Your Strategic Game Plan for 2026 (While We Wait for Answers)

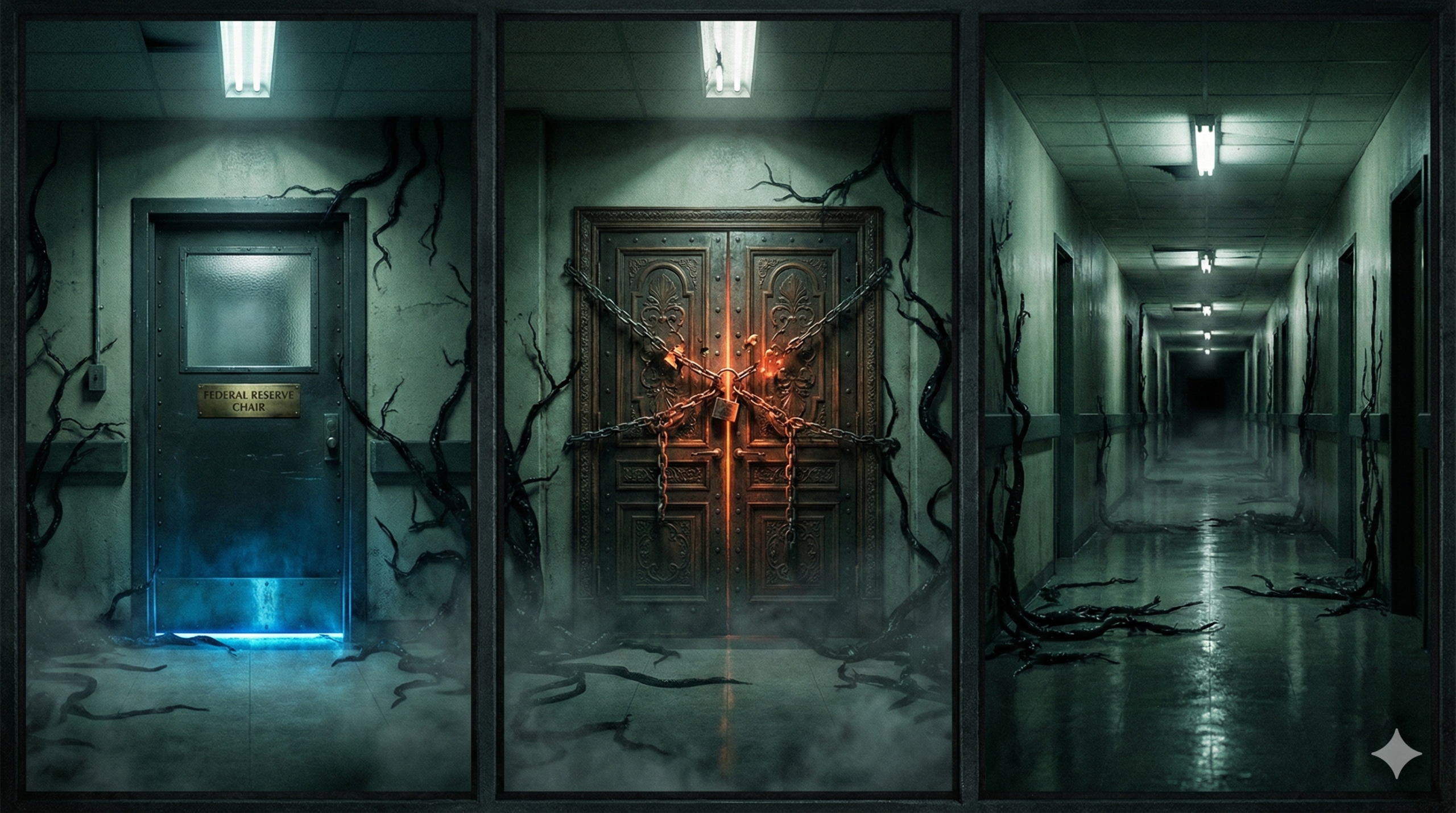

If you’ve followed this series from the beginning, you know by now that the Ellis County housing market has been through its own Upside Down journey.

