By Bobby Franklin, REALTOR® | North Texas Market Insider

Last Updated: January 4, 2026

Let me tell you something that’s going to separate you from 90% of homebuyers scrolling through TikTok right now: the housing market crash everyone’s predicting for 2026 isn’t coming.

The YouTube gurus with their dramatic thumbnails are screaming about the “inevitable collapse.” Social media is flooded with crash predictions backed by scary charts and apocalyptic captions.

Here’s what they won’t tell you: these same voices have been wrong every single year since 2012. They predicted crashes in 2013, 2018, 2020, 2023, and throughout all of 2024 and most of 2025. None of it happened. The market didn’t collapse. Prices didn’t crater.

Now it’s 2026, and they’re doing it again.

I’m going to show you exactly why the crash isn’t coming, what’s actually happening in the Dallas-Fort Worth market right now, and how smart buyers are positioning themselves to win while everyone else is paralyzed by fear.

The Crash Predictions That Keep Failing

Throughout 2024, the housing doomers were certain this was the year. What actually happened? National home prices stayed flat or ticked slightly higher. Existing home sales found a floor around 4 million transactions, low by historical standards, but nowhere near collapse.

According to Realtor.com’s 2026 outlook, national home prices are projected to rise about 2.2%, with existing home sales increasing 1.7%. Redfin calls 2026 “The Great Housing Reset”, with mortgage rates averaging around 6.3%, home prices growing about 1%, and sales volumes gradually improving.

These are the numbers of a market that’s rebalancing and creating opportunity for those smart enough to recognize it.

The Five Reasons the Crash Isn’t Coming

Here’s where we separate social media noise from market intelligence. The crash predictions fail because they ignore fundamental structural forces.

1. We’re Short 4.7 Million Homes – And That’s Not Fixing Itself Anytime Soon

The single most powerful force preventing a housing crash is something that sounds almost boring: severe housing supply shortage. But this isn’t just a talking point, it’s the mathematical reality preventing any widespread price housing collapse.

The United States is short approximately 4.7 million housing units right now. This didn’t happen overnight. It’s the result of a decade of underbuilding after the 2008 crisis, when construction screeched to a halt and never fully recovered. If that wasn’t enough we also saw strong household formation from millennials aging into their homebuying years, increased remote work flexibility that spread buyers to more markets, and demographic shifts that created more demand than supply could handle.

Here’s what that means in plain English: Even if demand cools significantly, there still aren’t enough homes for everyone who wants one.

When mortgage rates climbed from 3% to 7% during 2023-2024, you know what didn’t happen? A flood of inventory hitting the market. For-sale inventory remained below historical norms, especially in high-growth Sun Belt states like Texas. The market didn’t crash, it froze. Transactions slowed, homes sat longer, but prices held relatively stable because the supply-demand fundamentals were so far out of balance.

This supply-demand imbalance effectively puts a floor under prices. When there aren’t enough homes, prices don’t collapse, they stabilize, slow down, or plateau. But they don’t crater like the doomers predict, because basic economics prevents it. You can’t have a buyer’s market fire sale when there’s nothing to sell.

The North Texas Reality

In North Texas specifically, we’re seeing aggressive building trying to fill the gap. The South Creek Ranch development that’s breaking ground east of Dallas will eventually bring thousands of new homes online. We’ve got major projects in Midlothian, Red Oak, and throughout Ellis County. New construction is also happening in Celina, Prosper, and Anna in the northern suburbs.

But even with all this building activity, we’re nowhere close to oversupply. We’re going from severe shortage to… slightly less severe shortage. The Dallas-Fort Worth metroplex is adding roughly 150,000-180,000 new residents annually through a combination of births, deaths, and net migration. We’d need to build 60,000-70,000 housing units per year just to keep pace with population growth, and we’re consistently falling short of that number.

The strategic insight here: Markets with structural undersupply don’t crash, they correct. There’s a massive difference. A correction means prices might soften 3-5% in certain submarkets as pandemic-era excesses work through the system. A crash means prices drop 20%-40% as distressed inventory floods the market. We’re seeing the former, not the latter.

