- Gross yield: 8.5-9.5% annually

- Cash flow: $200-$400/month after PITI + maintenance reserve

- Appreciation: Modest 2-3% annually

Appreciation Markets (Waxahachie, Midlothian):

- Entry price: $360,000-$420,000

- Rent: $2,400-$2,800/month

- Gross yield: 7.0-7.5% annually

- Cash flow: $0-$200/month after PITI + maintenance reserve

- Appreciation: Strong 4-6% annually

The 2026 Opportunity:

Balanced market means less competition from other investors – you’re not bidding against 10 other offers

Seller concessions available to offset closing costs or rate buydowns

Distressed sellers emerging from rate lock-in effect – motivated sellers who need to move

New construction deals with builder incentives including rate buydowns or closing cost credits

Strategic Moves for Investors:

- Focus on cash flow in uncertain rate environment – appreciation is bonus, not foundation

- Target C+ to B- neighborhoods – highest rent-to-price ratios

- Buy near employment centers – Midlothian industrial area, southern Dallas job centers

- Avoid HOAs over $75/month – kills cash flow on rentals

- Underwrite conservatively: 8% vacancy, $150/month maintenance, $100/month CapEx reserve

The Underwriting Formula:

Example: $285,000 rental in Red Oak

- Down payment (20%): $57,000

- Loan amount: $228,000 at 7.0% = $1,517/month P&I

- Taxes: $595/month (2.5% annual)

- Insurance: $175/month

- HOA: $0

- Total PITI: $2,287/month

Rental income: $2,100/month

- Gross rent: $2,100

- Minus vacancy (8%): -$168

- Minus maintenance: -$150

- Minus CapEx reserve: -$100

- Net operating income: $1,682/month

Cash flow: $1,682 – $2,287 = -$605/month (DOESN’T WORK)

This property needs:

- Lower price: $250,000 makes it cash flow positive

- Higher rent: $2,400/month makes current price work

- Seller concessions: 3% credit buys down rate, improves cash flow

WHERE TO FOCUS:

- Red Oak: Best cash flow potential in Ellis County

- Ennis: Highest yields but most tenant management intensity

- Waxahachie: Lower yields but easier property management and stronger appreciation

WHAT TO AVOID:

- Luxury rentals over $2,800/month—tenant pool shrinks dramatically

- Properties needing major renovation—Ellis County doesn’t have investor-grade contractor base

- Anything cash flow negative—betting on appreciation alone is speculation, not investing

- Out-of-state self-management—hire property management or stay local

BOBBY’S TAKE: I see two investor mistakes constantly: (1) Buying based on California or northeast cash flow expectations without adjusting for Texas property taxes, and (2) Betting on appreciation in frontier markets like Ennis without cash flow cushion. Texas rewards investors who underwrite conservatively and focus on fundamentals.

Downsizers: Strategic Timing for Your Next Chapter

Your Profile:

- Empty nesters or near-retirement

- Current home: $450,000-$650,000 in Ellis County or DFW

- Target: $325,000-$425,000 smaller home

- Goal: Reduce maintenance, extract equity, simplify lifestyle

Why 2026 Is Strategic for Downsizing:

Your Home Has Value: Even in balanced market, properly priced larger homes sell because move-up buyers have equity and buying power

Inventory Expanding: You’ll have choices in 55+ communities, patio homes, and smaller footprint properties that were scarce 2021-2023

Buyers Want Your Home: 2,500-3,500 sq ft homes in good school districts are exactly what move-up buyers target

Rate Impact Is Minimal: You’re using equity, not maximizing borrowing power

The Financial Strategy:

Example: Selling $525,000 Waxahachie home, buying $375,000 patio home

- Current home sale: $525,000

- Mortgage payoff: $185,000

- Selling costs (6%): $31,500

- Net proceeds: $308,500

New home purchase:

- Purchase price: $375,000

- Down payment (from proceeds): $225,000 (60%)

- New mortgage: $150,000 at 6.3% = $929/month P&I

- Remaining cash: $83,500 (for retirement, travel, grandkids, reserves)

Lifestyle Benefits:

- Monthly payment drops: $2,400 to $1,650 (including taxes/insurance on smaller home)

- Maintenance reduction: No more 0.5 acre lawn care, two-story cleaning, large utility bills

- Equity access: $83,500 available for retirement goals

- Simplification: Right-sized for current needs

Strategic Moves for Downsizers:

- Don’t wait for “perfect” market – 2026 is balanced enough for both sides

- Sell first, buy second if you can tolerate temporary housing, removes contingency complications

- Consider 55+ communities – some gems in Ellis County offering maintenance-free lifestyle

- Downsize your possessions before listing – staged homes sell faster and higher, sell your clutter to sell your house faster

- Factor in moving costs and transition expenses – budget $8,000-$12,000 for the full transition

WHERE TO FOCUS:

- Waxahachie 55+ communities: Low-maintenance patio homes, HOA handles exterior

- Midlothian near medical facilities: Future healthcare access matters

- Western Ellis County: Close to grandkids if they’re in Tarrant County

WHAT TO AVOID:

- Buying too small – you still need guest room for grandkids, office space

- Sacrificing quality – you’re not “settling,” you’re right-sizing

- Emotional decision making – this is financial optimization for retirement

- Timing regret – whether you sell in 2026 or 2028, you’re still downsizing eventually

Neighborhood-Level Intelligence: Where Smart Money Moves in 2026

National and even regional data don’t tell you which specific neighborhoods are positioned best for 2026. This is where hyperlocal intelligence becomes your advantage.