Episode 1: We watched the portal open in 2020, ultra-low rates and pandemic disruption fundamentally reshaping reality.

Episode 2: We felt Vecna’s curse trap millions of homeowners in their current homes, unable to move without financial devastation.

Episode 3: We understood the Mind Flayer’s web, how Federal Reserve policy controls the entire market from above.

Episode 4: We explored Hawkins Lab’s experiments: four massive developments testing hypotheses that will reshape Ellis County forever.

Now, in Episode 5, we face the same question Stranger Things fans are asking right now:

How does this end? And what do we do while we’re waiting to find out?

THE FINAL SEASON: We’re All Waiting for Answers

Stranger Things Season 5, the final season, is coming to an end. The trailers show preparation, gathering of allies, facing the ultimate battle. But we don’t know:

- Will Hawkins survive?

- Can they close the gate permanently?

- Who makes it out alive?

- What does “normal” look like after everything that’s happened?

The Ellis County housing market in 2026 has the exact same energy.

We’re standing at a threshold moment with massive questions looming:

Who becomes the new Federal Reserve Chair in February 2026? Jerome Powell’s term ends, and President Trump will appoint his replacement. This person will control monetary policy, and therefore mortgage rates, for the next four years. Their philosophy could change everything.

Will portable mortgages become reality? There’s serious policy discussion about allowing homeowners to transfer their existing low mortgage rates to new properties. If this happens, Vecna’s curse breaks entirely. The lock-in effect that’s trapped millions of homeowners disappears overnight.

Will 50-year mortgages gain mainstream acceptance? Some lenders are testing ultra-long mortgage terms to lower monthly payments and restore affordability. This could open the market to buyers currently priced out – but at what long-term cost?

Will the four Ellis County experiments succeed or fail? South Creek Ranch, Myrtle Creek, Ridge Crossing, Lakeway Estates, these aren’t just developments. They’re billion-dollar bets on the future. Their success or failure determines where 30,000-40,000 new residents live and how existing property values respond.

Here’s the truth: We don’t have all the answers yet.

But just like the kids in Hawkins preparing for the final battle, we CAN prepare strategically based on what we DO know.

This is Episode 5: Closing the Gate. Not by pretending we know the future.

But by giving you the strategic game plan to win regardless of which version of the future arrives.

THE WILD CARDS: Three Scenarios That Could Change Everything

Before we get to your action plan, let’s talk about the three massive uncertainties hanging over the 2026 market, because your strategy needs to account for MULTIPLE possible futures.

Wild Card #1: The New Fed Chair (May 2026)

What We Know:

Jerome Powell’s term as Federal Reserve Chair ends May of 2026. President Trump will nominate a replacement who must be confirmed by the Senate. This person will control U.S. monetary policy through at least 2030.

Why This Matters:

The Fed Chair’s philosophy on inflation, employment, and interest rates directly determines mortgage rate trajectory. A hawkish chair (prioritizes fighting inflation) means rates stay higher longer. A dovish chair (prioritizes employment and growth) means rates could drop faster.

The Scenarios:

Scenario A: Continuity Pick

- Trump nominates someone with Powell-like philosophy

- Markets react calmly, rates follow current trajectory

- Mortgage rates gradually drift to 5.75%-6.25% by end of 2026

- Market Impact: Steady, predictable and good for planning

Scenario B: Aggressive Dove

- Trump nominates someone committed to dramatic rate cuts

- Markets initially celebrate, rates drop faster than expected

- Mortgage rates could hit 5.25%-5.75% by mid-2026

- Market Impact: Buying frenzy returns, inventory vanishes, prices spike

Scenario C: Surprise Hawk

- Trump nominates inflation fighter who keeps rates elevated

- Markets sell off, mortgage rates stay 6.5%-7% through 2026

- Market Impact: Continued buyer hesitation, inventory builds, price pressure

Your Strategic Response:

Don’t bet on ONE scenario. Position yourself to capitalize regardless:

- If you’re waiting for rates to drop to 5%, you might wait forever (Scenario C)

- If you’re assuming rates stay high, you might miss the window (Scenario B)

- Best play: Act based on YOUR situation, not Fed speculation

The Stranger Things Parallel: We don’t know what weapon defeats Vecna, but we can prepare multiple strategies and adapt when we see what works.