2. Record Homeowner Equity Means No Wave of Distressed Sellers

Remember 2008? That crash happened because people were underwater on their mortgages within months of buying. Homeowners across the country owed more than their homes were worth. Negative equity was rampant. When job losses hit and people couldn’t make payments, they had no choice but to walk away or sell at a loss, flooding the market with foreclosures and short sales. That’s what created the crash, forced selling at any price just to escape the debt.

Today’s market couldn’t be more different, and the numbers tell a story that crash predictors conveniently ignore.

Average loan-to-value ratios are near 44% compared to about 85% before the Great Recession. Translation: the average homeowner with a mortgage has about 56% equity in their home. That’s a massive financial cushion. Even if home prices dropped 20% tomorrow (which they won’t), most homeowners would still have substantial equity.

But it gets even better: approximately 40% of U.S. homeowners own their homes free and clear. No mortgage. No monthly payment beyond taxes and insurance. These homeowners have zero financial pressure to sell at distressed prices.

Let that sink in: nearly half of all homeowners have no mortgage debt whatsoever. The other half have substantial equity cushions that would take a complete economic collapse to wipe out.

What This Means Practically

There’s no army of distressed sellers coming. When people have equity, they don’t have to sell at fire-sale prices. They have options:

- They can wait out market softness

- They can rent out the property and become landlords

- They can take out home equity loans to cover temporary financial issues

- They can sell at reasonable market prices and still walk away with significant cash

Crashes require forced selling. Forced selling requires negative equity or severe financial distress at scale. We have neither.

Even if unemployment ticked up (which hasn’t happened significantly), homeowners with substantial equity aren’t forced into panic selling like they were in 2008-2010. They can negotiate with lenders, modify loans, or sell strategically because they’re not underwater.

The North Texas Advantage

In North Texas, equity positions are even stronger in many submarkets. Homeowners who bought in Ellis County in 2018-2019 have seen their home values increase 40-60% in many areas. Even after recent slight corrections, they’re sitting on massive equity gains. A family who bought a home in Waxahachie for $250,000 in 2019 now owns a home worth $360,000-$380,000. Even if prices softened another 5%, they’d still have over $100,000 in equity plus whatever principal they’ve paid down.

Strategic takeaway: Without distressed sellers flooding the market, there’s no crash mechanism. Inventory might increase gradually as the rate-lock effect eases and life circumstances force some moves, but we’re not getting the foreclosure tsunami that creates actual housing crashes.

3. Lending Standards Actually Work Now

Here’s something the crash predictors conveniently forget: We fixed the mortgage system after 2008. The loose, reckless lending that fueled the housing bubble is gone, replaced by some of the most conservative underwriting standards we’ve seen in decades.

Post-crisis reforms through the Dodd-Frank Act and CFPB regulations significantly tightened lending standards. Today’s underwriting requires verified income, stronger credit scores, and more conservative debt-to-income ratios than the loose “no-doc” and subprime programs that fueled the last crash.

What Changed Since 2008

Pre-2008 lending looked like this:

- No-doc loans (literally called “liar loans”) where borrowers stated income without verification

- NINJA loans (No Income, No Job, No Assets)

- Subprime mortgages with teaser rates that exploded after 2-3 years

- 100%+ financing where borrowers got mortgages for more than purchase price

- Minimal credit score requirements

- Debt-to-income ratios that were functionally ignored

Post-2008 lending looks like this:

- Full income verification through W-2s, pay stubs, tax returns, and employment verification

- Minimum credit scores of 620 for conventional, 580 for FHA, 640+ for many lenders

- Strict debt-to-income ratios (typically 43-50% maximum, including the new mortgage payment)

- Down payment requirements (even FHA requires 3.5% minimum)

- Ability-to-Repay rules that make lenders verify borrowers can actually afford the mortgage

- Risk retention requirements that keep lenders accountable for loan performance

What I See Every Day Working with Buyers

I work with buyers through this process constantly, connecting them with lenders like Denise Donoghue (The Mortgage Nerd) and Andrew Bryan (Miramar Mortgage Broker) who are putting buyers through legitimate, thorough underwriting processes. We’re not handing out mortgages to anyone with a pulse like we did in 2006.