Ellis County Appreciation Leaders (2026 Predictions)

Southwest Waxahachie (near South Creek Ranch):

- Current median: $345,000

- 2026 projection: +4.5% ($360,000)

- Why: Infrastructure improvements + South Creek Ranch proximity + new school construction

- Best for: First-time buyers and move-up buyers with 5-10 year time horizon

Midlothian ISD Zone (west of I-35E):

- Current median: $395,000

- 2026 projection: +3.8% ($410,000)

- Why: Strong school ratings, employment growth, limited land for expansion

- Best for: Families prioritizing schools, move-up buyers, buyers who want to avoid over-developed neighborhoods

Red Oak near Dallas ISD boundaries:

- Current median: $325,000

- 2026 projection: +5.2% ($342,000)

- Why: Undervalued relative to Dallas ISD access, new construction pipeline, mutliple data centers forcing infrasturcture upgrades

- Best for: Strategic value buyers, investors

Where Inventory Will Expand (Buyer Opportunities)

East Waxahachie (established subdivisions 10-20 years old):

- Expect: 15-20% more inventory as rate lock-in breaks

- Opportunity: Sellers motivated to move will negotiate on price and terms

- Target price: $320,000-$380,000

- Best for: Buyers wanting established neighborhoods, mature trees, larger lots

Ennis markets broadly:

- Expect: 25-30% more inventory as frontier market normalizes

- Opportunity: Highest negotiation leverage in Ellis County

- Target price: $275,000-$310,000

- Best for: Extreme value seekers, long-term holds, quiet small-town feels

New Construction Hotspots (Builder Incentive Opportunities)

Lakeway Estates (Waxahachie – Centre Living Homes partnership):

- Current incentives: Rate buydowns, closing cost credits

- Price range: $580,000-$750,000

- Why it works: Modern construction, near I-35E, Waxahachie ISD

- Best for: Move-up buyers, California relocators, lake-life buyers, quiet neighborhood on acreage seekers

Southwest Midlothian developments:

- Current incentives: Similar to Lakeway, some including appliances/upgrades

- Price range: $420,000-$550,000

- Why it works: Midlothian ISD schools, employer proximity

- Best for: Higher-income families, dual-earner households

School District Premium Zones

Waxahachie High School feeder pattern (new construction areas):

- Premium: 3-5% over comparable homes in weaker districts

- Justification: School ratings improving, new facilities opening

- Long-term value: Strong resale advantage

Midlothian ISD boundary areas:

- Premium: 5-8% over comparable Ellis County homes

- Justification: Established reputation, consistent performance

- Long-term value: Best appreciation protection in downturns

The Hidden Value Plays

North Red Oak (near I-20):

- Current undervaluation: 8-12% below comparable Waxahachie homes

- Catalyst: Dallas job center proximity, future infrastructure

- Timeline: 3-5 years to valuation parity

- Risk: Longer commutes, less established retail/dining

Ferris surrounding areas (3-5 mile radius from development):

- Current undervaluation: 15-20% below Waxahachie comparables

- Catalyst: Infrastructure spillover from 5,200-acre South Creek Ranch

- Timeline: 5-7 years as development phases begin

- Risk: Speculative, requires patience with appreciation

WATCH THIS: Properties within 2 miles of South Creek Ranch announcement have already appreciated 3-5% more than Ellis County overall since late 2024. Early movers are being rewarded. But don’t chase, your lifestyle needs still matter more than proximity.

The 2026 Month-by-Month Action Calendar

Real estate has seasonal patterns that smart buyers and sellers leverage. Here’s your tactical calendar for 2026.

January-February: The Strategic Planning Window

Market Conditions:

- Lowest competition (holiday hangover)

- Limited inventory (sellers wait for spring)

- Motivated sellers (job relocations, divorces, estate sales that couldn’t wait)

Best For:

- Buyers with urgency: Less competition means stronger negotiation position

- Investors: Motivated sellers more willing to accept investor offers

- Anyone who hates crowds: Do your house hunting without weekend open house madness

Action Items:

- Buyers: Get pre-approved, set up saved searches, research neighborhoods

- Sellers: If you must sell early, price aggressively, you’re fighting seasonality

- Everyone: Read and absorb comprehensive market forecasts (like this one), use them to plan your year

Rate Forecast: 6.2-6.5% range as spring selling season approaches

March-April: The Inventory Surge Begins

Market Conditions:

- Inventory spikes 25-35% as sellers list for spring

- Buyer traffic increases but not as fast as inventory

- Best buyer leverage of the year

- Tax refunds give first-time buyers down payment boost

Best For:

- Buyers in competitive price ranges ($300,000-$450,000): More choices without as much competition

- Sellers who priced right: Buyers are actively shopping, ready to transact

- Move-up buyers: Can list and shop simultaneously as inventory supports contingencies

Action Items:

- Buyers: SHOP AGGRESSIVELY, this is your window before summer competition

- Sellers: Price at market value or slightly below, you’re competing with 30% more inventory than February

- First-time buyers: Use tax refunds strategically for down payment or closing cost coverage

Rate Forecast: 6.0-6.3% as Fed policy stabilizes

May-June: Peak Selling Season

Market Conditions:

- Highest inventory of the year

- Highest buyer traffic (families want to move before school year)

- Balanced negotiation (neither side has overwhelming advantage)

- Multiple offer scenarios return for best properties

Best For:

- Sellers with desirable properties: Maximum buyer pool means highest probability of sale

- Buyers who know exactly what they want: You have inventory to choose from

- Families with school-age kids: Move now, settle before fall semester

Action Items:

- Buyers: Be DECISIVE – good properties in good locations still move fast even in balanced markets

- Sellers: This is your best chance to sell all year, don’t overprice and miss the window

- Everyone: Watch days-on-market trends. If properties in your target neighborhood are sitting 60+ days, that’s buyer leverage

Rate Forecast: 6.0-6.5% depending on economic data and Fed signals

July-August: The Summer Slowdown

Market Conditions:

- Inventory stays elevated but buyer traffic drops (vacations, heat, school starting)

- Slower sales velocity

- Sellers who didn’t sell in spring become more negotiable

- Best leverage shifts back to buyers

Best For:

- Buyers with flexibility: Sellers getting anxious about carrying costs

- Investors: Motivated sellers more willing to accept slightly lower offers

- Anyone who doesn’t mind Texas heat: Less competition in showings and offers

Action Items:

- Buyers: Target homes that have been listed 45+ days, these sellers are more negotiable

- Sellers: If you didn’t sell in spring, consider pulling listing until September OR a significant price reduction to below market level

- Everyone: This is when you find the deals if you’re patient

Rate Forecast: 6.0-6.5% with possible dip toward 5.75% if economic data weakens

September-October: The Fall Rally

Market Conditions:

- Second inventory spike as sellers who waited list now

- Buyer urgency returns (close before holidays)

- Corporate relocations peak (fiscal year transitions)

- Weather improves (no more 100-degree showings)

Best For:

- Sellers with well-maintained homes: Buyers are serious, ready to close quickly

- Corporate relocators: Best inventory without spring madness

- Move-up buyers: Can time sale of current home with purchase of next

Action Items:

- Buyers: Shop strategically, fall inventory is almost as good as spring without as much competition

- Sellers: This is your second chance after spring, don’t waste it with overpricing

- Investors: Fewer investor buyers in fall means less competition for rental properties

Rate Forecast: 5.8-6.2% if Fed implements additional cuts

November-December: The Holiday Freeze (With Opportunities)

Market Conditions:

- Inventory drops 40-50% as sellers pull listings for holidays

- Buyer traffic minimal (Thanksgiving, Christmas, New Year)

- Extreme motivation among active buyers and sellers

- Best negotiation leverage for buyers all year

Best For:

- Buyers with extreme urgency (job relocation, lease ending, growing family)

- Sellers with extreme motivation (divorce, estate sale, job relocation)

- Contrarian investors: Least competition all year

Action Items:

- Buyers: If you find something that works, you’ll have incredible negotiation power

- Sellers: Only list if you MUST sell, otherwise wait for January/February

- Everyone: Use holidays for planning 2027 strategies, not active transactions

Rate Forecast: 5.75-6.0% as year-end Fed policy takes effect

Insider’s Take: Most buyers and sellers follow the herd, list in May, shop in June. Smart money operates counter-cyclically. Some of my best buyer deals happen in July-August and November-December when motivated sellers face minimal competition. Some of my best seller results happen in September-October when buyers have urgency but less inventory to choose from.

Part IV: Your Action Framework

Risk Analysis: What Could Change Everything

Economic forecasts are educated predictions, not guarantees. Strategic planning requires understanding what could derail these projections and how to position yourself regardless.

Scenario 1: Recession Hits in 2026

Probability: 20-30% according to most economists

What Happens:

- Unemployment rises from 4% to 6-7%

- Corporate relocations to DFW slow or pause

- Consumer confidence drops, reducing buyer urgency

- Mortgage rates could spike OR drop depending on Fed response

- Home prices flatten or decline 3-5% in weakest markets

Impact on North Texas:

- DFW outperforms: Diversified economy means less severe impact than single-industry metros

- Ellis County vulnerable: Frontier markets always hurt worst in recessions

- Established suburbs protected: Collin/Tarrant counties see slower sales, not price crashes

How to Position:

If You’re a Buyer:

- Increase cash reserves: 6-12 months living expenses before buying

- Conservative debt-to-income: Stay under 35% total housing cost

- Focus on job security: Don’t buy if your employment is uncertain

- Target resilient markets: Established suburbs over frontier areas

If You’re a Seller:

- Sell early in year: Before recession signals become obvious

- Price aggressively: Move quickly while buyers still have jobs

- Avoid spring 2027 if recession hits: Wait for recovery instead of selling into panic

WATCH THESE INDICATORS:

- Unemployment rate rising above 4.5%

- Corporate relocation announcements slowing

- Local building permits declining 20%+

- Your employer announcing hiring freezes or layoffs

Scenario 2: Interest Rates Spike to 8%+

Probability: 15-20%

What Triggers This:

- Inflation resurges above 4%

- Federal Reserve forced to resume aggressive rate hikes

- Global economic instability drives bond market volatility

What Happens:

- Buyer purchasing power drops 15-20%

- Home sales volume crashes 20-30%

- Prices adjust downward 5-10% in most markets

- Inventory surges as motivated sellers panic

Impact on North Texas:

- First-time buyers frozen: Can’t afford monthly payments at 8% rates

- Move-up buyers trapped: Won’t trade 3% rate for 8% rate

- Cash buyers dominate: Investors and all-cash buyers face little competition

How to Position:

If You’re a Buyer:

- Lock rate quickly if you find the right property: Don’t wait for rates to improve

- Consider adjustable-rate mortgages (ARMs): 5/1 or 7/1 ARMs offer lower initial rates

- Negotiate seller concessions for rate buydowns: Seller pays points to reduce your rate

- Expand your timeline: If rates spike, waiting 12-18 months for Fed response may make sense

If You’re a Seller:

- Price below market: You’re competing against fear

- Offer financing incentives: Rate buydowns, seller financing, assumable loans

- Target all-cash buyers and investors: Market to buyers who don’t care about rates

Scenario 3: Housing Supply Floods the Market

Probability: 10-15%

What Triggers This:

- Baby boomer sales accelerate faster than expected

- Investor portfolios liquidate due to cash flow pressure

- New construction completions surge simultaneously

What Happens:

- Inventory jumps to 8-10+ months (from current 3-4 months)

- Prices decline 10-15% as sellers compete desperately

- Buyer leverage becomes extreme (multiple contingencies accepted, inspection repairs negotiated)

- First-time buyers face best conditions since 2010-2012

Impact on North Texas:

- Luxury markets ($750,000+) hit hardest: Smallest buyer pool, highest inventory

- New construction struggles: Builders forced to offer massive incentives

- Ellis County vulnerable: Newer developments with many investor owners risk concentrated selling

How to Position:

If You’re a Buyer:

- Wait for the bottom: If inventory surges above 6 months, prices will continue falling

- Negotiate everything: Inspections, repairs, closing costs, rate buydowns

- Target motivated sellers: Look for “price reduced” flags, 90+ days on market

- Be patient: Supply gluts take 12-18 months to clear

If You’re a Seller:

- Sell IMMEDIATELY: Don’t wait for spring if supply is surging

- Price 10% below comps: Be the attractive option in oversupplied market

- Offer every incentive: Closing costs, home warranty, rate buydown, appliances

- Consider renting instead: If you don’t need to sell, wait out the supply surge

Scenario 4: The Goldilocks Outcome (Base Case)

Probability: 40-50%

What This Looks Like:

- Rates drift down to 6.0-6.3% average

- Home prices appreciate modestly at 1.5-2.5%

- Inventory gradually normalizes to 4-5 months

- Transaction volume recovers 5-10%

- Balanced market where both buyers and sellers can succeed

This is the scenario all the economists are predicting. If you’re planning based on this outcome, you’re planning based on the most likely scenario.

How to Position:

If You’re a Buyer or Seller:

- Execute your plan based on life circumstances, not market timing

- Use the strategies outlined in this report

- Be patient but decisive, opportunities exist but aren’t desperate

- Work with knowledgeable local professionals who understand market nuance

BOBBY’S TAKE: I plan for Goldilocks, prepare for Recession, and stay alert for rate spikes or supply floods. That’s risk management. You can’t control which scenario unfolds, but you can control whether you’re positioned to handle any of them. That’s the difference between strategic and reactive.

The Decision Framework: Your Personal Action Plan

Data and analysis don’t matter if you can’t translate them into YOUR specific decision. Here’s how to know if 2026 is your year to act.