Wild Card #2: Portable Mortgages (The Vecna Curse Breaker)

What We Know:

There’s active policy discussion – both at federal and state levels – about allowing homeowners to transfer their existing mortgage rates to new properties. Some proposals would let you “port” your 3% mortgage to your next home purchase.

Why This Is MASSIVE:

Remember Vecna’s curse from Episode 2? The mortgage lock-in effect that trapped 93% of homeowners with rates below 6% in their current properties?

Portable mortgages would eliminate that curse entirely.

The Mechanics:

Under most proposals:

- You sell your current home with its 3.5% mortgage

- You buy a new home and transfer that 3.5% rate to the new property

- You only pay current market rates on any ADDITIONAL borrowing needed

Example:

- Current home: $350K with $280K mortgage at 3.5%

- New home: $475K purchase price

- You port the $280K at 3.5%, borrow additional $195K at current 6.5% rate

- Blended rate: ~4.6% instead of 6.5% on entire amount

The Scenarios:

Scenario A: Full Implementation (Low Probability)

- Federal legislation makes portable mortgages standard

- Market Impact: EXPLOSION of inventory as trapped sellers list immediately

- Prices initially drop 5-10% from supply surge, then restabilize

- Transaction volume doubles within 6 months

Scenario B: Limited/Pilot Programs (Medium Probability)

- Some states or lenders offer portable mortgages as niche product

- Market Impact: Modest inventory increase, benefits early adopters

- Creates two-tier market (portable vs. non-portable mortgage holders)

Scenario C: Blocked/Delayed (High Probability)

- Banking industry lobbies against, implementation stalls

- Market Impact: Status quo continues, lock-in effect persists

- Gradual natural unlocking as rates normalize over 2-3 years

Your Strategic Response:

For Sellers:

- Don’t delay selling while waiting for portable mortgages – they may never arrive

- If portable mortgages DO happen, expect massive competition from other sellers

- Best play: If you need/want to move, evaluate based on current reality

For Buyers:

- Don’t assume trapped sellers will flood market with inventory

- If portable mortgages happen, expect prices to initially drop then recover fast

- Best play: If you find the right property now, act, don’t wait for policy miracles

The Stranger Things Parallel: We don’t know if Eleven’s powers will fully return, but we can’t wait around hoping, we fight with the tools we have NOW.

Wild Card #3: 50-Year Mortgages (The Affordability Gamble)

What We Know:

Some lenders are experimenting with 50-year mortgage terms (vs. traditional 30-year). The pitch: dramatically lower monthly payments restore affordability for priced-out buyers.

The Math:

$400,000 mortgage at 6.5%:

30-year term:

- Monthly payment: $2,528

- Total interest paid: $509,680

- Total cost: $909,680

50-year term:

- Monthly payment: $2,172 ($356/month savings)

- Total interest paid: $903,360

- Total cost: $1,303,360

You save $356/month but pay an extra $393,680 in interest over the life of the loan.

The Scenarios:

Scenario A: Mainstream Adoption

- Major lenders embrace 50-year mortgages, become standard option

- Market Impact: Buying power increases 12-15%, demand surge

- Home prices rise to absorb new affordability (sellers capture the benefit)

- Long-term: Generational wealth transfer slows (families paying mortgages into retirement)

Scenario B: Niche Product

- Available but stigmatized, only desperate buyers use them

- Market Impact: Minimal, most buyers stick with 30-year conventional

- Those who use 50-year terms face discrimination in competitive markets

Scenario C: Regulatory Restriction

- Consumer protection concerns limit availability

- Market Impact: Remains tiny percentage of market

- Affordability crisis continues, conventional solutions needed

Your Strategic Response:

For Buyers:

- RUN THE NUMBERS before considering 50-year terms

- That $356/month savings costs you $393,680 over life of loan

- Ask yourself: Would I rather have lower payment today or build equity faster?

