September 18, 2025 – Market Intelligence Update

The Federal Reserve just made their first rate cut since December 2024, dropping the federal funds rate by 25 basis points to 4.00%-4.25%.

But here’s the thing everyone’s getting wrong, this isn’t the housing market rescue story you’re hearing everywhere else.

What Really Just Happened (The Inside Story)

Fed Chair Jerome Powell didn’t cut rates because housing was struggling. This was pure labor market strategy. Unemployment hit 4.3% (highest since late 2021) and people are staying unemployed for an average of 24.5 weeks. That’s nearly 6 months of job searching. The Fed saw the writing on the wall and made a “risk management” move.

Here’s the part most agents don’t understand: The federal funds rate isn’t your mortgage rate. The fed funds rate is what banks charge each other overnight. Your buyers’ mortgage rates? Those track the 10-year Treasury yield, which moves on completely different factors.

The Mortgage Rate Reality Check

Want to know something fascinating? Mortgage rates already fell in anticipation of this cut. We dropped to 6.13% on September 16th, the lowest in nearly three years. After the Fed’s announcement yesterday? Rates actually ticked UP to 6.22%.(Mortgage News Daily)

Current rates as I’m writing this:

- 30-year fixed: 6.13% – 6.35%

- 15-year fixed: 5.40% – 5.50%

- FHA 30-year: 6.65%

- VA 30-year: 6.76%

While everyone else is celebrating the rate cut, the smart money already moved.

What This Means for Your Buyers’ Wallets

Let’s get tactical. For our typical North Texas home at $354,375, dropping from 7% to 6.35% saves your buyer about $140 monthly. Over 30 years? We’re talking $50,000+ in interest savings.

With median family income at $104,200, that $2,080 monthly payment sits at 24% of gross income. Better than the 28%+ we were seeing, but still requires serious financial discipline.

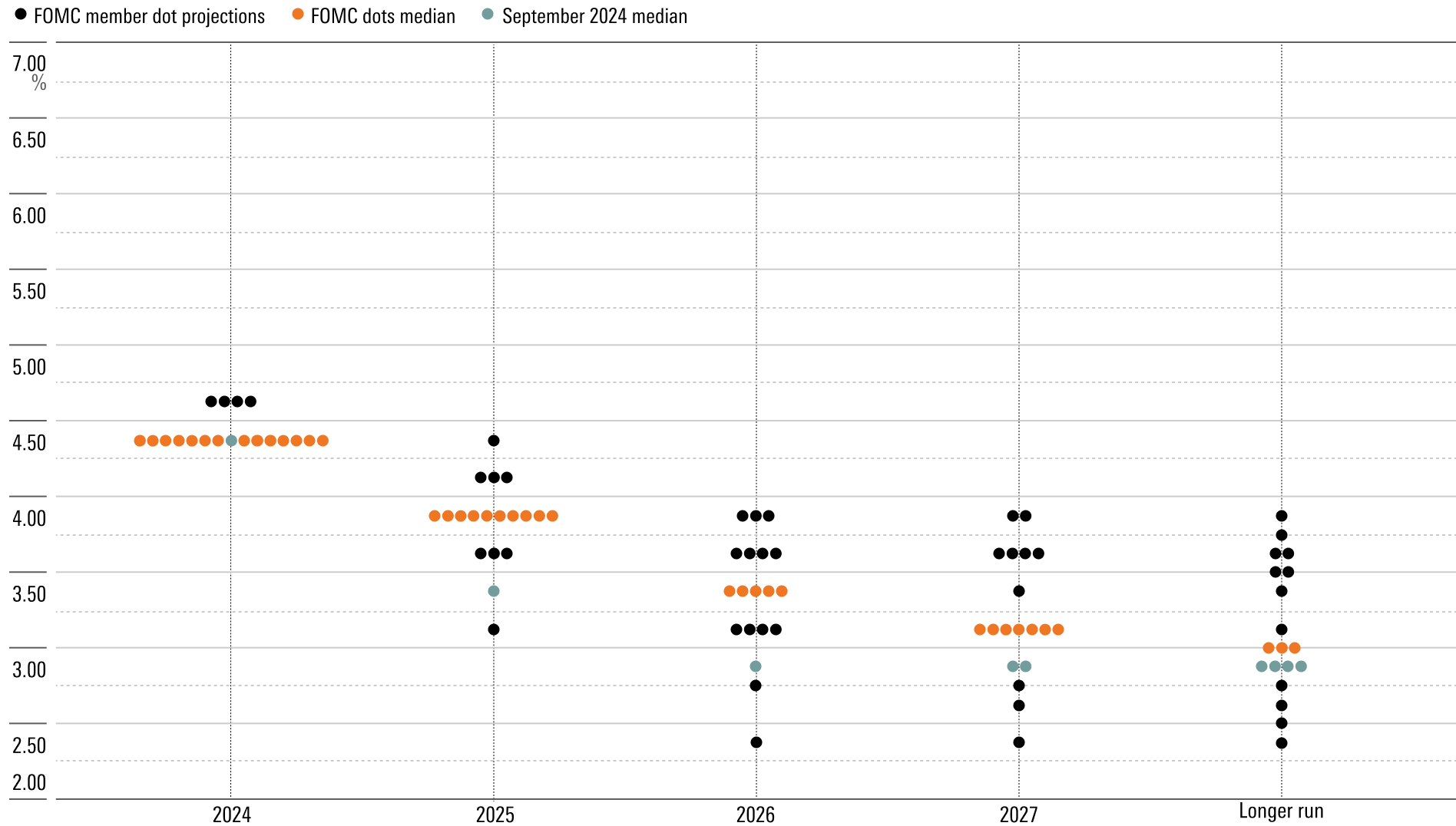

The Fed’s Future Playbook (What They’re Not Telling You)

