September 18, 2025 | Market Intelligence Report

Mortgage applications exploded 29.7% in one week, the biggest jump since January and the second-largest spike since rates crashed in March 2020.

But here’s the real intelligence: This isn’t just a number. It’s a market inflection point that’s about to separate the strategic players from the reactive ones.

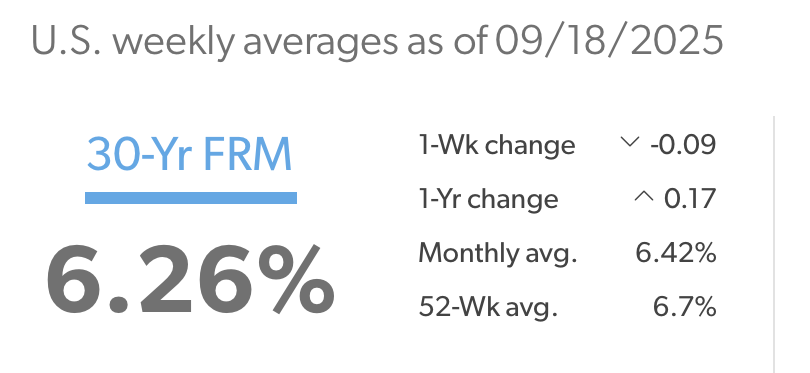

The 6.26% Game Changer: What Smart Money Already Knows

While everyone’s talking about the Fed’s quarter-point cut, the real story is what happened to actual borrowing costs. Mortgage rates dropped to 6.26%, their lowest level in nearly a year.

Here’s the math that matters for Ellis County buyers:

On a $400,000 home (right in our sweet spot), this rate means $1,965/month instead of the $2,108 we saw at 7% rates. That’s $143 monthly savings or $1,716 annually back in your buyer’s pocket.

But here’s the strategic insight most agents are missing: Using the 1/10 rule, this 0.74% rate drop just increased your buyers’ purchasing power by approximately 7.4%. That $400K buyer? They can now afford a $430K home at the same payment.(The 1/10 Rule)

This is chaos becoming opportunity. While others see numbers, we see market positioning.

The Refinancing Rush: Why This Intelligence Matters for Your Business

Refinance applications jumped 58% in one week and now represent 59.8% of all mortgage applications, the highest level since January 2022. The average loan size for refinances just hit a 35-year record high.(Mortgage Application Surge)

Strategic Translation: Every homeowner with a rate above 6.5% is now a potential client. In our DFW market where the average home price sits at $527,204, these aren’t small transactions. These are substantial equity positions ready to make moves.

North Texas Market Intel: The Buyer’s Window Is HERE

The data everyone else is reading shows inventory increases and longer market times. Here’s what that intelligence actually means for strategic players:

Market Positioning Advantage:

- Active Dallas listings surged 24.6% year-over-year

- Homes averaging 57 days on market (18.8% increase)

- 35.6% of Dallas homes experienced price reductions

- Properties selling at approximately 95% of list price

Strategic Intelligence: We’re not in a “buyer’s market”, we’re in a buyer’s ADVANTAGE market. There’s a critical difference. Inventory exists, but so does demand. This creates negotiating power without desperation pricing.

The Perfect Storm Analysis: Lower rates + realistic pricing + motivated sellers + seasonal timing = premium positioning opportunity for agents who understand the convergence.

First-Time Buyer Renaissance: The 20% Surge Signal

Purchase applications increased 3% week-over-week and are running 20% higher than the same week last year. But here’s the intelligence others missed: FHA applications hit almost 29% of total volume.

Market Translation: First-time buyers aren’t just coming back, they’re coming back with program support and improved affordability. The buyers who’ve been priced out for 18 months are now positioned to compete.

Strategic Opportunity: ARM applications reached their highest share since 2008 at nearly 10%. These buyers are betting on continued rate declines and accepting initial rate risk for immediate affordability. This is sophisticated buyer behavior, not desperation.

Seller Intelligence: The Strategic Positioning Playbook

For Ellis County sellers, this surge creates strategic complexity that separates professional representation from order-taking:

Opportunity Signals:

- Buyer activity increasing with improved affordability

- Pent-up demand from 18 months of sidelined buyers

- Fall selling season with motivated, qualified buyers

Strategic Reality:

- Elevated inventory requires competitive positioning, not hopeful pricing

- Price reductions are market norm, not failure

- Homes must be move-in ready to capture buyer attention

The Franklin Strategy: Position sellers for strategic success, not maximum price. A sold home at 95% of list in 30 days beats a home that sits for 90 days requiring multiple price cuts.

Q4 Market Projection: Reading the Strategic Landscape

Rate Outlook: While rates dropped significantly, Treasury yields control mortgage rates more than Fed policy. Further declines may be limited, making current rates a positioning opportunity, not a trend beginning.

Price Intelligence: DFW median appreciation is running 3-4% annually showing sustainable growth that supports strategic transactions without speculative pressure.

Seasonal Strategy: Q4 traditionally sees decreased activity, but current rate environment may extend buying season through November. Smart agents are preparing for expanded seasonal opportunity.

Strategic Action Protocol: Your Next 30 Days

For My Buyer Clients:

- Immediate pre-approval strategy – rates remain volatile, lock positioning asap

- 30-60 day rate locks recommended during shopping period

- Focus on realistic pricing – negotiate repairs and closing costs, buyers market doesn’t mean you’ll get everything you ask for

- ARM evaluation for 5-7 year move timeline clients

For My Seller Clients:

- Competitive pricing strategy – based on closed sales, not listing prices

- Show-ready condition – staging investment pays premium returns

- October timing optimization – capture rate-driven buyer activity

- Flexible negotiation positioning – closing costs and repairs as competitive tools

The Strategic Advantage: Why This Intelligence Matters

This 29.7% application surge isn’t statistical noise, it’s market evolution happening in real time. Agents who understand the strategic implications position themselves as market intelligence sources as opposed to those who react to the headlines who end positioning themselves as nothing more than order processors.

The Chaos Opportunity: While rate volatility creates uncertainty for some, it creates positioning advantage for strategic players who understand market convergence.

North Texas Fundamentals: Our demographic strength, job growth, and infrastructure development provide the stable foundation that makes rate-driven opportunities particularly valuable.

Professional Positioning: Evolving regulations and market complexity make strategic representation more valuable than ever. This isn’t about transaction facilitation, it’s about market navigation.

Market Intelligence Summary

- 6.26% mortgage rates create 7.4% increased buying power

- 58% refinancing surge signals major equity movement opportunity

- North Texas buyer advantage with inventory and negotiating power

- Strategic timing through October for maximum positioning

- Professional guidance premium in rapidly evolving conditions

The Bottom Line: While other agents wait for market direction, strategic players are creating market direction. This rate environment isn’t just opportunity, it’s competitive separation.

Your database is full of people who need this intelligence. Your community is full of people making decisions based on outdated information. Your competition is reading the same headlines as everyone else.

You’re providing strategic market intelligence that drives smart decisions.

That’s not real estate sales. That’s market authority.

📊 Your North Texas market intel source

🎯 Text 214-228-0003 for insider updates

Bobby Franklin – REALTOR®

Legacy Realty Group – Leslie Majors Team

Serving Ellis County & DFW