Today’s lenders are:

- Reviewing two years of tax returns

- Verifying employment directly with employers

- Analyzing bank statements for down payment sourcing

- Calculating debt-to-income ratios that include student loans, car payments, credit cards, and the proposed mortgage

- Running credit multiple times throughout the process

- Requiring appraisals that actually reflect market value

The result: Data from major lenders and housing economists confirms that today’s borrowers are far better qualified and much less likely to default than the average borrower heading into the 2008 crisis. Average FICO scores for purchase mortgages are in the 730-750 range, significantly higher than the 2006-2007 average in the low 700s.

The Strategic Implication

Better borrowers mean fewer defaults. Fewer defaults mean no foreclosure wave. No foreclosure wave means no crash.

This isn’t complicated economics, it’s basic math. When borrowers are properly qualified, have skin in the game through down payments, and can actually afford their mortgages, they don’t default at rates that create market crashes. Even if economic conditions soften, today’s borrowers have the financial cushion to weather temporary setbacks that would have forced defaults in the subprime era.

4. The Rate-Lock Effect Is Keeping Inventory Artificially Low

This one’s fascinating because it’s unique to this cycle and creates a powerful constraint on inventory that prevents crashes even when demand cools. Economists call it the “rate-lock effect” or the “golden handcuffs” phenomenon, and it’s fundamentally changing market dynamics.

Here’s the situation: Because so many homeowners refinanced into ultra-low mortgage rates during 2020-2021 when rates briefly touched 2.5-3%, more than 80% of borrowers with mortgages now hold loans at least one percentage point below prevailing market rates. According to recent analysis, over 60% of mortgage holders have rates below 4%, and a substantial percentage have rates in the 2-3% range.

The Psychological and Financial Lock-In

Now ask yourself: If you had a 2.8% mortgage on a $350,000 home, would you give it up to buy a similar house at 6.5%?

Let’s do the math:

- Your current payment at 2.8% on $280,000 (assuming 20% down): roughly $1,155/month (principal & interest)

- Your new payment at 6.5% on $280,000: roughly $1,770/month (principal & interest)

- Difference: $615/month or $7,380/year

That’s the same house, costing you an extra $7,380 per year, or $147,600 over a 20-year period, just because of the interest rate difference. And that’s assuming you buy an identical house at an identical price, in reality, move-up buyers typically buy larger or more expensive homes, making the payment shock even more severe.

The rational response: You stay put. You renovate instead of moving. You make your current house work even if it’s not perfect. You wait for rates to come down before considering a move.

The Market Impact

This creates a powerful constraint on inventory that keeps supply tight even when demand softens. The market doesn’t crash, it gets stuck in a standoff between:

- Buyers who want lower rates before committing

- Sellers who don’t want to give up their low rates to move

Researchers and housing analysts are calling the national market “frozen” or “stuck in a standoff”, not crashing, just constrained. Transaction volumes have fallen because fewer people are moving, but prices have held relatively stable because there’s no flood of inventory to push them down.

Who Actually Moves in This Environment?

The only people who move in large numbers during the rate-lock period are those who have to move:

- Job relocations where remote work isn’t an option

- Life changes (divorce, death, birth of children requiring more space)

- Financial distress requiring a move (though as we discussed, equity cushions make this rare)

- Move-down scenarios where selling a larger home and buying smaller makes sense even with rate differences

Strategic insight: This constraint actually favors buyers who are financially prepared to move now, because you’re competing with fewer other buyers. The rate-lock effect has removed a significant portion of potential competition from the market. While your neighbor is staying in their 3-bedroom wishing for a 4-bedroom but not willing to give up their 2.9% rate, you can negotiate harder on the 4-bedroom homes that are available because there are fewer competing buyers.