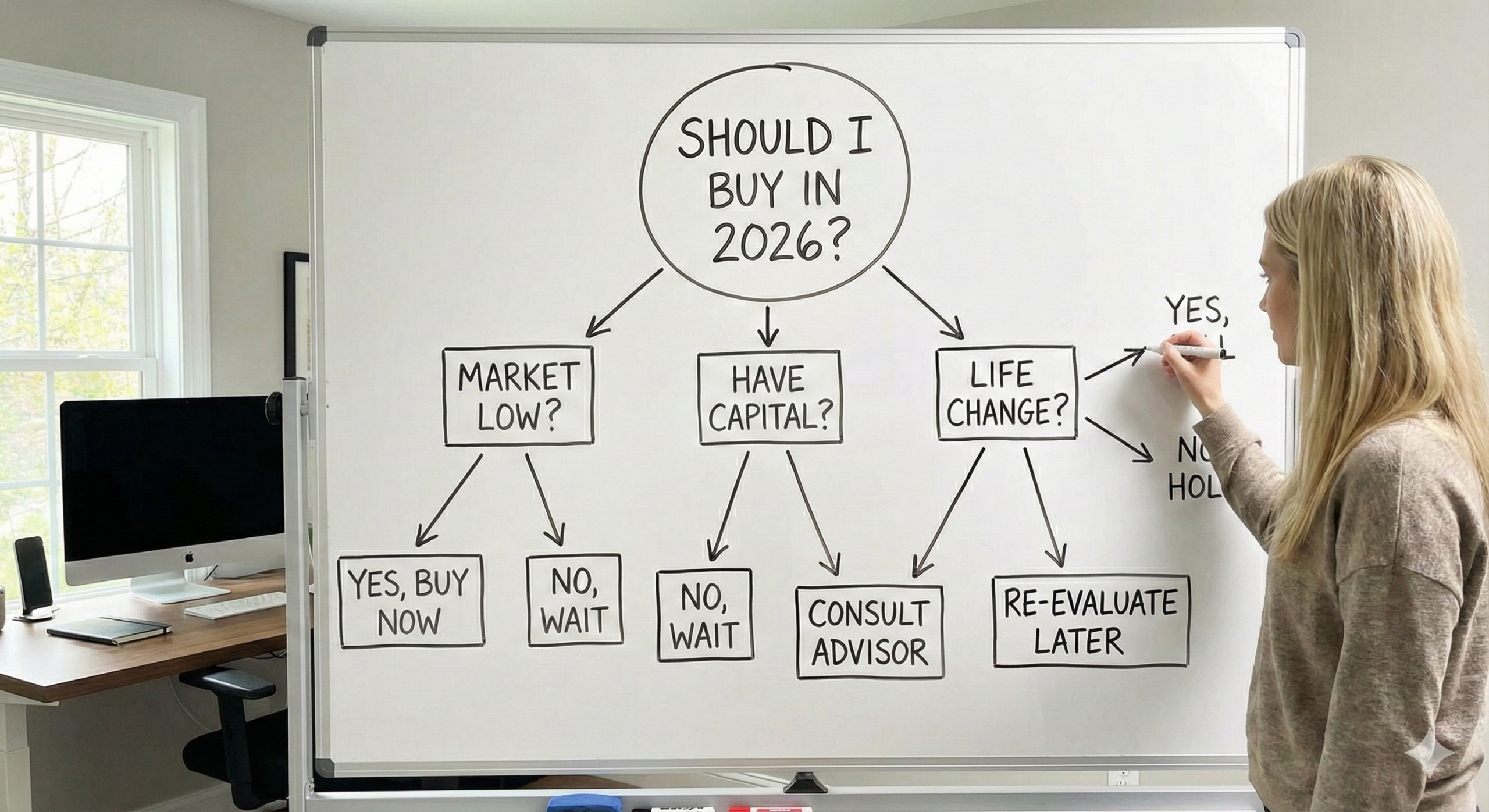

The “Should I Buy in 2026?” Decision Tree

Start Here: Can you answer YES to all five financial foundation questions?

- Job stability: Are you confident in your employment for the next 3+ years?

- Emergency fund: Do you have 3-6 months of expenses saved BEYOND your down payment?

- Down payment: Do you have 3.5-20% saved plus closing costs?

- Debt-to-income: Is your total housing cost under 40% of gross income?

- Credit: Is your credit score 620+ (ideally 680+)?

If ANY answer is NO: Focus on financial foundation before buying. Use 2026 to build savings, improve credit, stabilize employment.

If ALL answers are YES, continue:

Life Circumstances Check:

Answer YES or NO to each:

- Planning to stay in North Texas 5+ years?

- Current housing situation is inadequate (space, commute, schools, rent burden)?

- Tired of landlord control over your living situation?

- Want to build equity instead of paying landlord’s mortgage?

- Family situation stable enough for homeownership commitment?

Score:

- 4-5 YES answers: 2026 is YOUR year to buy

- 2-3 YES answers: Buying makes sense if the right property appears

- 0-1 YES answers: Renting likely makes more sense for now

Market Timing Check:

Answer YES or NO:

- Are you willing to buy at 6.0-6.5% rates instead of waiting for 3%?

- Can you avoid FOMO and walk away from overpriced properties?

- Are you comfortable with modest 2-3% annual appreciation (not 10%+)?

- Do you have 3-6 months to shop patiently for the right property?

- Will you work with experienced local representation?

