This could be fantastic. Or it could be a disaster. Either way, we need to talk about it.

Look, I get calls every week from buyers who are frustrated. They’re making decent money, household income of $85K, $95K, even pushing six figures, and they still can’t comfortably afford a home in decent North Texas neighborhoods. The math just doesn’t work anymore. So when the Trump administration floated the idea of 50-year mortgages on November 9th, with FHFA Director Bill Pulte calling it “a complete game changer,” I understood why people got excited. [1]

Lower monthly payments? Sign me up, right?

Not so fast.

Here’s the thing about chaos in the housing market, and make no mistake, we’re living through serious disruption right now, it creates opportunity for those who see five steps ahead. But it also creates traps for people who only look at the surface numbers. A 50-year mortgage might look like a lifeline when you’re drowning in affordability concerns, but we need to examine whether it’s actually a rescue boat or an anchor.

Let me break down what’s really happening here, what it means for North Texas buyers, and whether this proposal solves anything or just kicks the can down a very, very long road.

What Trump’s Administration Is Actually Proposing

President Trump introduced this concept by comparing it to FDR’s introduction of the 30-year mortgage during the Great Depression. The pitch is straightforward: spread your loan payments over 50 years instead of 30, drop your monthly payment, and suddenly homeownership becomes accessible to millions of Americans currently priced out. [2]

The numbers sound appealing at first glance. Take a $400,000 loan at 6.25% interest, pretty standard for what we’re seeing in Ellis County right now. With a traditional 30-year mortgage, you’re looking at monthly principal and interest payments of about $2,463. Stretch that same loan to 50 years, and your monthly payment drops to around $2,180. That’s $283 less every month.

For families currently spending 39% of monthly income on housing costs, which is where the median household sits right now, that reduction feels significant. That’s an extra $280 that could cover groceries, car payments, or start building an emergency fund.

But here’s where we need to think like strategists, not just consumers responding to a lower monthly number.

The Monthly Payment Mirage

Let’s get specific about what different North Texas buyers would actually save with a 50-year mortgage, because context matters:

If you’re buying around $300,000 (think parts of Waxahachie, Red Oak, or southern Ellis County):

- 30-year payment: $1,847/month

- 50-year payment: $1,748/month

- Monthly savings: $99

For a $400,000 purchase (much of Midlothian, parts of Mansfield, entry-level in growing suburbs):

- 30-year payment: $2,463/month

- 50-year payment: $2,331/month

- Monthly savings: $132

At the $500,000 level (newer construction in Prosper, parts of Frisco, move-up homes in established neighborhoods):

- 30-year payment: $3,079/month

- 50-year payment: $2,913/month

- Monthly savings: $165

Now, be honest with yourself. Does saving $99 to $165 per month, roughly 5-6% less, justify what you’re giving up? Because that’s the real question we need to answer.

The Real Cost: Welcome to a Lifetime of Interest Payments

This is where the proposal falls apart under scrutiny, and why every housing economist I’ve read analysis from is raising red flags.