The North Texas Angle

In North Texas, the rate-lock effect is particularly strong because so many people bought or refinanced during 2020-2021. Look at Ellis County, we saw massive buyer activity in 2020-2021 as people fled higher-cost Dallas suburbs and locked in both low prices and low rates in areas like Waxahachie, Midlothian, and Red Oak.

Those buyers now have rates in the 2.5-3.5% range and substantial equity from appreciation. They’re double-locked: low rates they don’t want to give up, and equity they don’t want to leave on the table by overpaying for their next home. This keeps inventory constrained in the move-up segment, which then constrains inventory in the entry-level segment because fewer move-up buyers creates fewer entry-level listings.

The bottom line: Constraints favor patient, prepared buyers who understand the game being played while everyone else is paralyzed.

5. No Jobs Crisis = No Housing Crisis (And DFW is Still Creating Jobs)

Housing crashes rarely, if ever, happen without a jobs crisis. This is economic history 101, yet crash predictors consistently ignore employment data in favor of more dramatic metrics.

Look at every major housing crash in modern American history:

- Great Depression: Unemployment hit 25%, housing values collapsed

- 1980s Farm Crisis: Rural housing crashed as agricultural jobs vanished

- 2008-2010 Housing Crash: Unemployment spiked to 10%, millions of jobs lost across every sector, foreclosures followed

The pattern is clear: Severe job losses lead to mortgage defaults lead to foreclosures lead to distressed inventory lead to price crashes. Without the job losses triggering the cascade, the crash mechanism doesn’t activate.

Where’s the Jobs Crisis Now?

It’s not here. And more importantly, the leading indicators aren’t pointing to one.

While 2024 included recession fears and economic slowdown warnings (there’s always doom-and-gloom if you look for it), the U.S. labor market stayed relatively resilient through 2024-2025. Unemployment has remained well below the 6-7% levels that typically trigger housing distress, hovering in the 3.5-4.5% range depending on the month. Initial jobless claims, one of the best leading indicators of labor market deterioration, haven’t spiked to concerning levels.

More importantly, layoffs have been concentrated in specific sectors (tech, some manufacturing) rather than broad-based across the entire economy like 2008-2010. When housing crashes happen, everyone loses jobs, construction workers, mortgage brokers, real estate agents, retail workers, service industry employees, everyone. That’s not what we’re seeing.

The North Texas Employment Advantage

Here in North Texas, the picture is even stronger. Dallas-Fort Worth continues to rank as one of the top metros for employment growth, corporate relocations, and population increases.

What’s happening in DFW right now:

- Major corporate headquarters relocations continue (this trend that started in 2018-2020 hasn’t stopped)

- Distribution and logistics job growth driven by e-commerce and DFW’s central location

- Healthcare sector expansion as population grows and ages

- Professional services growth supporting the expanding business base

- Construction and trades jobs supporting ongoing development

- Technology sector presence, though more diversified than single-industry tech hubs

Companies are still moving headquarters to the DFW area because of:

- Business-friendly tax environment (no state income tax)

- Lower cost of living for employees compared to coastal markets

- Central location for logistics and distribution

- Large, educated workforce

- Quality of life factors

- Infrastructure investment supporting growth

People are still moving here for work, not leaving. The DFW metro added over 150,000 net new residents in 2023 and is on track for similar growth through 2024-2025. That’s not what happens in markets heading for housing crashes.

The Strategic Employment-Housing Connection

Strong labor market + population growth + job creation = sustained housing demand.

It’s not complicated. When people have jobs, they:

- Can afford mortgage payments (no foreclosure wave)

- Have confidence to buy homes (demand stays elevated)

- Move to areas for employment (population growth supports prices)

- Stay current on debts (no distressed inventory flood)

When people lose jobs at scale, the opposite happens, and you get housing crashes. We don’t have the jobs crisis that precedes housing crashes.