Score:

- 4-5 YES answers: You have the right mindset for 2026 buying

- 2-3 YES answers: You’ll need to manage expectations carefully

- 0-1 YES answers: You’re not mentally ready to buy in current conditions

FINAL DECISION:

GREEN LIGHT (Buy in 2026):

- Solid financial foundation (all 5 YES)

- Strong life circumstances (4-5 YES)

- Realistic market expectations (4-5 YES)

- Action: Get pre-approved, start shopping, use strategies in this report

YELLOW LIGHT (Conditional):

- Strong in 2 of 3 categories, weaker in one

- Action: Address weak area, then proceed when ready

RED LIGHT (Wait):

- Weak in 2+ categories

- Action: Focus on foundations, plan for 2027-2028

For more information on the unseen costs of waiting, read our article Waited 3 Years For Rates To Drop, Now The House I Want Is Unaffordable

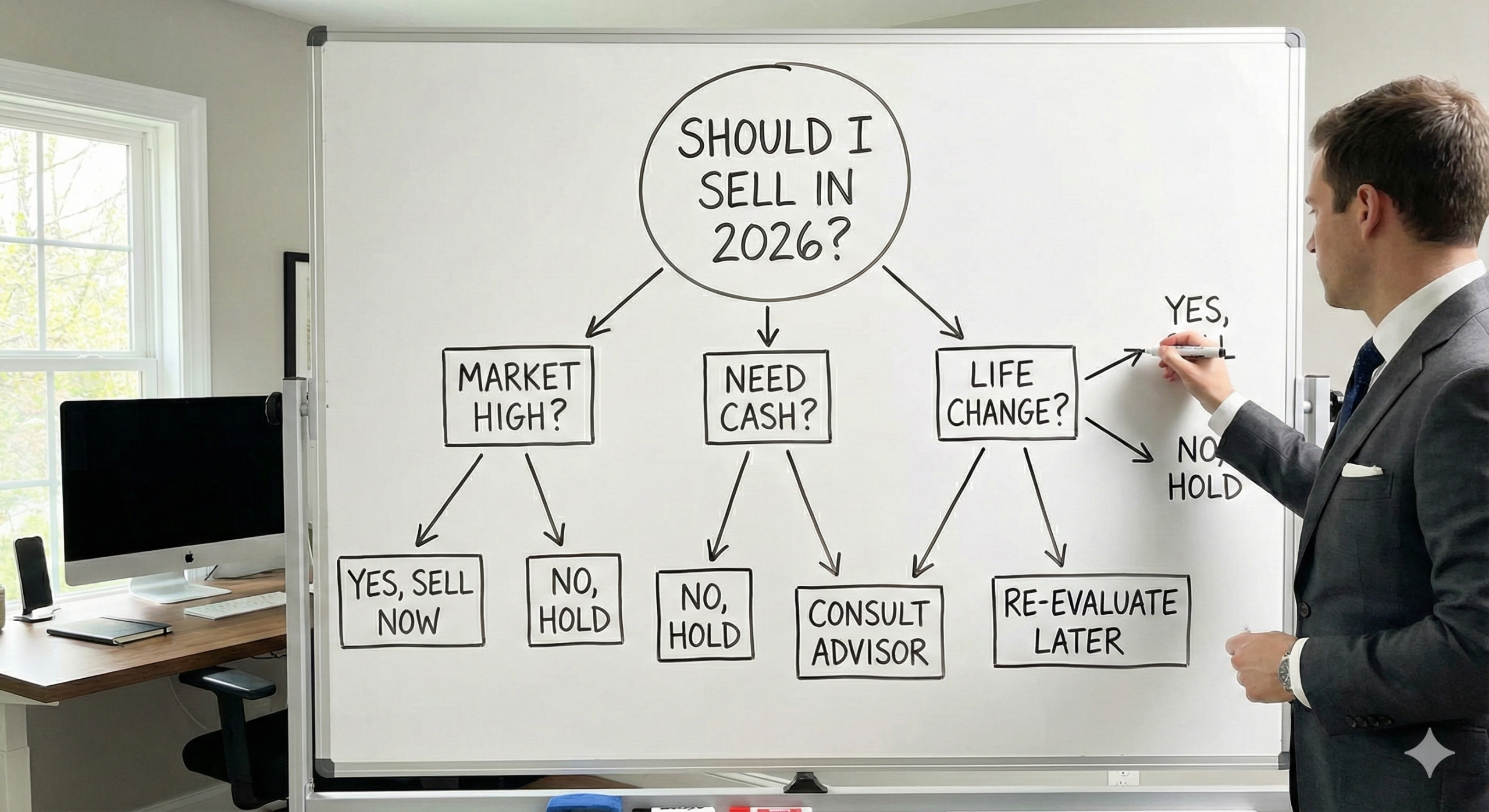

The “Should I Sell in 2026?” Decision Tree

Start Here: Why are you selling?

Reason Category A (Strong motivation):

- Job relocation requiring move

- Divorce or family situation change

- Downsizing for retirement

- Growing out of current home

- Major repair needs you can’t afford

If Category A: You’re selling based on life circumstances. The 2026 market is balanced enough to sell successfully but only with right pricing and strategy.

Reason Category B (Weak motivation):

- “I think the market peaked”

- “I want to time the market perfectly”

- “Waiting for prices to go higher”

- “Saw my neighbor’s sale price and want same”

If Category B: You’re speculating, not selling based on need. Unless market conditions dramatically shift, you’ll likely regret market timing attempts.