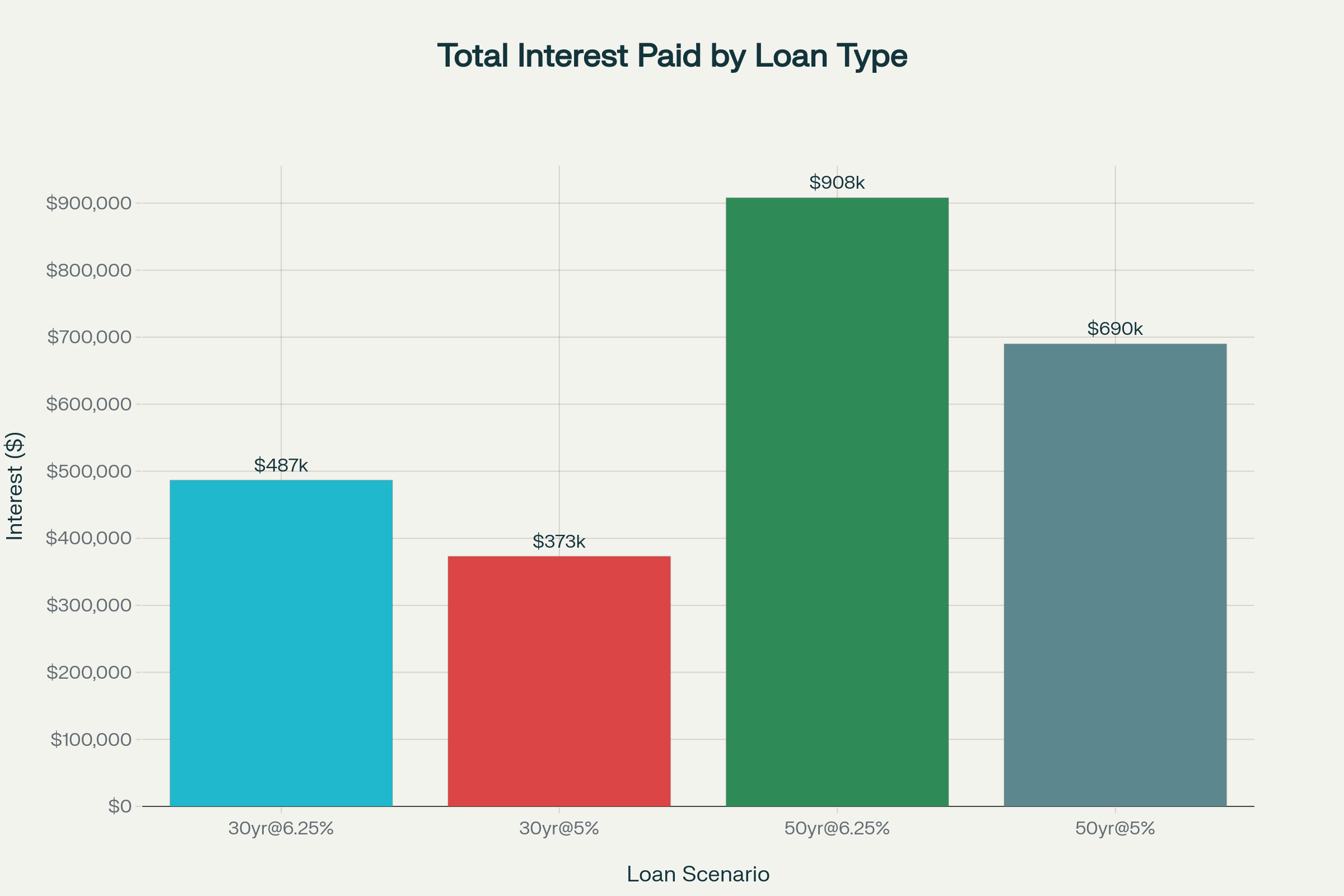

On that same $400,000 loan we’ve been discussing, here’s what you’ll actually pay over the life of the loan:

30-Year Mortgage:

- Total interest paid: $487,000

- Total amount paid: $887,000

50-Year Mortgage:

- Total interest paid: $998,000

- Total amount paid: $1,398,000

You read that correctly. You’ll pay an additional $511,000 in interest just to save $132 per month depending on your interest rate. That’s not a typo. That’s not creative math. That’s the reality of how compound interest works over extended timeframes.

Let me put this in perspective: After 30 years of faithfully making payments on your 50-year mortgage, you know how much you’ll have paid in that extra interest? The full $511,000. And you’ll still owe $93,500 on your home.

Three decades of payments, and you’re nowhere close to actually owning your home.

The Equity Problem: Why Building Ownership Actually Matters

One of the most concerning aspects of this proposal, and frankly, one that tells me whoever designed it wasn’t thinking about long-term wealth building, is how slowly you accumulate equity in your home.

Equity isn’t just a financial term. It’s the foundation of middle-class wealth in America. It’s how families build financial security. It’s what you tap for your kid’s college education, or to start a business, or to fund your retirement. It’s generational wealth that gets passed down.

Here’s how equity buildup compares on a $400,000 loan:

After 5 years:

- 30-year mortgage: 6.7% equity ($26,800)

- 50-year mortgage: 1.4% equity ($5,600)

After 10 years:

- 30-year mortgage: 15.8% equity ($63,200)

- 50-year mortgage: 3.4% equity ($13,600)

After 20 years:

- 30-year mortgage: 45.2% equity ($180,800)

- 50-year mortgage: 10.2% equity ($40,800)

After 30 years:

- 30-year mortgage: 100% equity, you own your home

- 50-year mortgage: 23.4% equity ($93,600), you still owe $306,400

Think about what this means practically. If you’re 35 years old buying your first home with a 50-year mortgage, you’ll be 65 years old(retirement age) and still owe three-quarters of your home’s original value. You’ll be 85 before you own it outright.

That’s not homeownership. That’s perpetual renting with extra steps and way more risk.

The Regulatory Reality: Can This Even Happen?

Here’s where it gets interesting from a strategic standpoint. This proposal sounds great in a social media post, but implementing it faces massive legal and regulatory barriers.

The Dodd-Frank Act, passed after the 2008 financial crisis specifically to prevent the kind of risky lending that crashed the economy, currently restricts “Qualified Mortgages” to a maximum 30-year term. This wasn’t arbitrary. This was designed to protect consumers from predatory lending products that look affordable short-term but destroy wealth long-term. [3]

For 50-year mortgages to become widely available, one of three things needs to happen:

Option 1: Congress amends Dodd-Frank. Given the current political landscape and how controversial any housing finance reform becomes, this isn’t happening quickly. We’re talking months at minimum, more likely years of debate.