What Could Change This?

To be clear, I’m not saying a jobs crisis is impossible, I’m saying it hasn’t happened and leading indicators aren’t flashing red. If there were a severe recession that caused broad-based unemployment to spike to 7-8%+, that would change the housing calculus significantly.

But here’s the thing: even if a moderate recession hit and unemployment ticked up to 5-6%, today’s homeowners have so much more equity and so much better loan quality than 2008 that we still wouldn’t see the foreclosure tsunami necessary to create a crash. We’d see a softening, more distressed inventory coming to market, maybe prices dipping 5-10% in some areas, but not a crash.

The Insider perspective: While everyone else is looking for reasons to panic, informed buyers are looking at actual economic fundamentals. The fundamentals; employment, wage growth, population increases, and corporate relocations, all support continued housing demand in North Texas, even if national markets soften.

What Does This All Mean?

These five structural forces, housing shortage, record equity, functioning lending standards, rate-lock inventory constraints, and sustained employment, create a fundamentally different market than 2008. They’re not going away in 2026. They represent years-long trends that provide a floor under prices even during market normalization.

This is why the crash predictions keep failing. The doomers look at surface indicators (rising rates! cooling demand! inventory increases!) while ignoring the foundational economics that prevent crashes from materializing.

While everyone else waits for something that isn’t coming, informed buyers in North Texas are recognizing this normalization period for what it is: opportunity disguised as uncertainty.