- Best play: Only use 50-year if monthly cash flow is truly limiting factor AND you plan to refinance aggressively when rates drop. Treat this like an ARM and refinance in first 3-5 years.

For Sellers:

- If 50-year mortgages go mainstream, expect buyer pool expansion

- But don’t COUNT on it, price your home for current 30-year market

- Best play: If buyers start qualifying for more because of 50-year terms, adjust pricing accordingly

The Stranger Things Parallel: Trading long-term consequences for short-term survival, just like making deals with forces you don’t fully understand. Sometimes necessary, but eyes wide open about the cost.

THE STRATEGIC GAME PLAN: Your Move-by-Move Playbook

Now that you understand the wild cards, let’s talk about what you should actually DO in 2026.

This isn’t generic advice. This is your strategic playbook based on Episodes 1-4 intelligence combined with 2026 uncertainties.

If You’re Buying in Ellis County in 2026

STEP 1: Know Which Hawkins Lab Experiment Aligns With Your Life

Don’t shop randomly. Pick your lane based on priorities:

You’re a Myrtle Creek buyer IF:

- You value resort amenities and community lifestyle

- You want multiple builder options (Perry, Highland, David Weekley)

- You’re comfortable with $375K-$600K price points

- You prioritize convenience and manufactured community

You’re a Ridge Crossing buyer IF:

- You value boutique exclusivity and premium builders

- The 2.05% tax rate math makes sense for your budget

- You want proximity to Waxahachie High School

- You’re willing to pay $490K+ for Highland/DRB quality

You’re a Lakeway Estates buyer IF:

- You prioritize SPACE over amenities (1-acre lots)

- NO MUD/NO PID matters to you ($150-200/month savings)

- You want lake proximity and privacy

- You’re in the $475K-$625K range AND value my Centre Living relationship advantages

You’re waiting for other options IF:

- None of these experiments match your priorities

- You need sub-$350K entry points (look at existing homes or other communities)

- You’re holding out for specific features these don’t offer

STEP 2: Stop Waiting for “Perfect” Conditions

The conditions will NEVER be perfect:

- Rates might drop… or the new Fed Chair might keep them elevated

- Portable mortgages might pass… or might get blocked by banking lobby

- Inventory might surge… or might stay constrained

- Prices might soften… or new demand might push them higher

Here’s the strategic reality:

If you’re waiting for 5% rates, you might wait 2-3 years (or forever under hawkish Fed Chair)

If you’re waiting for inventory explosion, portable mortgages aren’t guaranteed to happen..

If you’re waiting for price drops, Ellis County’s 30,000-40,000 new residents by 2030 will likely support continued appreciation

The move: If you find the RIGHT property that serves your life for 7-10 years, ACT. You can always refinance rates. You can’t time-travel to capture the right property.

STEP 3: Optimize Within Current Reality

Since we CAN’T control:

- Fed Chair selection

- Portable mortgage policy

- Broader market forces

We CAN control:

- Which community we choose (right experiment for our priorities)

- Which builder we work with (value vs. overpriced)

- What incentives we negotiate (upgrades, credits, rate buy-downs)

- Total cost of ownership (understanding MUD/PID, HOA, tax rates)

Specific tactics:

✅ Buy during aged inventory windows (60-90 days on market = negotiation leverage)

✅ Push for incentives over price reductions (get more value, protect comps)

✅ Understand lot premiums (save $15K-30K by choosing base lots strategically)

✅ Work with agents who have builder relationships (my Centre Living access at Lakeway Estates provides real advantages)

✅ Calculate total monthly cost (not just mortgage: include ALL taxes and fees)

STEP 4: Have a Refinance Strategy

Assume you’ll refinance within 3-5 years.

If you buy at 6.5% today, you’re likely to refinance at 5.5%-6% by 2027-2029 as:

- New Fed Chair settles into policy rhythm

- Market normalizes post-election

- Economic conditions stabilize

Your payment at 6.5% isn’t permanent. It’s your entry price.