Option 2: Lenders offer them as “non-qualified mortgages.” This means higher interest rates, stricter requirements, and fewer lenders willing to offer them. It becomes a niche product for specific situations, not a widespread solution.

Option 3: Fannie Mae and Freddie Mac update their guidelines. The government-sponsored enterprises would need to agree to purchase these loans from lenders, which requires formal approval processes and updated automated underwriting systems.

Even if the Trump administration pushes hard for this(and I think they will, given the political appeal of “making homeownership affordable”) we’re looking at a long implementation timeline with significant uncertainty.

What This Actually Does to Home Prices (Spoiler: Not Good)

This is where we need to think several moves ahead, not just react to the immediate pitch.

Housing affordability isn’t primarily about buyers’ ability to make monthly payments. It’s about supply and demand. North Texas doesn’t have an affordability crisis because buyers can’t make mortgage payments. We have an affordability crisis because we’re not building enough homes to meet demand, particularly in growing markets like Ellis County, where population growth continues outpacing housing development. [4]

When you introduce 50-year mortgages without adding a single new home to the market, here’s what happens:

Step 1: More buyers can suddenly “afford” to bid on homes because their monthly payments drop with longer terms.

Step 2: These buyers compete for the same limited inventory, bidding against each other.

Step 3: Sellers see increased demand and raise asking prices to capture that additional purchasing power.

Step 4: Home prices rise to absorb the increased affordability, erasing any real benefit to buyers.

This isn’t theoretical. This is exactly what happened when lending standards loosened in the early 2000s, contributing to the housing bubble that eventually crashed the entire economy. We’re essentially creating artificial demand without addressing the fundamental supply shortage.

Tyler Cowen, one of the most respected economists in the country, used GPT-5 to analyze this proposal and concluded that government-backed 50-year mortgages would “likely lower monthly payments but raise house prices, slow equity build-up, raise default risk in downturns, and increase interest-rate risk in the financial system.” [5]

Translation: This looks like it helps buyers, but it actually helps lenders, investors, and sellers while trapping buyers in long-term debt with minimal equity and significant risk.

How This Could Impact North Texas Specifically

Our market is different from California, different from Florida, different from the Northeast. We need to think about how this plays out locally.

North Texas has remained relatively healthy compared to many markets. As of mid-2025, we’re seeing median home prices ranging from $385,000 in Fort Worth to $525,000 in Frisco, with most areas showing steady year-over-year appreciation of 3-7%. Current mortgage rates around 6.25-6.35% have kept some buyers on the sidelines, but inventory levels have been improving, and the fundamentals remain solid.

If 50-year mortgages become widely available, here’s what I expect:

Increased competition in the $300K-$600K range. This is where most North Texas buyers compete. Entry-level and move-up properties in growing communities like McKinney, Frisco, Waxahachie, and throughout Ellis County. More qualified buyers means more competition, which typically means multiple offers, escalating prices, and pressure to waive contingencies.

Upward price pressure on existing inventory. When buyers can afford more house (on paper) through extended terms, sellers raise prices. That’s not speculation, that’s established market behavior. We could see appreciation accelerate beyond the current 3-7% rate, particularly in high-demand communities.

First-time buyer vulnerability increases. The average first-time buyer age has already climbed to 40 nationwide. A 50-year mortgage means these buyers wouldn’t own their homes outright until age 90. That’s not building wealth, that’s creating permanent debt class.

Better Strategies That Actually Work

Look, I understand the appeal of anything that makes the monthly number lower. I work with buyers every week who are stretching to make homeownership happen. But there are proven strategies that improve affordability without signing up for half a century of debt:

Texas Down Payment Assistance Programs offer real, immediate help. The Texas State Affordable Housing Corporation’s Home Sweet Texas program and Homes for Texas Heroes provide down payment assistance and competitive rates. The City of Fort Worth offers up to $25,000 in forgivable down payment assistance for eligible buyers. This is real money that reduces your loan amount, not just spreads it over more years.

Increased housing supply is the only real solution. Building more homes, particularly smaller, affordable two-bedroom/two-bathroom houses that work for young families, singles, and moderate-income buyers, addresses the root cause. North Texas builders are active in growing communities, and targeting areas with better inventory levels gives you more negotiating power.

Rate buy-downs and ARM strategies can reduce your monthly payment significantly in the short term while you wait for rates to drop, then you refinance to a conventional 30-year loan. This gives you flexibility without the long-term consequences of 50-year debt.

Strategic market timing and location choices matter more than loan terms. Working with an agent who understands local market nuances, which Ellis County neighborhoods offer the best value, where new development is happening, which communities have strong fundamentals, helps you find affordability without gimmicks.

What the Experts Are Actually Saying

The backlash to this proposal has been significant, even from some of Trump’s own supporters.