Here’s the inside intelligence: The Fed’s “dot plot” shows two more 25-basis-point cuts expected by end of 2025, potentially hitting 3.50%-3.75%. Looking ahead:

- End 2025: 3.6% federal funds rate

- End 2026: 3.4% target

- Long-term neutral: Around 3.0%

But here’s where it gets interesting, there was massive disagreement among Fed officials. Some want NO more cuts this year. Others want aggressive reductions. Translation: Nobody really knows what’s coming.(Federal Reserve Dot Plot)

North Texas Market Reality (What the Data Actually Shows)

Forget the national headlines. Here’s what’s happening in OUR backyard:

The Numbers That Matter:

- Average days on market: 57 (up 18.8% year-over-year)

- Dallas homes with price reductions: 35.6% last month

- Homes selling for: ~95% of list price

- Inventory increase: 26% compared to last year

Price Intelligence:

- Dallas County median: $380,000 (flat year-over-year)

- Texas median: $354,375 (slight uptick from $340,000)

- Dallas prices dropped 0.21% annually in April – first decline in TWO YEARS

Market Dynamics:

- 885 listing cancellations in Dallas County (past 30 days) – that’s a 42% INCREASE

- New construction often beating resale prices

- Seller profit margins dropped from 39.2% to 29.7%

Why Rate Cuts Won’t Save Housing (The Inconvenient Truth)

Listen carefully: The Fed can’t fix housing affordability with rate cuts alone. Here’s why:

1. Long-Term Rates Don’t Follow Fed Rates

Peter Boockvar from One Point BFG Wealth Partners nailed it. Fed cuts hit short-term rates, not the long-term rates driving mortgages. Government deficits and investor concerns keep 10-year Treasury yields elevated regardless of Fed policy.(Business Insider: Housing Market)

2. Supply-Demand Math

DFW added 177,922 people from 2023-2024, but new construction and inventory grew faster than buyer demand. Basic economics: more supply + same demand = downward price pressure.

3. Historical Pattern Recognition

September 2024: Fed cuts their rate and mortgage rates drop to 6.08%, everyone celebrates. January 2025: rates shoot above 7%. The market clearly doesn’t care about your Fed celebration party.

First-Time Buyers: The Struggle is Real

The data doesn’t lie:

- Only 24% of purchases (historically low)

- Median age: 38 years (used to be 20s in the 1980s)

- Down payment challenges from high rent + student debt + childcare costs

- National median exceeding $400,000

Strategic Timing Intel for North Texas

For Buyers (The Perfect Storm):

Fall 2025 could be the buyer opportunity we’ve been waiting for. Mortgage rates at 2025 lows + home prices cooling 3-12% + homes selling 5% below list = serious buyer negotiating power.

Charles Goodwin said it best: “The biggest mistake I see is waiting for the perfect rate.” If you’re ready to buy, lock your rate NOW. (Mortgage Rates Today)

For Sellers (Reality Check Time):

The market shifted. Period. Properties take longer to sell, price reductions are standard, and many sellers are canceling rather than accepting reality. If you MUST sell:

- Price competitively from Day 1

- Build extra time into your timeline

- Consider seller concessions or rate buydowns

- Make sure it’s move-in ready

Real Estate Investment Opportunities

Commercial real estate benefits more directly from rate cuts. The CBRE forecasts 15% investment volume increase (up from 10% projection).(CBRE Official)

For residential investors, here’s the play: 6-12 month lag between rate cuts and price appreciation creates acquisition opportunities. Acquire, rehab, and prepare during the window before prices rise significantly.

Economic Risks (What Keeps Me Up at Night)

The Fed cut rates while inflation sits at 2.9% – above their 2% target – with tariff pressures building. Key risks:

- Core PCE inflation rising

- 24% of unemployed people out of work 27+ weeks

- GDP growth projected to slow to 1.6% in 2025

Your Action Plan for North Texas Domination

Do This Now:

- Get pre-approved immediately – rates are near yearly lows

- Lock your rate if under contract – certainty beats perfection

- Expand search areas – regional price variations create opportunities

- Consider new construction – builders offering serious incentives

Strategic Planning:

- Watch the Fed’s December meeting

- Monitor 10-year Treasury yields (not Fed rates)

- Track local inventory and price trends

- Consider ARMs if selling within 5-7 years

The North Texas Bottom Line

The Fed’s rate cut helps, but it’s not solving affordability overnight. However, the combination of lower rates + increased inventory + cooling prices creates the most buyer-friendly conditions in YEARS.

Forget pandemic-era 3% rates, they’re not coming back. Most forecasts show mid-6% range through 2026.

Here’s the truth: If you’re ready to move, current conditions offer the best buyer opportunity in years. If you’re selling, realistic pricing and patience are non-negotiable as we transition from seller-dominated market conditions.

The Fed’s rate cut helps, but LOCAL market dynamics, employment trends, and inventory levels determine your success in North Texas real estate.

While everyone else is celebrating yesterday’s news, the smart money is already positioning for what’s next.

🏡 Tracking DFW developments so you don’t have to

📲 Text 214-228-0003 for weekly insights

Bobby Franklin – REALTOR®

Legacy Realty Group – Leslie Majors Team

Serving Ellis County & DFW