The Stranger Things Parallel: You go into the Upside Down with the weapons you have NOW, not the ones you wish you had. Eleven didn’t wait for her powers to fully return, she fought with what she could do in the moment.

If You’re Selling an Existing Home in Ellis County in 2026

STEP 1: Accept You’re Competing Against Hawkins Lab Experiments

Your competition isn’t just other existing homes, it’s:

- Brand new construction with warranties

- Modern floor plans optimized for 2026 living

- Resort amenities at Myrtle Creek

- Premium finishes at Ridge Crossing

- 1-acre lots at Lakeway Estates

You can’t out-new new construction.

But you CAN win on:

- Speed (move-in ready vs. 6-8 month construction timelines)

- Character (established trees, unique features, personality)

- Value (lower price for similar square footage)

- Location (established neighborhoods, mature infrastructure)

- Flexibility (negotiable terms, creative solutions)

STEP 2: Price for Current Reality, Not Hope

The temptation: “I’ll list high and see what happens. Maybe portable mortgages pass and demand surges.”

The reality: Overpriced listings sit while properly-priced homes sell.

Your strategy:

If comparable new construction at Myrtle Creek is $425K, your existing home can’t demand $440K unless you offer meaningful advantages.

Do this math:

- New construction price: $425K

- Your competitive advantage (mature trees, pool, workshop, etc.): ~$15K-25K value

- Your maximum defensible price: $440K-450K

- Builders are offering 1/2/6 warranties and often rate by downs and closing cost incentives.

- BUT you would need $20,000-$40,000 in seller concessions to your buyers just to compete.

- Your sales price just went to $375K.

Price ABOVE that? You’re gambling that something changes (portable mortgages, rate drops, inventory shortage). You might be right, but you might sit on market for 6-9 months while that plays out.

STEP 3: Time Your Listing Strategically

Best timing windows for sellers in 2026:

January-February (Before Fed Chair Announcement):

- Buyers still making decisions under Powell-era expectations

- Less competition from new spring listings

- Serious buyers (not casual browsers)

Late March-May (Traditional Spring Market):

- Maximum buyer activity

- Weather improves for showings

- Families positioning for summer moves

September-October (Fall Market Comeback):

- Buyers who waited through summer getting serious

- School year settled, families ready to move

- Less competition than spring (many sellers already sold)

Avoid:

- Mid-February (Fed Chair announcement could create uncertainty/paralysis)

- June-August (Ellis County heat, vacation season, lower activity)

- November-December (holiday season, year-end paralysis)

STEP 4: Create Urgency Through Value, Not Desperation

Don’t:

❌ Drop price every 2 weeks (signals desperation)

❌ Offer to pay buyer’s costs without negotiation (looks desperate)

❌ Leave home vacant and sterile (feels abandoned)

Do:

✅ Price right initially (strong debut, immediate showings)

✅ Stage to highlight advantages (mature landscaping, unique features)

✅ Offer strategic incentives (rate buy-down contribution, closing cost credits, but make them EARN it through strong offer)

✅ Tell the story (why YOUR home beats cookie-cutter new construction)

The Stranger Things Parallel: “Nancy survived by understanding her enemy better than they understood themselves. She didn’t defeat Vecna; but her investigation, strategic planning, and precise execution kept her in the fight when others would have died.

THE TRUTH ABOUT CLOSING THE GATE

In Stranger Things, closing the gate isn’t about making everything go back to “normal.” Hawkins will never be the same. The characters will never be the same. They’ve been through too much, seen too much, lost too much.

The Ellis County housing market is the same.

We’re not going back to 2019. We’re not getting 3% mortgages back. We’re not returning to the pre-pandemic world where you could casually browse homes for 6 months before deciding.

But we ARE closing the gate on the most chaotic period.

The portal opened in 2020. We’ve been through:

- Vecna’s curse trapping millions of homeowners

- The Mind Flayer’s economic manipulation from above

- Hawkins Lab experiments reshaping our communities

2026 is the year we stabilize.

Not perfect. Not easy. But predictable enough to plan around.