Financial Reality Check:

Calculate these numbers:

- Current home value (based on recent comps, not Zillow)

- Mortgage balance remaining

- Equity (value minus mortgage)

- Selling costs (6% realtor fees ‘avg.’ + 1-2% other costs = 7-8% total)

- Net proceeds (equity minus selling costs)

Example:

- Current value: $425,000

- Mortgage: $265,000

- Equity: $160,000

- Selling costs (7.5%): $31,875

- Net proceeds: $128,125

Next Question: Where does that money go?

Option 1: Buying another North Texas home

- Net proceeds become down payment

- Can you buy what you need with those proceeds plus new mortgage?

- Will your monthly payment increase or decrease?

- Does the trade-off make sense financially?

Option 2: Relocating out of Texas

- How do home prices in destination market compare?

- Will your proceeds buy comparable or better home?

- Have you researched destination market thoroughly?

- Do you have employment lined up in new location?

Option 3: Renting after selling

- What’s your monthly rent in comparable property?

- How long do you plan to rent?

- What happens to your proceeds while renting?

- What are your property taxes and insurance savings from not owning?

Market Positioning Check:

Answer YES or NO:

- Is your home in good condition (minimal deferred maintenance)?

- Would professional photos make your home show well?

- Are you willing to price at current market value (not 2021 prices)?

- Can you handle 30-45 day sales timeline (not 3 days like 2021)?

- Are you prepared to negotiate on inspection items?

Score:

- 4-5 YES answers: Your home is positioned to sell successfully in 2026

- 2-3 YES answers: You’ll need to invest in presentation or adjust pricing expectations

- 0-1 YES answers: Consider delaying sale until you can improve positioning

FINAL DECISION:

GREEN LIGHT (Sell in 2026):

- Category A motivation (life circumstances)

- Solid financial picture (net proceeds meet your needs)

- Good market positioning (4-5 YES)

- Action: List in spring or fall, price at market, use strategies in this report

YELLOW LIGHT (Conditional):

- Category A motivation but weak positioning OR

- Category B motivation but exceptional market positioning

- Action: Improve weak areas before listing

RED LIGHT (Wait):

- Category B motivation (market timing)

- Poor financial picture (would lose money or proceeds insufficient)

- Weak positioning (needs major repairs or improvements)

- Action: Stay put, improve property, wait for stronger motivation

Insider’s Take: Every week someone asks me “Is now a good time to sell?” My answer: Are you selling because you NEED to move or because you WANT to time the market? Life circumstances create good times to sell. Market timing creates regret. Sell when your life requires it. Stay when it doesn’t.

What Social Media Is Getting Wrong About 2026

Let me tell you what I’m hearing on social media and why it’s incomplete or misleading.

Myth #1: “Wait for Rates to Drop to 5% Before Buying”

What they say: “Don’t buy now, wait for rates to improve. You’ll get much better pricing when rates drop.”

Why this is wrong:

Rates likely won’t hit 5% in 2026 (or 2027). Economists are projecting 6.0-6.3%, and even that’s not guaranteed.

Even if rates drop to 5%, home prices will rise as more buyers enter the market. You might save $150/month on the mortgage but pay $20,000-$30,000 more for the home, which would add the same or more back onto your payment.

You’re missing 12-18 months of equity building and appreciation while you wait. On a $400,000 home, that’s $16,000-$24,000 in missed wealth building.

You can refinance later if rates actually drop significantly. You can’t go back and buy at 2026 prices once they’re gone.

The Truth: Buy when your life circumstances align with market conditions that work for your finances. If 6.3% rates fit your budget on a home you want, that’s your signal, not some mythical future 5% rate.

Myth #2: “The Market Is Going to Crash, Be Patient”

What they say: “Don’t buy now, we’re due for a crash like 2008. Prices will drop 20-30% if you just wait.”

Why this is wrong:

2008 was driven by systemic lending fraud and oversupply. Today’s buyers are more strictly qualified, equity positions are strong, and supply is still constrained.

Economists universally oppose a market crash for 2026. The worst-case mainstream prediction is 3-5% decline in weakest markets, not 20-30% nationwide.

Even if prices drop 5%, you’ve paid 12-18 months of rent waiting (call it $30,000-$45,000) to save maybe $20,000 on purchase price. That’s not strategic math.

Crashes require oversupply + economic catastrophe. We have neither conditions present currently.

The Truth: If you’re hoping for a crash to afford a home, you’re betting against your own financial future. Crashes hurt everyone, including your job security and investment accounts.

Myth #3: “Ellis County Is Too Far, You Need to Be Closer to Dallas”

What they say: “Don’t buy in Ellis County, the commute is too long and you’ll regret it. Stay in Collin or Tarrant counties.”

Why this is wrong (or incomplete):

Remote and hybrid work have changed commute equations. If you’re commuting 2-3 days per week instead of 5, Ellis County works fine.

You’re trading 15 minutes of commute time for $100,000-$150,000 in purchase price savings and 1,000+ square feet more space.

Ellis County infrastructure is improving rapidly with highway expansions and commercial development reducing “distance penalty.”

Collin County appreciation has slowed to 1-2% annually while Ellis County maintains 3-5% in strategic areas. Over 10 years, that’s a significant wealth difference.