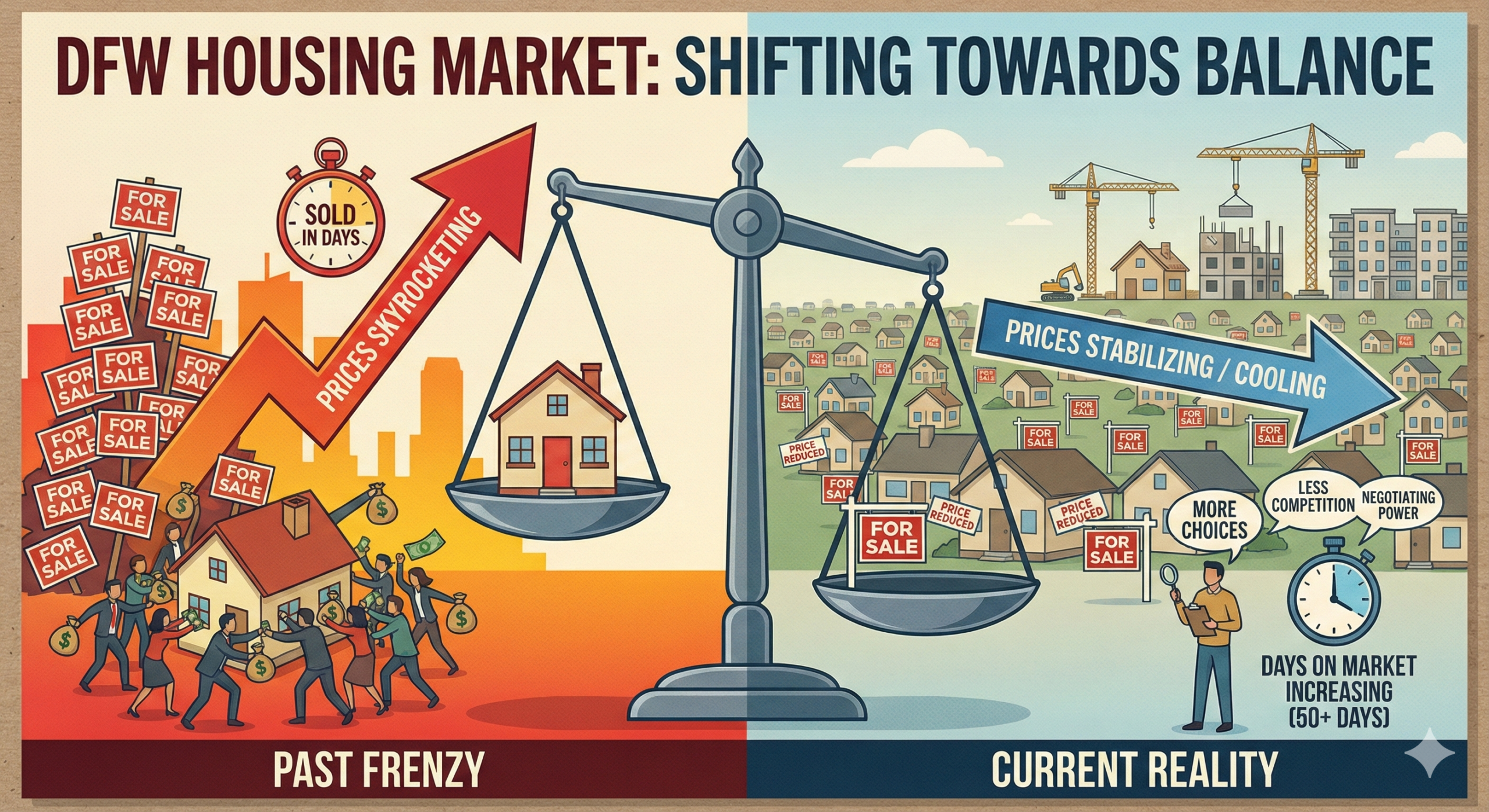

What’s Actually Happening in Dallas-Fort Worth Right Now

Let’s talk about what matters: your backyard.

The Real DFW Numbers

The Dallas-Fort Worth region remains one of the most closely watched housing markets in America. Here’s what’s actually happening:

Current Fort Worth median home price: approximately $344,000, down roughly 1.7% year-over-year after years of rapid appreciation. Across the broader DFW metro, price adjustments range from 2-4% over the past 12 months, a mild correction, not a crash.

Days on market have lengthened to about 60-65 days in Fort Worth, compared to under 20 days during the COVID peak. Inventory has increased, giving buyers more choices, but we’re still far from oversupply.

Why DFW Remains a Top Investment Market

A recent PwC/Urban Land Institute report ranked Dallas-Fort Worth as the #1 U.S. real estate market to watch for 2026. Number one.

Why? Strong job growth, corporate relocations, robust demographic trends, pro-business environment, and population growth that consistently outpaces housing supply.

Texas-specific forecasts from Texas A&M anticipate modest home-price movements, slight sales growth, and continued rent stability statewide through mid-2026.

2026 North Texas Forecast

Home prices: Flat to slightly negative in select DFW submarkets, generally -1.5% to -4%. Some neighborhoods will see modest appreciation. That’s a normal market.

Sales volume: Texas home sales projected to grow modestly, with improved transaction counts as rates stabilize.

Mortgage rates: Consensus suggests average 30-year fixed rates in the low-6% to high-5% range by late 2026.

For buyers: More negotiation room, more time to evaluate homes, better odds of avoiding bidding wars, particularly in the $400,000-$750,000 range where builders are active.

The Questions Buyers Are Actually Asking

Let me address the questions I’m hearing every day from buyers in Ellis County and across North Texas.

“Should I Wait for Interest Rates to Drop Before Buying?”

The truth: When rates fall meaningfully, buyers flood back into the market. Competition increases. Bidding wars return. You trade a lower rate for a higher purchase price and lose negotiating power.

Mortgage experts emphasize a more strategic approach: focus on finding the right home at a payment you can afford now, and view the interest rate as something you can refinance later.

“Marry the house, date the rate” means: buy the property that works for you long-term, and refinance the mortgage when rates improve. You can’t refinance your purchase price.

Real example: A $400,000 home today at 6.25% = $2,460/month payment. Wait a year for 5.5% rates, but that home is now $420,000 = $2,385/month. You “saved” $75/month but paid $20,000 more for the house. Plus you lost a year of equity building and threw another year of rent away.

“Is Now a Good Time to Buy in Dallas-Fort Worth?”

If you’re financially prepared and plan to stay 5-7 years, 2026 is offering buyer advantages we haven’t seen since before the pandemic:

- More inventory and selection

- More negotiating power with sellers

- More time to inspect and evaluate

- Builder incentives are back

- You’re buying in a top-growth metro with strong fundamentals

With homes taking longer to sell, buyers are seeing concessions: closing-cost credits, interest rate buydowns, repair allowances, and timeline flexibility.

Inventory in many DFW submarkets is higher than during the pandemic boom, yet still below oversupply levels. That combination creates a window for patient, well-qualified buyers to secure good homes without 2021’s chaos while benefiting from long-term regional growth.

“Should First-Time Buyers Wait Until Later?”

You do NOT need 20% down to purchase a home. Well-structured FHA loans (3.5% down), VA loans (0% down for veterans), USDA loans (0% down for eligible areas), and conventional 3-5% down programs remain available.

The math: Paying $1,800/month rent while saving 20% for a $350,000 home ($70,000) might take 3-5 years. During those years, you spend $64,800-$108,000 on rent you’ll never see again, and that $350,000 home might now cost $380,000-$400,000.

Or: Put down 5% ($17,500), buy now, start building equity immediately, and refinance out of PMI later when you’ve built equity and rates potentially improve.

How to Win in the 2026 North Texas Market

Stop waiting for a mythical “perfect” market. Strategic timing based on your situation and actual market conditions is what wins.

What Smart Buyers Are Doing Right Now

Taking their time: No artificial urgency. You can inspect thoroughly and make informed decisions.

Negotiating hard: Sellers have adjusted expectations. Closing cost credits, repair allowances, and rate buydowns are back on the table.

Working with builders: New construction communities are offering rate buydowns, included upgrades, and closing cost assistance.

Getting pre-approved properly: Full documentation pre-approval gives negotiating power and eliminates surprises.

Focusing on fundamentals: Location, school districts, commute times, long-term value, not market timing.

The Bottom Line: Chaos is Opportunity

Market normalization creates opportunity for informed buyers. While everyone else sits on the sidelines waiting for a crash that isn’t coming, there’s a window right now to:

- Get into a home with more negotiating power than you’ve had in years

- Take your time to find the right property

- Build equity while the market rebalances

- Position yourself for long-term wealth in one of America’s top growth markets

The housing market didn’t crash in 2024 and it won’t crash in 2026. It’s normalizing, and smart buyers are positioning to win.

Ready to Stop Waiting and Start Winning?

If you’re serious about buying in Ellis County or greater Dallas-Fort Worth in 2026, let’s talk about what’s actually available, what you can realistically afford, and how to position you to win in today’s market.

I don’t do fear-based marketing or crash predictions for clicks. I provide market intelligence so you can make informed decisions based on real data, not social media noise.

Whether you’re a first-time buyer figuring out how to start, a move-up buyer wondering if now is the time, or an investor looking for North Texas opportunities, I’m here to give you straight truth about what’s happening.

When I refer you to lenders like Denise Donoghue (The Mortgage Nerd) or Andrew Bryan (Miramar Mortgage Broker), those recommendations are based on service quality and what’s best for you, not hidden financial arrangements. I operate in full compliance with Fair Housing Act, RESPA, and NAR guidelines to ensure you’re protected and treated ethically.

Let’s cut through the noise and get you positioned to win.

Bobby Franklin, REALTOR®

Legacy Realty Group – Leslie Majors Team

📲 214-228-0003 | northtexasmarketinsider.com

Disclaimer: This article provides general market information and analysis. It is not financial, legal, or investment advice. Housing markets can change rapidly. Consult with qualified real estate, mortgage, legal, and financial professionals before making any real estate decisions. All statistics and forecasts cited are from third-party sources and subject to change. Commission structures, lending terms, and market conditions vary. Past performance does not guarantee future results.