The Southwest Public Policy Institute released a comprehensive report calling 50-year mortgages a “false promise” that would “inflate home prices, not lower them” and “convert homeownership into a perpetual debt instrument, eroding household wealth.” They argue the policy would “exacerbate financial inequality by rewarding lenders and investors while trapping middle-class borrowers in intergenerational debt.” [6]

U.S. Representative Marjorie Taylor Greene, hardly an opponent of Trump’s agenda, publicly opposed the proposal on social media, expressing concerns about long-term debt burden on families.

Logan Mohtashami from HousingWire stated: “I understand that we have housing affordability challenges in America, but subsidizing more demand from 30- to 50-year mortgages is not the policy we want to take now. Housing has to balance itself out through slowing home-price growth and wages increasing.”

When housing analysts, economists, and even political allies are raising red flags, that should tell you something.

Is There Ever a Situation Where a 50-Year Mortgage Makes Sense?

I’m not going to be absolutist here. There might be specific, narrow circumstances where a 50-year mortgage could work strategically:

If you plan to refinance within 5-10 years when rates drop significantly, the temporary lower payment might help you get into the market now without the long-term consequences.

If you’re a high-income earner using it specifically for cash flow management while you invest aggressively elsewhere, and you have the discipline to make additional principal payments to accelerate equity buildup.

If you have investment opportunities that could earn returns consistently exceeding your mortgage interest rate, the spread might justify the strategy.

But for the vast majority of North Texas homebuyers, particularly first-time buyers, middle-income families, and anyone planning to stay in their home long-term, a 50-year mortgage creates more problems than it solves.

Critical Questions Every Buyer Should Ask

Before even considering a 50-year mortgage if it becomes available, answer these questions honestly:

- Can I afford to make regular additional principal payments to accelerate equity buildup?

- What happens if I need to sell within 5-10 years and have minimal equity?

- How will carrying mortgage debt into my 70s, 80s, or 90s impact retirement security?

- Will I qualify for a conventional 30-year loan with slightly higher payments if I adjust my price range?

- Are there down payment assistance programs or other strategies that could help me buy with a shorter-term loan?

- What does my financial advisor say about this strategy?

- What does this mean for passing wealth to my kids?

If you can’t answer all of these questions with confidence, a 50-year mortgage probably isn’t right for your situation.

The North Texas Path to Real Homeownership

Here’s what I tell every buyer I work with: Sustainable homeownership isn’t about finding the lowest possible monthly payment. It’s about building wealth over time, creating financial security, and positioning yourself for long-term success.

In North Texas, that means:

Leveraging local expertise to find communities and properties with strong fundamentals, good growth potential, and current affordability.

Using proven assistance programs that put real money toward your down payment and closing costs, reducing your loan amount rather than just extending the term.

Targeting markets with improving inventory where you have negotiating power rather than facing multiple-offer situations every time.

Building equity systematically through traditional 30-year (or shorter) mortgages that have you on a path to actual ownership, not perpetual debt.

Understanding market cycles so you’re buying at the right time for your specific situation, not just when a new lending product becomes available.

The housing affordability crisis requires real solutions: more construction, zoning reform to allow higher density, policies supporting wage growth, and programs helping with down payments and closing costs. Extending mortgage debt from 30 to 50 years shifts the burden onto individual families while benefiting lenders through decades of additional interest payments.

What Happens Next

As we wait for further developments from the Trump administration and FHFA regarding implementation timelines and final terms, stay informed but stay strategic. Don’t make decisions based on marketing hype or political promises. Make decisions based on your specific financial situation, long-term goals, and what actually builds wealth over time.

If you’re serious about buying a home in North Texas, whether in Waxahachie, Ellis County, or surrounding areas, work with professionals who understand local market dynamics, can help you navigate complex financing options, and are willing to have honest conversations about what actually serves your long-term interests.

Because here’s the truth: The best mortgage is the one you pay off. The best home purchase is the one that builds wealth over time. And the best real estate advice comes from people who care more about your success than their commission check.

This 50-year mortgage proposal might be a game changer. But we need to make sure it’s changing the game in the right direction, toward sustainable homeownership and wealth building, not perpetual debt and lender profits.

Stay smart. Think strategically. And remember: In times of market chaos, opportunity belongs to those who see five steps ahead, not those who just react to the headlines.

Curious about moving to North Texas? Check out my relocation guide.(click the image below)

📊 Get market moves before they hit the news

🎯 Text 214-228-0003 | Link in bio

Bobby Franklin – REALTOR®

Legacy Realty Group – Leslie Majors Team

This article provides educational information about mortgage products and housing policy based on current proposals and market analysis. It is not financial advice. Readers should consult qualified financial advisors and licensed mortgage professionals regarding their specific situations. All information current as of November 10, 2025.