The new Fed Chair will establish a policy direction, even if we don’t love it, at least we’ll know it.

Portable mortgages will either happen or they won’t, the uncertainty will resolve.

50-year mortgages will either gain traction or fade away, we’ll know within 12 months.

The four Ellis County experiments (South Creek Ranch, Myrtle Creek, Ridge Crossing, Lakeway Estates) will either validate their hypotheses or fail, and that will tell us what the market actually wants.

By end of 2026, the gate will be closed.

Not because problems disappeared. But because we’ll have clarity instead of chaos.And clarity is what lets you execute strategy.

YOUR STRATEGIC POSITION: Why You’re Ready for This

If you’ve read all five episodes of this series, you now know:

From Episode 1: How we got here – the portal opened in 2020, creating unprecedented market disruption that reset all baselines.

From Episode 2: What’s trapping people – Vecna’s curse of mortgage lock-in affects 93% of homeowners and creates the inventory shortage.

From Episode 3: Who controls the game – the Mind Flayer’s web of Federal Reserve policy determines mortgage rates and broader economic conditions.

From Episode 4: What’s being built – four major Ellis County experiments testing different market hypotheses that will reshape our community.

From Episode 5 (this one): What’s coming in 2026 – the wild cards (new Fed Chair, portable mortgages, 50-year mortgages) and your strategic response to each scenario.

You have intelligence that 95% of Ellis County buyers and sellers don’t have.

Most people are making $400K-$600K decisions based on:

- “It looks nice”

- “The payment seems okay”

- “My friend bought there”

You’re making decisions based on:

- Understanding which Hawkins Lab experiment aligns with your actual priorities

- Knowing how MUD/PID taxation affects total cost of ownership

- Recognizing that builder incentives > price reductions

- Preparing for multiple 2026 scenarios instead of betting on one outcome

- Timing your moves strategically around market windows

That’s not luck. That’s intelligence.

And intelligence is what closes gates and wins battles.

THE FINAL BATTLE: Your Next Move

We’re at the end of the series. You have the intelligence. You understand the experiments. You know the wild cards.

Now it’s time to execute.

If you’re buying in Ellis County in 2026, you need someone who:

- Understands all four Hawkins Lab experiments (South Creek Ranch, Myrtle Creek, Ridge Crossing, Lakeway Estates)

- Has direct builder relationships that create tangible advantages (my Centre Living access at Lakeway Estates and Ridge Crossing insider connections)

- Tracks incentive cycles, lot premiums, and negotiation windows across all communities

- Helps you position for MULTIPLE possible futures (Fed Chair scenarios, portable mortgage possibilities, rate trajectories)

If you’re selling an existing home, you need someone who:

- Understands exactly what new construction you’re competing against

- Can position your advantages without overpricing into irrelevance

- Times your listing for maximum strategic impact

- Knows which buyers specifically seek existing homes vs. new construction

If you’re investing or waiting, you need someone who:

- Provides ongoing market intelligence so you can set informed trigger points

- Alerts you when opportunities arise (aged inventory, motivated sellers, emerging value)

- Understands the 3-5 year appreciation trajectory based on South Creek Ranch and infrastructure investment

That’s not every agent.

That’s me.

I’m not selling you hope. I’m not promising miracles. I’m not pretending to know which way the Fed Chair will lean or whether portable mortgages will pass(though I’m hopeful they do)

What I’m offering is strategic intelligence and execution.

I’ve spent 5 episodes breaking down this market in detail that most agents will never bother with. I track developments, infrastructure, policy changes, and builder dynamics because that’s what creates advantage.

The gate is closing on the chaos of 2020-2025.

2026 is the year we move from survival mode to strategic execution.

The question isn’t whether you SHOULD act.

The question is whether you’ll act WITH intelligence or WITHOUT it.

Ready to build your strategic game plan? Let’s talk.

Call/Text: 214-228-0003

Read the complete series: northtexasmarketinsider.com

Bobby Franklin, REALTOR®

Legacy Realty Group – Leslie Majors Team

📲 214-228-0003 | northtexasmarketinsider.com