The Truth: Ellis County isn’t right for everyone (daily commuters to downtown Dallas should probably stay north). But for remote workers, retirees, or those working in southern Dallas, it’s the best value play in DFW.

Myth #4: “New Construction Is Always Better Than Resale”

What they say: “Buy new construction, you won’t have maintenance issues and everything is modern.”

Why this is incomplete:

New construction costs 10-15% more than comparable resale for the same square footage and location.

Builder-controlled HOAs are expensive ($75-$150/month common) and restrictive.

You have zero negotiation power with builders in strong markets. Builders don’t negotiate price, they “incentivize” instead.

Resale homes have established landscaping, mature trees, and proven neighborhood dynamics. New construction is blank slates with unknown futures.

New ≠ quality. Some builders cut corners. Some 10-year-old homes were built better than today’s new construction.

The Truth: New construction makes sense for specific buyers (those who want customization, latest energy efficiency, want to be “first owner”). But resale often offers better value per square foot and more negotiation leverage in balanced markets.

Myth #5: “You Should Wait Until After the Election”

What they say: “Don’t buy until after [insert political event], you don’t know what will happen to the economy.”

Why this is wrong:

Real estate markets don’t pause for politics. Life circumstances (growing family, job relocation, retirement) happen regardless of election outcomes.

Political uncertainty creates opportunity for decisive buyers. While others wait, you face less competition.

Fed policy matters more than politics for real estate, and Fed policy is driven by economic data, not elections.

You’ll miss your ideal property while waiting for political certainty that never arrives (because there’s always another election, crisis, or uncertainty ahead).

The Truth: Political events create noise, not signal. Buy or sell based on personal circumstances and economic fundamentals, not election cycles.

Insider’s Take: Most people default to whatever keeps them comfortable, “wait and see,” “be patient,” “let’s watch what happens.” That’s not strategy. That’s paralysis.

I tell clients the truth: if your finances work, your life circumstances require it, and a property meets your needs at a price that makes sense, then political uncertainty and rate speculation are just excuses to avoid decisions. Decisive people build wealth. “Wait and see” people pay rent.

Part V: The Bottom Line & Next Steps

The Bottom Line: 2026 Is About Strategic Positioning, Not Perfect Timing

Here’s what everything I’ve shared comes down to: 2026 represents the most balanced, opportunity-rich housing environment we’ve seen in years, but only for people who understand what’s happening and position themselves strategically.

The convergence of moderating mortgage rates (6.0-6.3%), wage growth finally outpacing home prices, expanding inventory, and price stability creates conditions fundamentally more favorable than anything we’ve experienced since before the pandemic.

For North Texas specifically, our structural advantages; corporate relocations, economic diversification, relative affordability, and sustained population growth, all position us to outperform most major markets while providing genuine value compared to coastal alternatives.

For Ellis County particularly, we’re at an inflection point where infrastructure investment, major development projects like South Creek Ranch, and continued DFW growth spillover create appreciation potential that more established suburbs can’t match.

But here’s the reality that most real estate content won’t tell you: there is no perfect time. There are only strategic decisions based on current conditions aligned with your specific circumstances.

If you’re waiting for 3% rates, you’re going to wait for years or an economic catastrophe. If you’re waiting for prices to crash, you’re fighting against supply constraints and demographic demand that make crashes unlikely. If you’re waiting for some mythical moment when everything is perfect, you’re going to watch from the sidelines while strategic buyers build equity and sellers accomplish their life goals.

As Danielle Hale summarizes: “After a challenging period for buyers, sellers and renters, 2026 should offer a welcome, if modest, step toward a healthier housing market.”

Modest improvement is still improvement. And for buyers and sellers ready to move from analysis to action, that modest step might be exactly the opportunity needed.

What This Means for Your Specific Situation

Look, I can give you all the economist predictions and national trends in the world, but what really matters is how these market conditions align with your timeline, your goals, and your financial position.

Are you growing out of your current space? Is your commute killing you? Did you get a job relocation? Are you tired of throwing money at rent while watching your friends build equity? Do you need to sell to access your equity for the next phase of life?

Those personal circumstances matter infinitely more than trying to time the market perfectly. Because while you’re waiting for perfect conditions, you’re missing out on months or years of the life you actually want to be living.

The economists agree: Top economists have one word to sum up the housing market for 2026, opportunity.

The question isn’t whether opportunity exists. The question is whether you’re positioned to recognize it and act when it aligns with your goals.

Your Next Steps: From Intelligence to Action

If you’re a buyer ready to explore your options:

- Get pre-approved with a lender experienced in Texas markets and down payment assistance programs. Denise Donoghue and Andrew Bryan are both trusted choices.

- Define your target areas using the neighborhood intelligence in this report

- Set up saved searches to monitor inventory trends in real-time

- Research school districts, commute times, and total cost of ownership for your top choices

- Engage local representation who understands Ellis County and North Texas market dynamics

For more information on how to choose a lender read our How To Choose A Mortgage Lender Guide

If you’re a seller considering your options: